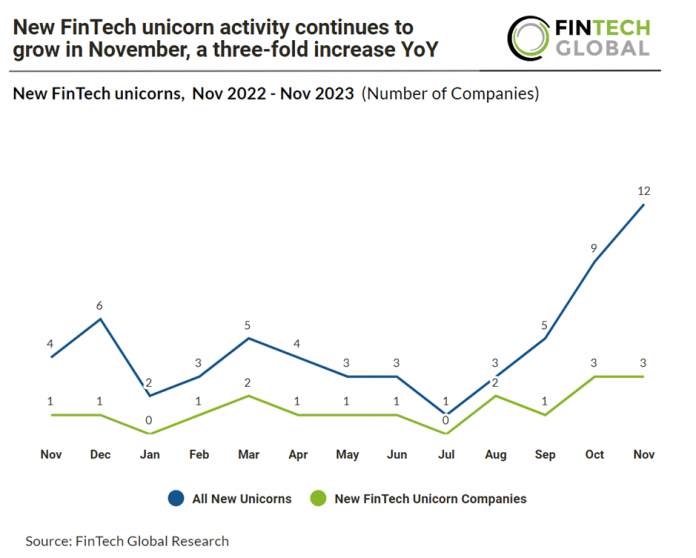

New FinTech unicorn activity continues with strong November at three new announcements in total. In total there were 12 unicorn announcements in November a 33% rise from October whilst New FinTech unicorn announcements stayed level.

Tabby, a buy now pay later provider, achieved unicorn status after raising $58m in their latest Series C funding round, led by Peak XV Partners and STV. The company intends to use the funds to expand its product line into next-gen consumer financial services and support its growing operations. Led by Hosam Arab, CEO, Tabby provided an app that aims to create financial freedom in the way people shop, earn and save. Over 10,000 global brands and small businesses, including H&M, Adidas, IKEA, SHEIN, noon, and Bloomingdale’s, use its technology to accelerate growth and gain loyal customers by offering flexible payments online and in stores. Tabby is active in Saudi Arabia, UAE, Egypt and Kuwait and crossed 3 million active shoppers last year. Hosam Arab said: “With rising interest rates and growing inflation, it has never been more important for people to have access to payment flexibility to stay in control of their finances. Despite downward pressure on FinTech valuations, our business continues to sustainably scale as we lead the generational shift towards fair and transparent financial products in MENA.”

InCred Holdings Limited has successfully secured INR 500 Crores ($60 million) in its Series D funding round. With this latest funding achievement, InCred is has become the second Indian startup to join the unicorn club in 2023, following in the footsteps of Zepto. The influx of capital will be strategically allocated to bolster InCred’s core business areas, with a particular emphasis on consumer loans, student loans, and MSME lending. This injection of funds significantly enhances the company’s ability to expand its operations and establish a more substantial presence in the market. The funding round enjoys support from a diverse group of investors, including a global private equity fund, corporate treasuries, family offices, and UHNIs (Ultra-High-Net-Worth Individuals). “This funding commitment marks a significant milestone in our journey and takes us into the ranks of unicorns. With our ‘Risk First’ approach, cutting-edge technology, and class-leading management team, we are well positioned for sustained growth in the business over the years to come,” Bhupinder Singh, founder and group CEO of InCred, said.

BioCatch, an Israeli company specializing in software development for detecting and preventing bank fraud and money laundering, achieved unicorn status with a new secondary deal, as reported by Calcalist. The company successfully secured approximately $70 million from Sapphire Ventures at a valuation exceeding $1 billion. Notably, this transaction was completed just one day before the Hamas-Israel conflict. This marks BioCatch’s second significant secondary transaction in 2023, with investment fund Permira Growth Opportunities becoming the third-largest shareholder in the company in May by acquiring a $40 million package from existing shareholders, also at a valuation close to a billion dollars.