Credit risk management company CredoLab has closed a $1m venture round from Walden International.

Singapore-based CredoLab is a mobile application that extracts a digital footprint from a consumer’s smartphone and then uses the data to create a digital credit scorecard. Its algorithm analyses information from around 50,000 data points and helps those with no or little traditional credit history to access lending.

Founded in 2016, the company has customers in 15 countries across South East Asia, China, Latin America, Africa, and the Commonwealth of Independent States.

Funds from the investment will be used to support expansion across undeserved regions including Asia and Africa. CredoLab is also looking to partner with alternative data providers to help banks and consumer finance companies with generating leads.

Walden International vice president Kris Leong said, “There is a big pool of unbanked consumers in Asia with no formal credit histories. In just a short period of time, CredoLab has partnered with almost 30 consumer lending institutions to generate digital credit scorecards for thin-file consumers.

“With CredoLab’s plug-and-play data science solution, banks and retail lenders can profitably serve the unbanked, and individuals and businesses can access useful and affordable financial products and services that meet their needs.”

Prior to this investment, CredoLab secured an oversubscribed pre-Series A round led by Fintonia Group. The round, which was undisclosed but was double that of its initial target, also received commitments from institutional investors such as Reliance Modal Ventura.

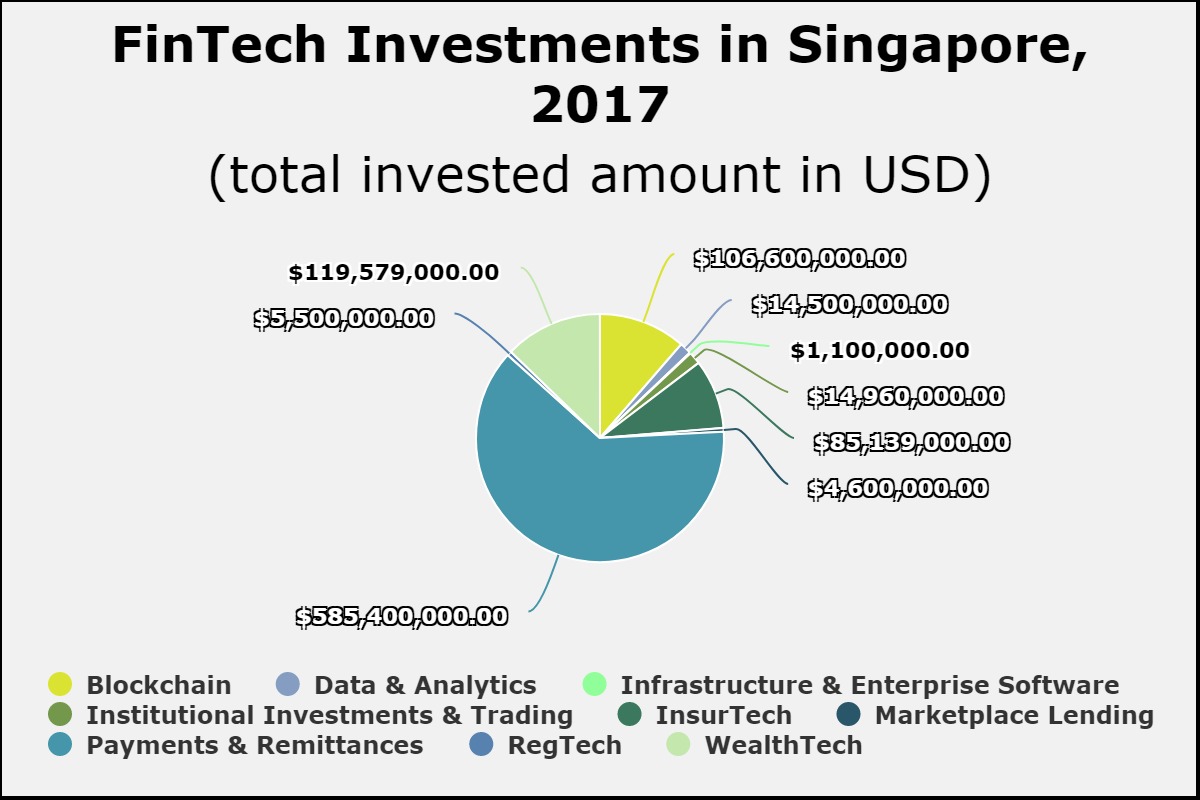

Payments and remittances companies received the lion share of funding in Singapore’s FinTech sector last year, according to data by FinTech Global. Of the $933m that was invested to the country in 2017, around 63 per cent went to companies focused on payment solutions.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global