Key Lending Technology investment stats up to Q3 2023

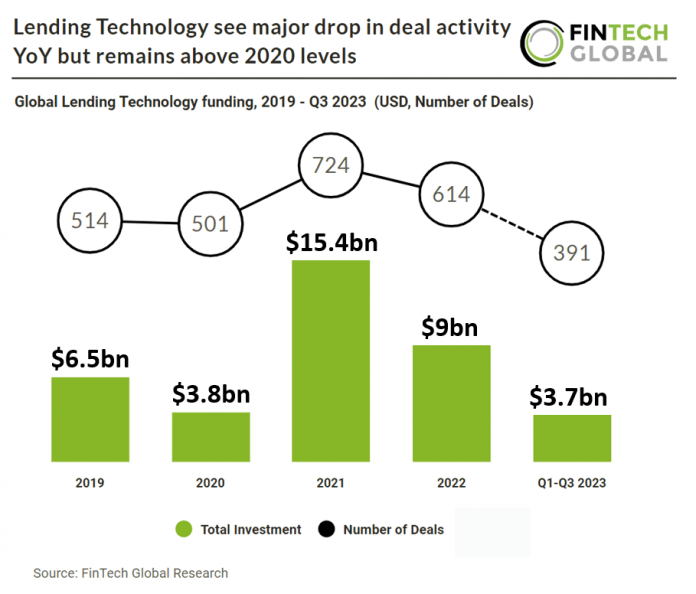

• Lending Technology deal activity is on track to reach 521 transactions in 2023, a 15% drop from 2022 but a 3.3% increase compared to 2020’s levels

• Lending Technology investment is expected to reach $4.9bn in 2023, a 46% drop from 2022

• The USA was the most active Lending Technology country in Q1-Q3 2023 with 196 deals, a 51% share of total deals

Lending Technology, like many other FinTech subsectors has seen a significant drop in funding during the opening three quarters of 2023, although deal activity has seen a much less dramatic drop. Lending technology deal activity is poised to reach 521 transactions in 2023, marking a 15% decline compared to 2022 but still reflecting a 3.3% uptick from the levels seen in 2020. Lending technology investment is anticipated to hit $4.9bn in 2023, representing a substantial 46% decrease from the previous year.

Abound, a British consumer lending financial firm, had the largest Lending technology deal in Q1-Q3 2023 after raising £500m in their latest venture funding round from K3 Ventures, Hambro Perks Ltd. and SR Ventures. The company intends to use the funds to expand the number of customers it lends to, to grow its headcount, and to develop its business-to-business offer. Established in 2020 under the leadership of Gerald Chappell, who serves as the CEO, and Dr. Michelle He, Abound is a financial service that leverages Open Banking and artificial intelligence to offer loans ranging from £1,000 to £10,000, with repayment terms extending up to 5 years. As of now, the company has experienced consistent monthly growth of 30% and has assisted more than 150,000 customers through its platform. It’s worth noting that Abound operates as the consumer-facing division of Fintern Ltd, which also owns Render, the proprietary technology employed by Abound to facilitate intelligent lending solutions.

The USA was the most active Lending Technology country during the first nine months of the year with 196 deals, a 51% share of all transactions globally. The UK was second with 27 deals, a 7.1% share of total deals and India was third with 21 deals, a 5.5% share of total deals.

In august 2023 proposed US regulations targeting smaller banks could reduce available credit, requiring them to maintain higher capital reserves and adhere to stricter standards similar to those of larger banks, have the potential to create significant challenges within the regional banking sector. These regulations, put forth by the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency, aim to ensure financial stability but may hinder smaller banks’ lending capacity and increase their capital burdens. The recent downgrades and credit rating adjustments by Moody’s for multiple U.S. banks in response to these proposals highlight the concerns in the banking sector. Although the regulations are subject to change and will be implemented gradually, they signal a new regulatory landscape that could have broader economic implications, as challenges in the regional banking sector may reverberate throughout the U.S. economy.