Kin, a direct-to-consumer home insurance company has raised an additional $15m in Series D funding, bringing the total raised in the round to $109m.

The investment came from Geodesic Capital, QED Investors, and additional investors.

Kin is on a mission to make homeowners insurance more convenient and affordable by eliminating the need for external agents. Kin’s technology platform delivers a seamless user experience, customised options for coverage, and fast, high-quality claims service.

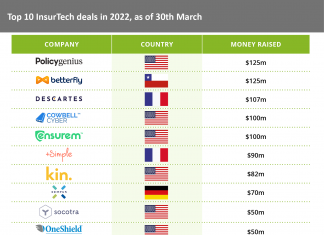

Since the first close of its Series D round in March 2022, Kin said it has continued its systematic, capital efficient growth, more than doubling its gross written premium while making gains in operational efficiency and driving toward profitability.

The additional funding, which was provided using the same terms and valuation as the initial investment, strengthens Kin’s liquidity position and provides the company with the capital needed to significantly expand its offerings and market share moving forward.

Sean Harper, CEO of Kin, said, “Despite the tough market for high-growth companies right now, we’ve increased revenue 2.2x, improved each of our major operating metrics, and kept the same valuation. These are good outcomes, especially when other startups are accepting punishing terms or a valuation hit.

“We’ve been able to achieve these outcomes because the business has performed really well and we didn’t raise capital at the hype-driven multiples that many technology companies did in 2021.”

Jon Rezneck, partner and head of the investment team at Geodesic Capital, added, “Homeowners insurance distribution is an acyclical market and Kin’s unit economics, which have always been good, have only continued to improve. We were pleased for the opportunity to continue to support Kin by putting additional capital to work, further powering their mission to simplify and personalize home insurance.”

Earlier this month, Bubble Insurance Solutions, a digital insurance broker, partnered with brokerage and franchise platform JPAR Real Estate to bring embedded home insurance to home buyers.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global