Online student loan platform Future Finance has secured a £100m funding facility from Waterfall Asset Management.

The company provides student loans to UK students, where government loans and bursaries are not enough to fund education costs. Loans are facilitated through the company’s platform and consider credit history, the university their studying at and the course they are taking.

While a student is studying, repayments are low, and this continues for the first three months after graduating. Loans are typically on five-year terms and a holder can apply for a ‘repayment holiday’, which is a three-month break from repayments and can be used four times during the loan.

To date, the company has helped fund £70m in loans to students, according to Future Finance.

This investment comes a couple of months after Future Finance closed a €40m Series C round, which was raised to support more loans. KCK led the investment round, while S-Cubed, Invus, Fenway Summers, as well as other existing backers.

In total, the company has raised more than €90m in equity and a further £150m through debt. The new credit line will enable Future Finance to grow its lending platform. The company hopes to expand access and opportunities for students and young professionals across the UK.

Waterfall Asset Management managing director Henrik Malmer said, “The nascent UK student lending market offers a unique investment opportunity with the potential to achieve attractive risk-adjusted returns. Future Finance, with an experienced management team and a proven track record, is well positioned to continue building on their first mover advantage in this market.”

Earlier in the year, Waterfall Asset Management deployed an undisclosed debt facility into digital lending and credit solution developer Fundation Group. The New York-based company partners with banks to help them create online credit avenues to help boost customer retention.

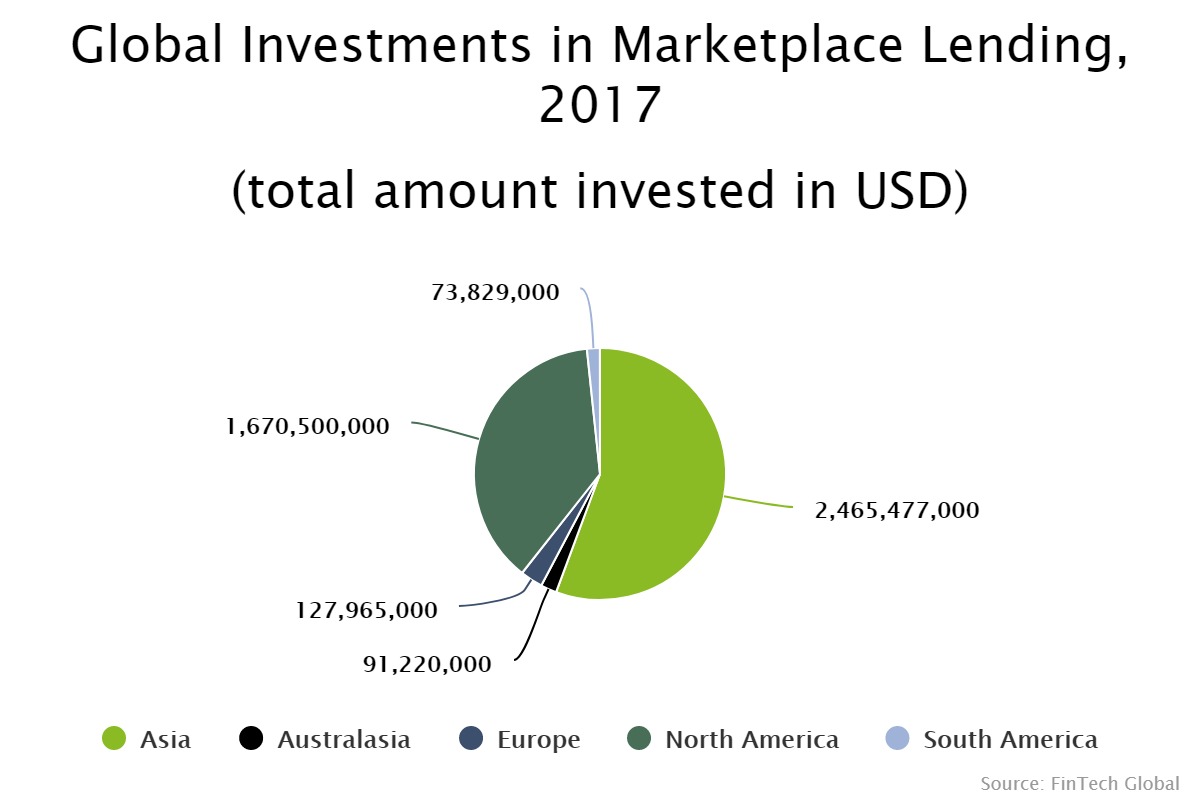

Online loan companies received just under half of total funding into the marketplace lending sector, according to data by FinTech Global. The biggest region for funding into online lending companies was Asia, bagging 55 per cent of the $4.4bn deployed in the sub-sector globally.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global