ION Investment Group, a trading and workflow automation software provider, has acquired Openlink Financial.

Openlink develops trading, treasury and risk management solutions to drive transparency and connect data across the business. The technology is used across the financial services, treasury, energy and commodities markets.

Financial institutions can use the trading and risk management technology to support their workflows their interest rates, credit, FX, equity, commodity and associated derivative products. Asset managers can mange risk across all market exposures and hedges, while central banking users can maximise security, market oversight, trading and control.

Through the acquisition, Openlink will be able to scale ION’s reach with capabilities to boost its current offerings.

ION offers automation software for financial institutions, central banks, governments and corporates to simplify treasury management and trading processes. The company helps users to manage real-time asset classes including derivatives, equities and FX, as well as monitoring the risk.

Earlier in the week, HiGro acquired tapped its second fund to acquire a majority share in business process management company DRS Imaging Services.

There have been several business automation platforms to close funding over the past month. Germany-based Signavio netted €15.5m in its Series B to support the grow the presence of its modelling and management system.

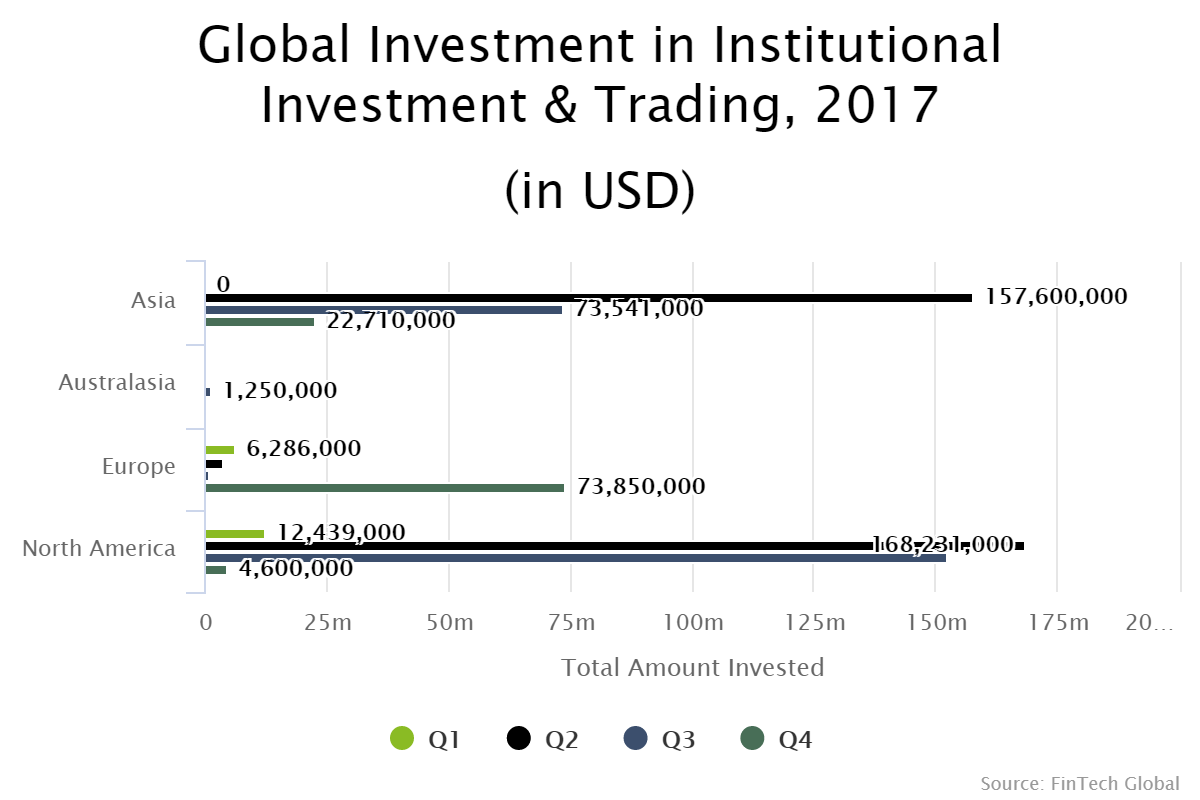

Last year, funding to the institutional and investing sector was dominated by the North American market, according to data by FinTech Global. Of the $755m deployed to the space, 44 per cent of the capital was invested to North America.

Copyright © 2018 FinTech Global