Iwoca, a SMB loan provider, has received an additional ?50m debt facility by a syndicate of banks.

NIBC Bank led the debt round, with participation also coming from Shawbrook Bank and Pollen Street Capital.

London-based iwoca helps small businesses to gain access to credit via its online platform. Businesses can gain access to loans from ?1,000 to ?150,000 for cash flow, stock or investments on terms of up to 12 months.

Credit limits are set by business performance, with the company typically lending up to one month revenue or ?10,000 for a startup.

With this financing, the company will look to support more micro and small business customers. Since its launch, the company has originated over ?400m in critical loans to support 20,000 loans in small businesses.

Shawbrook Bank associate director Karan Burman said, ?At Shawbrook we recognised the value of the iwoca proposition in the alternative finance space, particularly its potential in supporting under-served micro and small businesses across the UK. So, at Shawbrook we were very happy to provide iwoca with their first institutional funding line back in 2016, and to extend this support now as the business continues to grow.p>

iwoca previously raised a ?21m Series C round led by Prime Ventures in 2016. Other companies to support the round included Acton Capital Partners, CommerzVentures, Global Founders Capital and Redline Capital. The company total fundraising efforts have reached around $60m.

Last year, NIBC Bank contributed to the ?39m funding round into FinTech startup builder FinLeap. The Germany-based company provides startups with support and infrastructure to nurture the development of their own solutions.

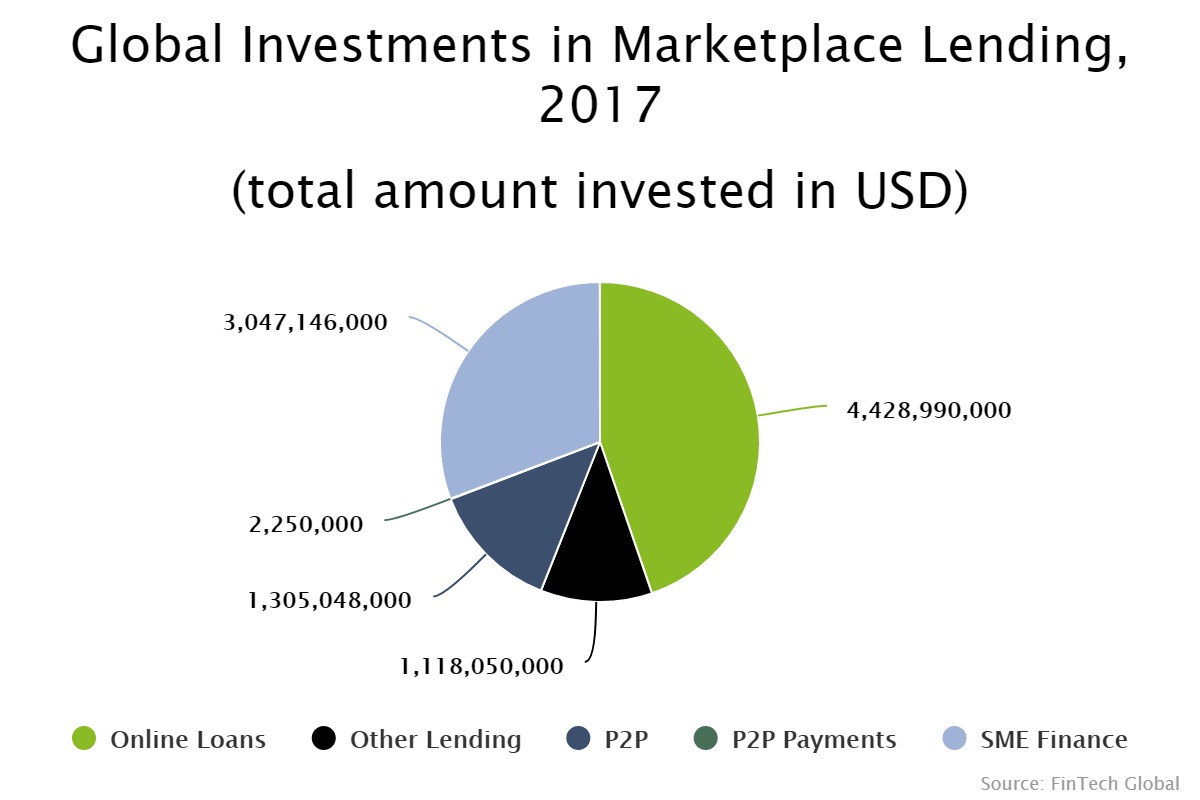

SME finance was the second biggest sub-sector of the marketplace lending space last year, according to data by FinTech Global. Online loan companies led the way with a 45 per cent share in the market, whgile SME finance businesses received 31 per cent of the total capital.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global