Singapore-based Golden Gate Ventures is reportedly raising its third venture capital fund with a target of $100m.

The first close of the fund is expected later in the month, and a final close is planned for before the end of the year, according to a report by Bloomberg which cites a person familiar with the matter. The vehicle will look to continue investing in e-commerce, payments and mobile app companies.

Prior to this fundraise, Golden Gate closed its second vehicle on $60m in 2016, surpassing its initial target by $10m. Some of the investors to back Fund II included Temasek, Facebook co-founder Eduardo Saverin, two Asia-based institutions and a European-based media conglomerate.

The firm also formed a partnership with Korea-based Hanwha Life Insurance to support opportunities in Southeast Asia.

Golden Gate focuses on the Southeast Asia market, and has backed companies across Singapore, Indonesia, Malaysia, Thailand, the Philippines and Vietnam. The firm also supports businesses that are looking to expand to Southeast Asia, having also invested across Hong Kong, Taiwan, Japan, Korea, and the US, according to the company.

Investments from the firm range from seed, Series A and Bridge rounds, typically between $1m and $5m.

FinTechs in Golden Gate’s portfolio includes expense management app Jojonomic, Southeast Asia payment gateway developer Coda Payments, and credit scoring and verification platform Lenddo.

In an interview with FinTech Global, Golden Gate Ventures venture partner Michael Lints said that one of the biggest draws for the Southeast Asia market was B2C solutions. He stated that there was an open gap in B2C payments which could support so many people make the transition to mobile payments, instead of cash.

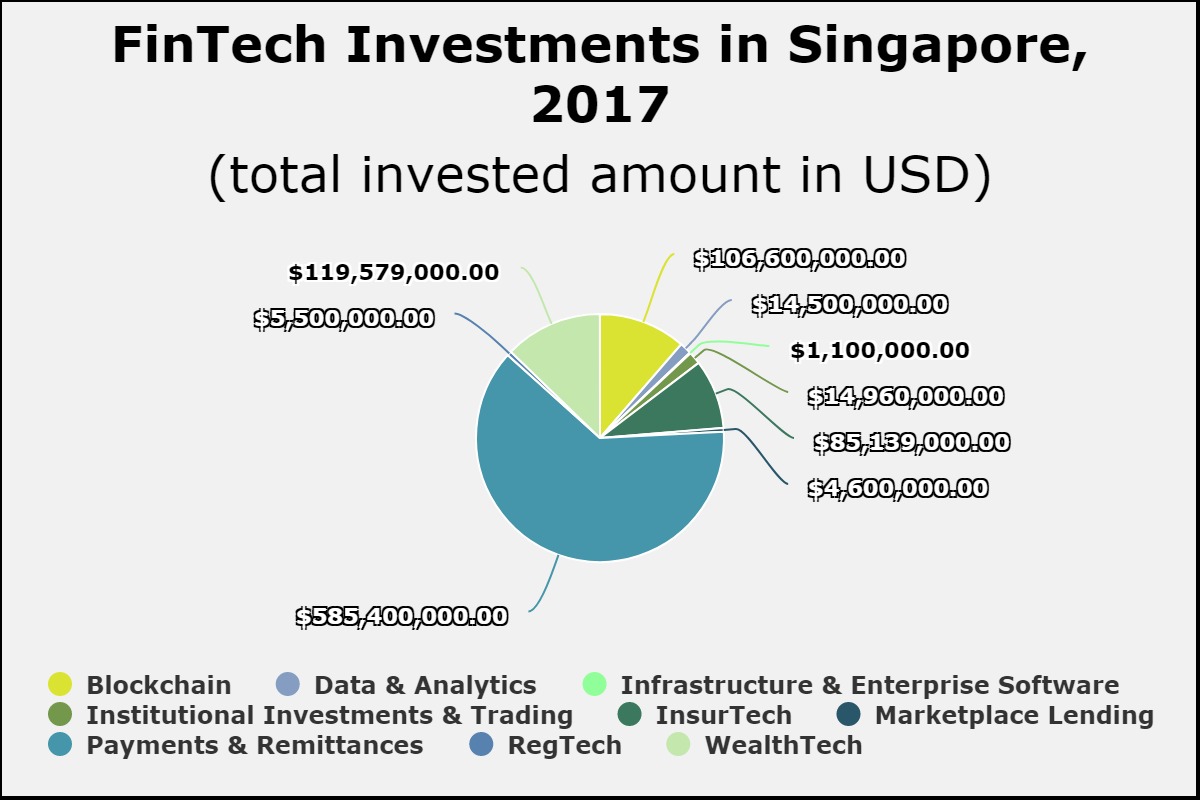

Last year, of the $937m that was invested in to Singapore’s FinTech sector, around 62 per cent was deployed to companies focused in the payments and remittance sector, according to data by FinTech Global.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global