Prime Venture Partners has closed its third fund on INR 400 crore ($60m) to back FinTechs in India.

Key areas on focus for the fund is digital India, FinTech, financial services, healthcare, education, logistics and global SaaS solutions.

Prime looks to support the ‘Digital India’ opportunity, but has also supported companies that target the US, Middle East and other international markets or companies that started in India and are looking for international expansion.

Founded in 2011, the firm looks to invest in early-stage companies in India that are combating gaps in technology. Prime looks to be the first institutional investor, and completes between 3 to 5 transactions a year.

Prior to this vehicle, the firm closed its second fund on $45m in 2015, and its debut on $8m in 2012.

Prime Venture Partners partner Rajesh Mashruwala said, “There has never been better time for Indian innovators. When most of the world is plagued by political and economic uncertainties, India offers stable policy, level playing field and commitment to build digital economy.”

The firm’s portfolio includes app-based consumer credit line Moneytap, real estate financial services Happay, payments platform Ezetap and payroll and benefits company NiYO.

Last month, the Indian state of Maharashtra has adopted a new comprehensive FinTech policy to foster the development of startups in the area. The goal is to set the area up as a global FinTech hub in the Mumbai Metropolitan region.

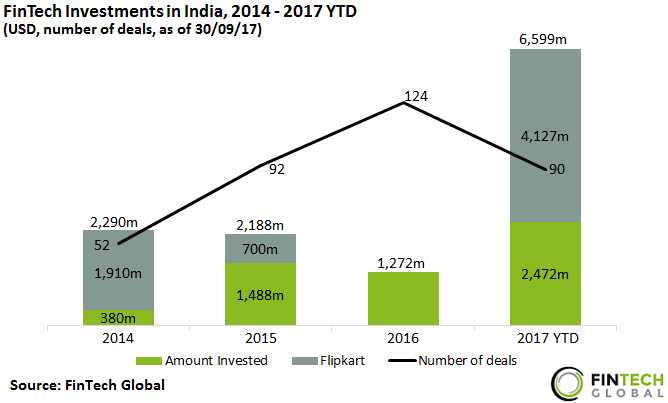

There is a huge appetite for FinTechs in India, with $7bn being invested into the country last year, according to data to FinTech Global. There was over five-times more capital invested in to the country last year, compared to 2016.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global