Financial information platform 100Credit has reportedly picked up $159m in its latest funding round.

Private equity firm China Reform Fund Management led the investment with participation also coming from Sequoia Capital China, according to a report by China Money Network which cites the company’s WeChat account.

Founded in 2014, 100Credit is a financial information company that implements AI, cloud technology, and big data to give customers a lifecycle management platform. The Beijing-based company offers a credit approval system which uses big data to speed up credit approval, verification and fraud prevention through its ‘Risk Compass’.

The company’s technology is used by banking solutions, micro-finance industry and insurance industries.

This equity injection will be used to hire more staff, bolster its AI lab, further its research and development efforts for AI, blockchain and big data, and invest in its financial risk management products, it said.

With the new equity injection, the company has raised a total of $270m. Preciously the company picked up $111m through its Series A and B rounds, according to the article. Previous backers include China International Capital Corporation, Hillhouse Capital Group, Sequoia Capital China, IDG Capital and Union Mobile Financial Technology.

China’s FinTech has had a very active start to the year, with this being the fifth company to close funding this month. Last week, behavioural analysis and solution platform Sensors Data bagged a $44m investment from Warburg Pincus. Sequoia Capital China were also among the investors to contribute to the company’s funding round.

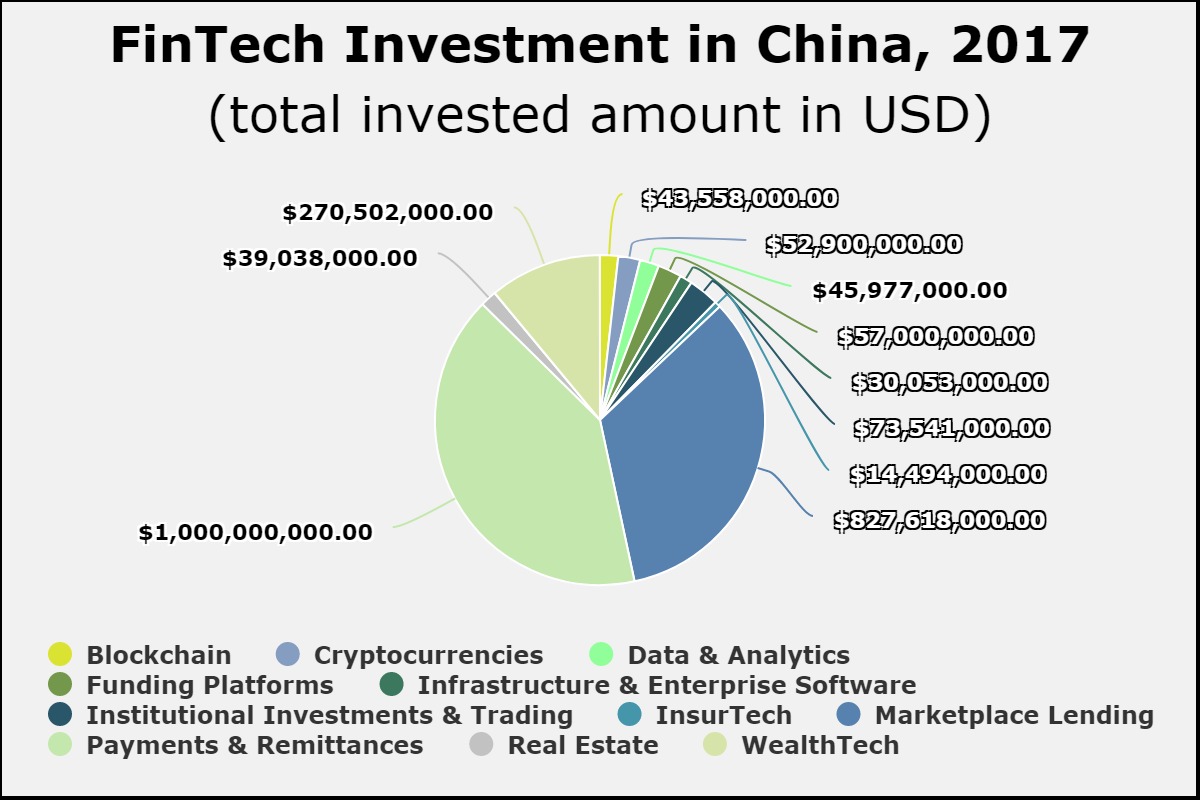

The Chinese FinTech space was dominated by payments and marketplace lending companies last year, according to data by FinTech Global. Of the $2.4bn that was deployed into the country, around 75 per cent went to these two sectors.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global