Israel-based BondIT, an investment portfolio company, has reportedly bagged $4m in its latest round of funding.

This funding comes as an extension to its Series B which the company closed late last year, according to a report by FinTech Futures. It is unclear who supplied the new line of equity.

The company previously raised $14.5m in its Series B round led by Fosun Group, which became a major shareholder in the company following the deal.

BondIT offers a fixed portfolio to income traders and their portfolios. Through its technology and market network, BondIT can enable investment managers to create and optimise bond portfolios with machine learning algorithm-powered automation tools.

Utilising data science and AI learning, the company is able to remove complexities and inefficiencies experienced with fixed income products. The platform gives investors the ability to quantitatively optimise the risks and returns of the portfolios.

Through the new round of funding, the company hopes to boost its global expansion plans, with a focus on the US market. It also plans to bring AI-powered solutions to China’s fixed income vertical.

There have been a series of Israel FinTechs to raise funding this year, including mobile security platform SecuredTouch bagging $8m last month.

Recently, Israel-based investor Entrée Capital Ventures held the $80m final close for its second technology fund and will invest in Israeli technology companies.

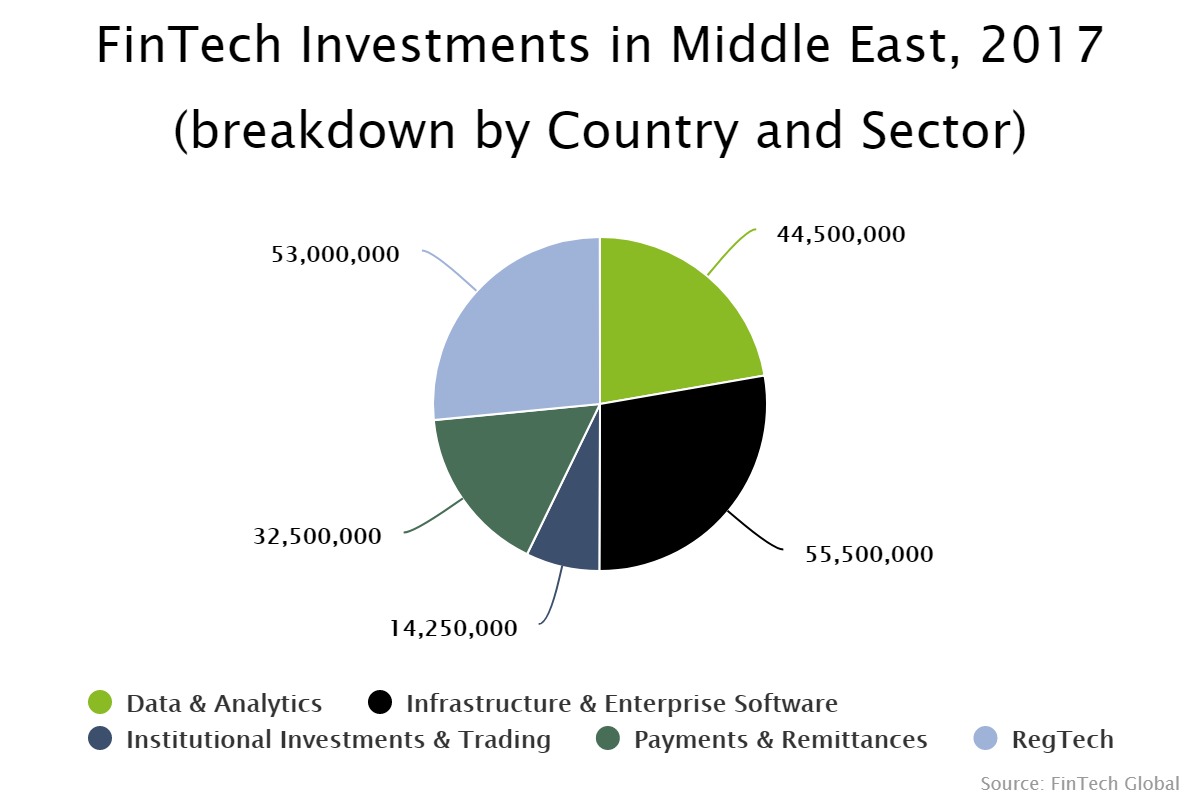

Last year, funding into Israel’s FinTech market was dominated by three sectors, infrastructure and enterprise software, RegTech and data and analytics companies, according to data by FinTech Global. The lion share was held by the infrastructure and enterprise software space, bagging 28 per cent of the total $197.8m invested. RegTech companies were just behind, with 27 per cent of the total funding.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global