Business process management and automation software developer MetaSource has completed a debt refinancing and dividend recapitalisation by LaSalle.

This transaction will boost the company capital base to support its continued acquisition strategy, as well as providing liquidity to its shareholders. Following the deal, LaSalle will remain as the controlling shareholder.

Utah-based supports the financial services industry with as selection of business management and workflow automation services. The company technology can help clients to improve its efficiency, streamline processes and manage compliance risk.

MetaSource can support a range of operations including invoicing, security, compliance, contract management. One solutions, LoanStor, provides the mortgage originators with a platform that can handle onboarding, loss mitigation, and loan portfolio acquisition and transfer.

LaSalle partner Ryan Anthony said, ?We are pleased to have executed this transaction to generate returns for MetaSource shareholders and look forward to helping management through the next phase of growth.p>

Earlier in the month, robotic process automation software company UiPath bagged $153m in tis Series B round led by Accel. The company, which launched in 2015, supports business with the automation of tasks through its AI and predictive analytics technology.

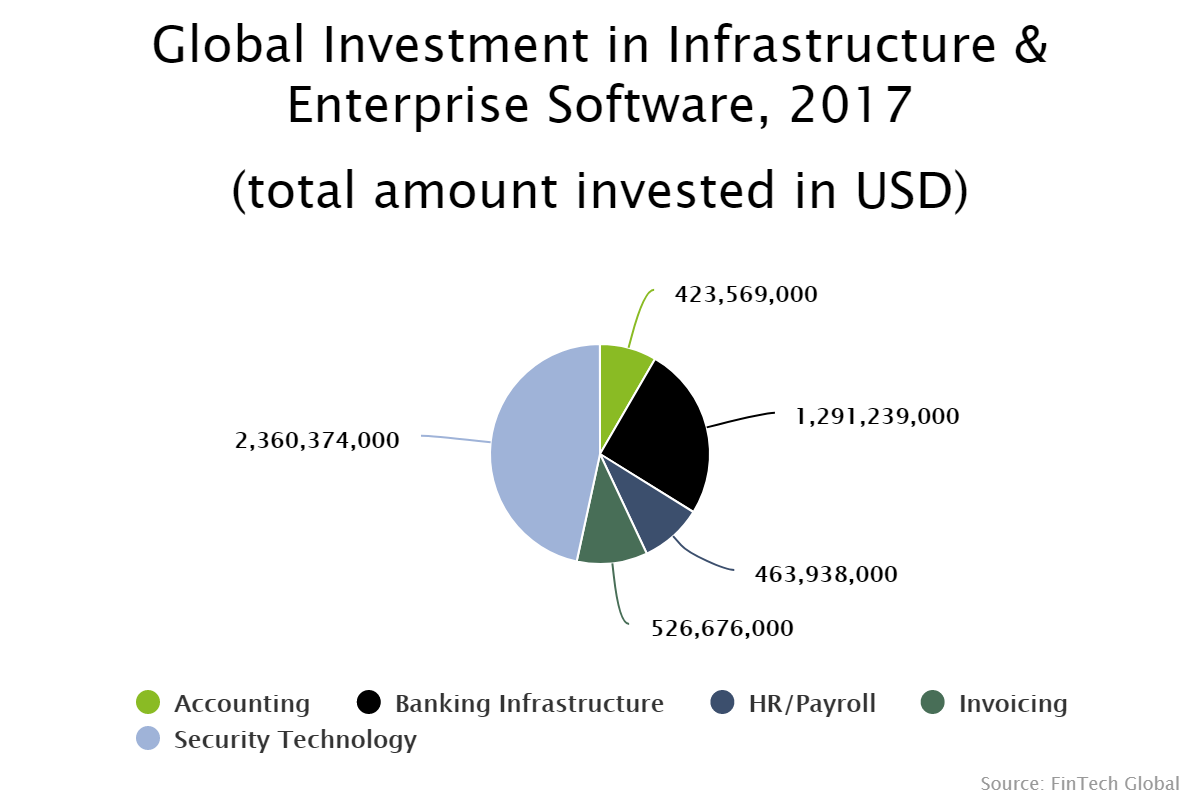

The banking infrastructure was the second biggest sub-sector for funding in the infrastructure and enterprise software space, according to data by FinTech Global. The area picked up $1.2bn, which is just over 25 per cent of the total funding.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global