Brighte, an online lending platform for home energy improvements, has reportedly secured a $20m debt facility.

The credit was supplied by the National Australia Bank, according to a report by Startup daily. This funding follows a $4m Series A raised by the company last year, led by Grok Ventures.

Australia-based Brighte offers homeowners access to capital to help them make their homes more energy efficient. Borrowers can access up to $30,000 on 60-month repayment terms, with a 0 per cent interest.

Loans can be taken out on the platform for a selection of home improvements including, solar, roofing, lighting, heating and cooling, windows and smart energy technologies, among others. Policy holders can access their account to view repayment history, make payments, and review policies via mobile and desktops.

Vendors are also able to use the platform to check customer payment plans, how much they are owed and when they will be paid.

Last month, home loan company Athena Homes completed a $15m Series A funding round backed by investors including Macquarie Bank, and Square Peg Capital. The company helps consumers to get quick access to credit and pay it off quicker.

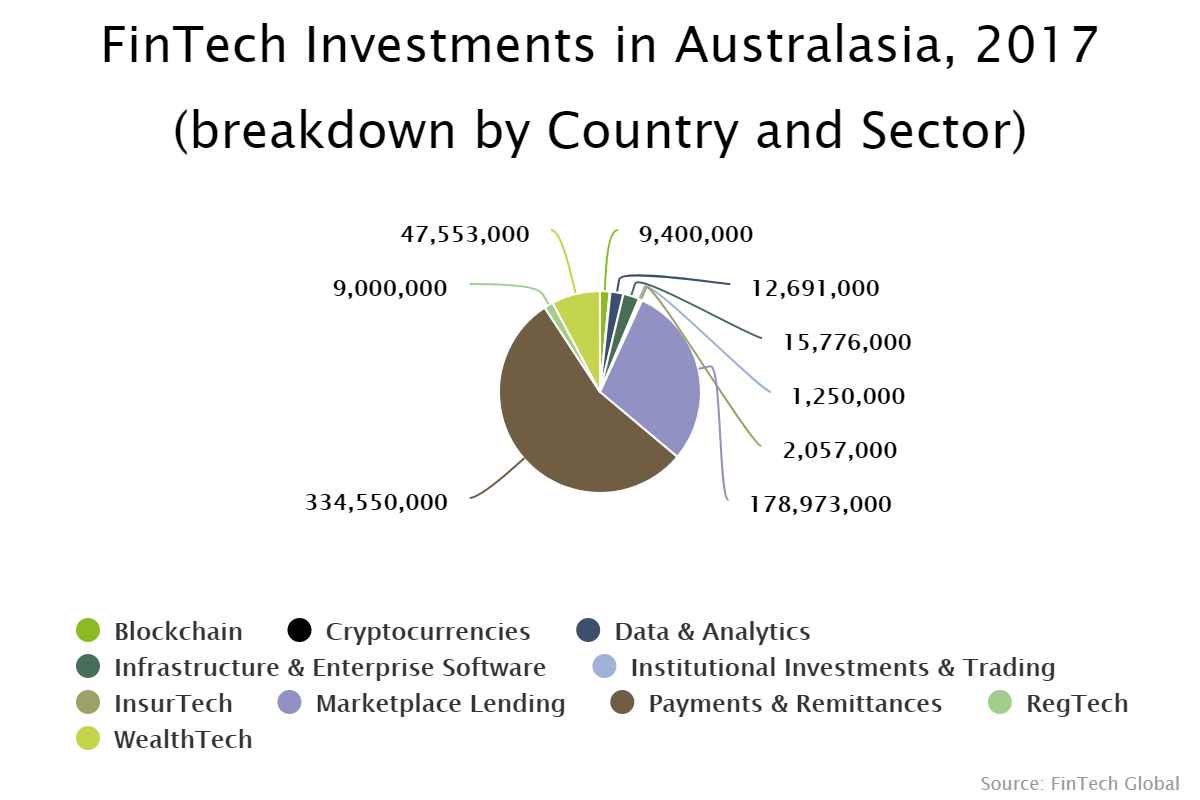

Payments and remittances companies led the way for funding in Australia’s FinTech space last year, with it bagging 55 per cent of capital, according to data by FinTech Global. The second biggest market was marketplace lending, which netted 29 per cent of the $612m that was invested in 2017.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global