Digital lending platform Fundation has secured a $120m credit facility from SunTrustBank to increase its lending capacity.

Waterfall Asset Management also supplied funds to the round as a Class B lender.

Virginia-based Fundation is an online lender and credit solution provider for small businesses. It partners with banks and financial institutions to optimise their omni-channel lending capabilities, by enabling them to outsource processes to its end-to-end solution.

Some of the company’s partnerships include Regions Bank, Citizens Bank, the BancAlliance network of community banks, and the Minority Business Development Agency.

Borrowers can access Fundation to take out a term loan of between $20,000 to $500,000 for a period of one to four years. A working capital or short-term loan is also available, with $20,000 to $100,000 available for 18-month terms.

This loan will be used to extend Fundation’s lending capacity to US-based small businesses.

Fundation CEO Sam Graziano said, “Garnering the support of one of the leading super regional banks engaged in asset backed finance is another milestone for our Company. As we continue to bolster the size and quality of our capital base, we can become an even stronger ally to our strategic partners and their small business clientele.”

The company is majority-owned by private equity firm Garrison Investment Group, which initially invested into the company in 2013. Fundation still holds a separate $120m credit facility, supplied by Goldman Sachs in 2016, as well as a $35m credit line deployed in 2017 by MidCap Financial.

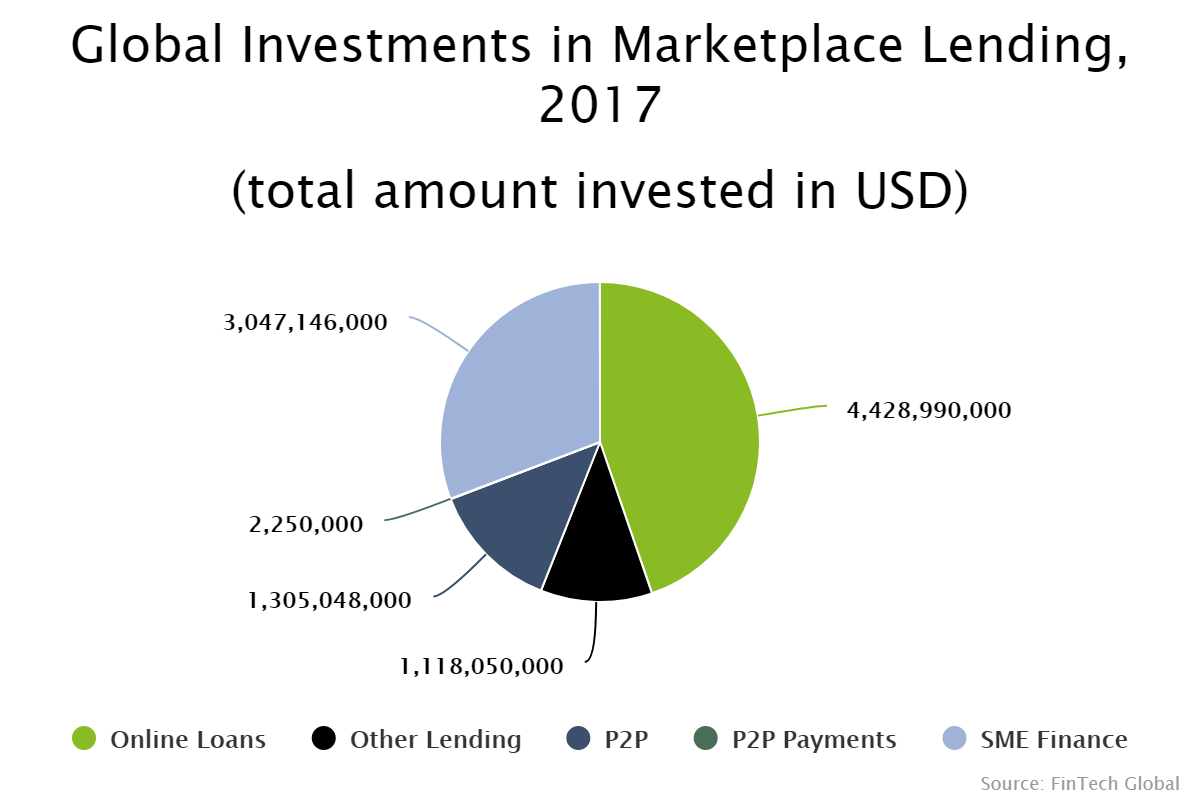

SME financing companies received the second biggest chunk of funding in the marketplace lending sector last year, according to data by FinTech Global. There was $9.9bn invested in the sector globally, of which, around 31 per cent was deployed into the SME finance space.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global