Singapore-based robo-advisor StashAway has reportedly scored $5.3m in a Series A funding round.

Contributions to the round came from a group of family offices, including Rozario family, according to various reports in the media.

StashAway is a robo-advisor that can help personalise diversified portfolios of exchange-traded funds. The platform starts off by asking questions regarding goals, risk, and how much the user is willing to invest each month, in order to build a personal portfolio.

Investments will be managed and re-adjusted by the technology, but users can increase or decrease monthly deposits, change risk, withdraw funds, create more portfolios or manage their investments on any platform. Consumers can set targets such as retirement, buying a home, child education funding, or just general investing, with a personal strategy being implemented to help achieve the goal.

This capital injection will be used to develop the company’s technology, as well as supporting the launch in to a new market in Asia-Pacific later in the year, the articles state. The new funding round brings the total capital raised by StashAway to around $8.4m.

Earlier in the year, fellow robo-advisor platform Wealthfront, closed a $75m investment round led by Tiger Global Management. The company gives consumers financial planning services, investment management and banking related option, helping everyone access the investing market.

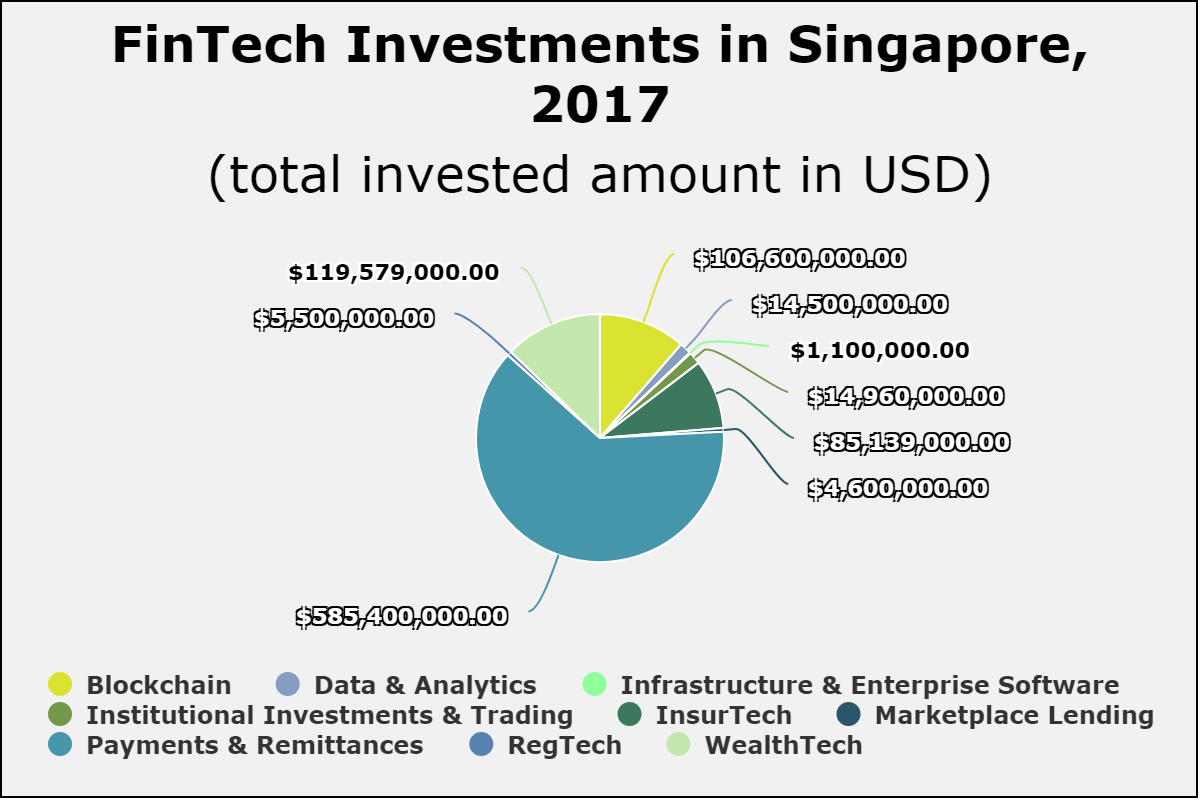

While payments and remittance companies dominated the funding in to Singapore’s FinTech sector last year, WealthTech was the second biggest sector. According to data by FinTech Global, 64 per cent of the $933m invested in the country’s FinTech space, went to companies developing payment solutions. WealthTech took the next biggest chunk, with a 13 per cent share of the total funding.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global