E-commerce software developer Moltin looks to bolster its presence in the US and double its customer base, following the close of its latest funding, Moltin CEO James Driscoll told FinTech Global.

Moltin collected an $8m Series A round led by Underscore VC, last week, with participation also coming from existing investors Connect Ventures and Frontline Ventures. As part of the transaction, former-Demandware executive Jamus Driscoll has joined the company as CEO.

Boston-headquartered Moltin provides an API-based e-commerce solution to help retailers digitise their store in a simple and flexible way. The API helps to connect the entire commerce system and provide holistic experiences through interactive digital displays, social media, smart televisions, video games and any other touchpoint.

Clients using the technology are able to implement a cross-platform shopping cart and digital checkout, inventory management, online orders, payment gateways, and data model control. The payment solution accepts transactions from over 200 countries and more than 100 gateways.

Driscoll said, “We believe there is a lot of pent-up demand for Moltin. More than 17,000 developers have used Moltin since its inception. They’ve battle-tested our product in the sandbox, and many brands are using it as a result.” Retailers are looking towards API-focused approaches to digital commerce as traditional methods can’t extend to new channels.

Over the next year, the company is looking to enhance its US operations, double its customer base and build on its applications to offer more experiences or through partnerships with retailers. Moltin, which has offices in Boston and Newcastle, has no plans for opening new offices but is looking to double its team.

Capital from the round will go towards commercialising operations in the US and supporting the sales and marketing resources for its go-to-market strategy, Driscoll said. Proceeds will also be used to build upon its core API capabilities and create more applications to support commerce channels.

Driscoll said, “Today, more than half of all internet traffic comes from a mobile device and increasingly shoppers are starting their commerce journeys on a mobile device. And, it’s no longer just about a mobile website or mobile app. Consumers may be exposed to a brand’s product or service on Instagram, a digital advertisement, a promotional email … each one of these touchpoints is an opportunity to inspire consumers to make a purchase.”

The biggest opportunity that Driscoll sees is putting commerce in the consumers hands at all points of access. Traditional e-commerce platforms have optimised for webstores, but the technology can be adapted to reach more areas, but retailers need to understand the potential.

“Over the next few years, commerce will be embedded in the majority of consumer touchpoints — and rather than having to go through a multi-step process to make a purchase, it will be a simple click, natively embedded in the experience, so that it’s seamless for the consumer — in a sense it will be “invisible.” Once consumers experience “invisible commerce” they will come to expect it from every brand.”

This investment brings Moltin’s total funding efforts up to $10m. The company previously raised a $2m seed investment in 2016, led by Frontline Ventures and support from Funders Club and AngelList syndicate.

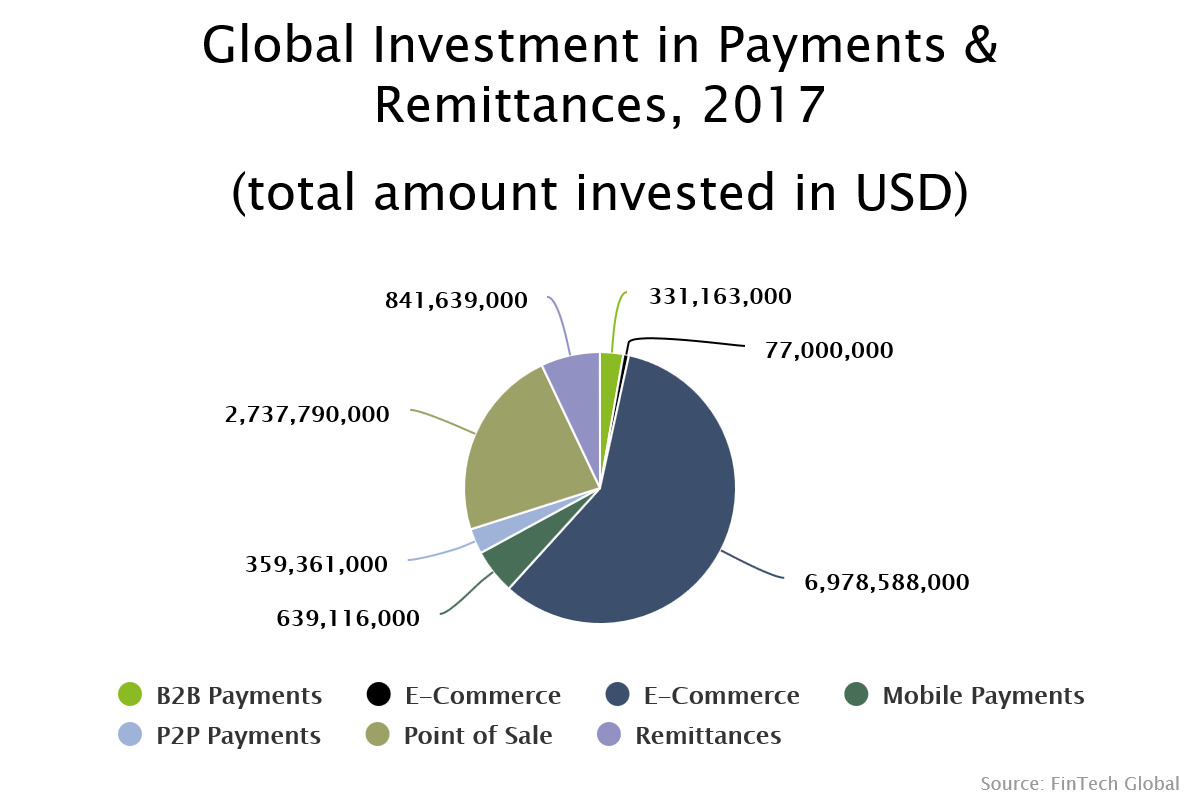

Last year, around 58 per cent of the capital invested in to payments and remittance companies went to ones focused on e-commerce. The sub-sector raised $6.978bn, while the second biggest area for funding was POS solutions, which raised 2.7bn.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global