LendingPoint has closed a $600m credit facility from Guggenheim Securities, just months after a $500m credit line last year.

Georgia-based LendingPoint is an online lending platform, which gives borrowers the chance to get up to $26,500 in credit, across a 12 to 48-month plan. The platform uses its technology to assess the credit risk of a borrower, acknowledging credit score, job history, financial history, credit behaviour and income.

The company processed over 850,000 borrowing applications for more than $9.2bn in the first quarter of 2018.

Earlier in the year, the company acquired POS lending technology platform to create LendingPoint Merchant Solutions. This solution, which launched in March, enables retailers to offer retailers and service providers with POS financing. These loans are available for between $500 and $15,000 for 12 to 60-month periods.

LendingPoint co-founder and CEO Tom Burnside said, “When we started LendingPoint, we knew that by successfully solving lending for people with credit scores between 580 to 700 – those we call ‘NearPrime’ – we would maintain strong capital markets support. This new Guggenheim facility and its pricing confirms that we’re succeeding.”

Guggenheim Securities previously deployed a $500m credit facility in September last year, and brings LendingPoint’s total financing to $1.1bn in just nine months.

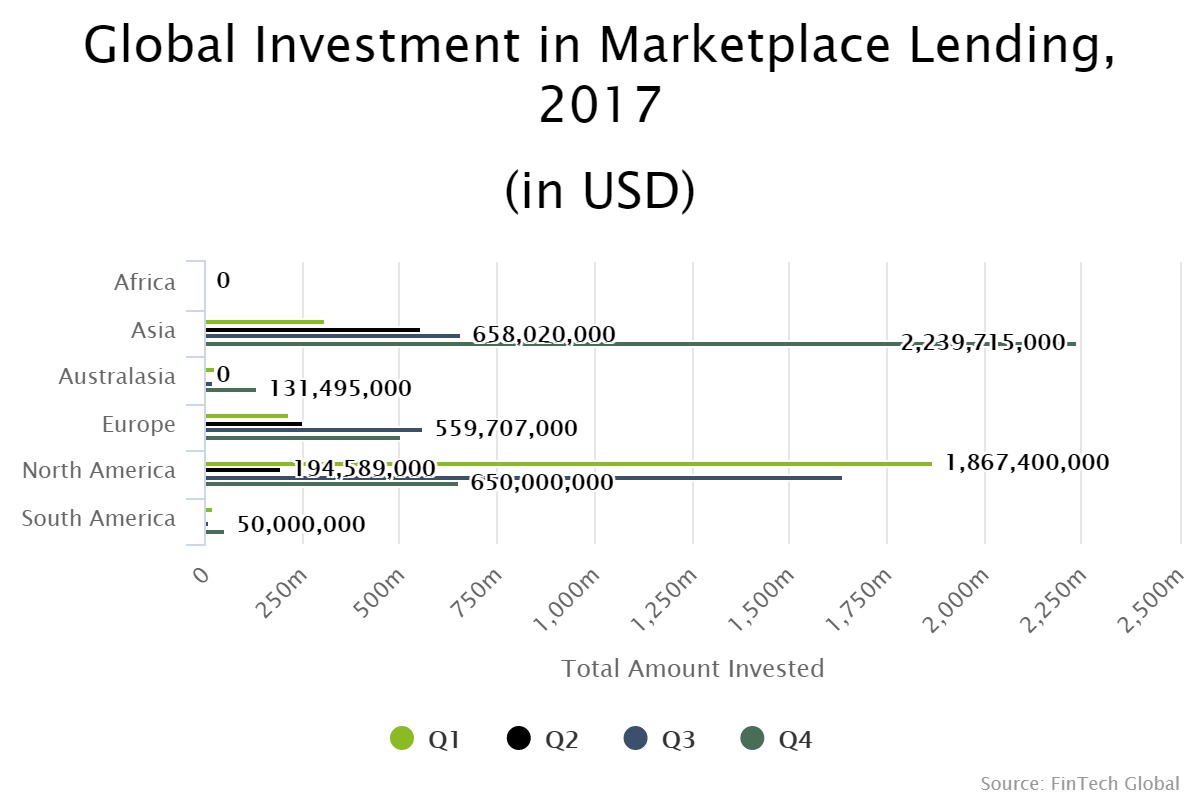

There was $9.8bn invested into the global marketplace lending sector last year, with North America representing the biggest chunk, according to data by FinTech Global. The region received 44 per cent of the capital of invested into the space.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global