Japanese FinTech startup freee has collected $60m in its Series E round of funding to accelerate the development of its small business platform.

The capital was raised by LINE Corporation, MUFG Bank, LIFE CARD CO and a number of international institutional investors. The new line of financing brings freee total funding to $155m since it was founded in 2012.

freee is an accounting and HR solution for SMBs in Japan which has more than 1 million business accounts using the software. Through the platform, clients can automate various back-office tasks such as payroll, accounting, data management, bookkeeping, and invoicing, among others.

Last month, the company launched its budgeting, cash flow forecast/planning, and flexible analytics services to its accounting solution. The new features empower clients to track real-time business performance and bolster growth via analytics.

This capital injection will be used to bolster the growth of its business efficiency tool, and accelerate the development of its small business platform. freee is also exploring building business alliances with partners.

Earlier in the year, MUFG Bank invested into Seedcamp fourth venture capital fund which closed on ?60m. The firm is looking to deploy around 15 per cent of its capital to FinTechs.

Fellow Japanese FinTech company Paidly raised $55m in its Series C round which was led by ITOCHU Corporation. The company is a post-pay credit service which enables consumers to take out a short-term loan when buying an item at a retailer.

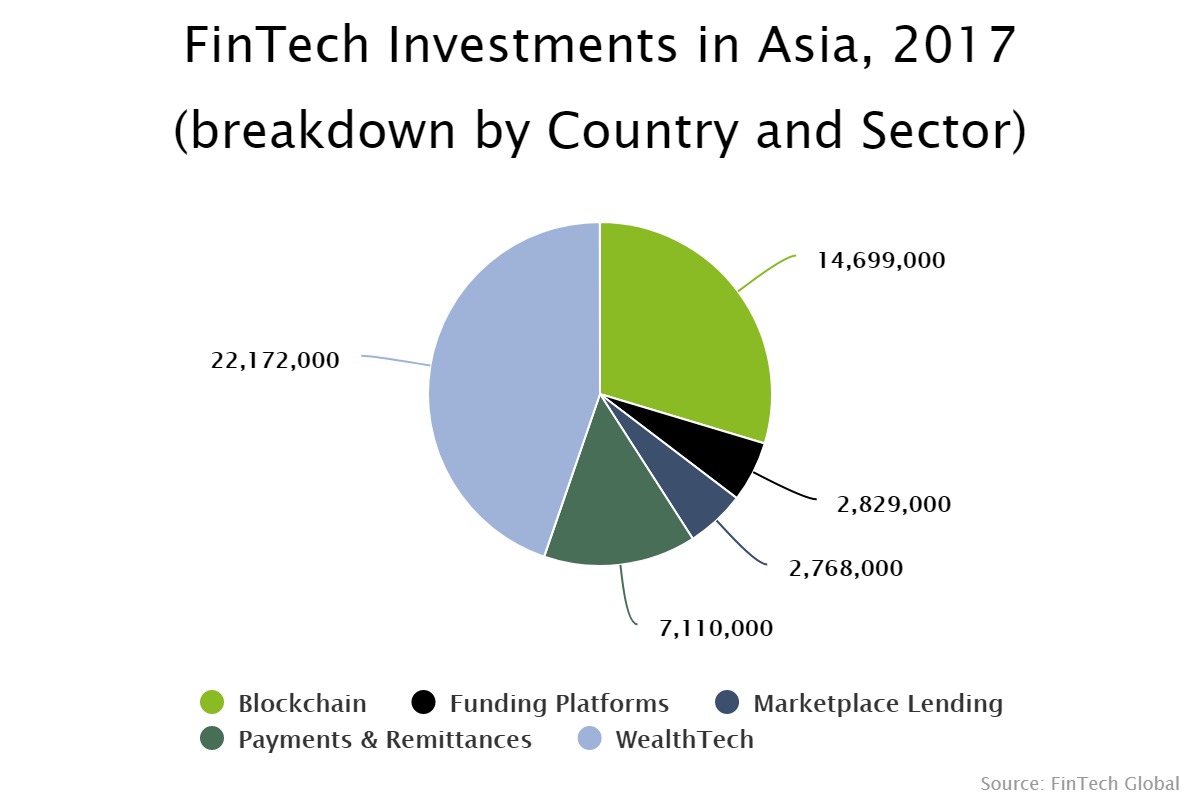

Japan FinTech sector is still fairly small in Asia, especially when compared to India and China which have seen colossal amounts of money invested into the sector. According to data by FinTech Global, there was only $49.5m invested into the country last year, of which, WealthTech companies received the largest share.

Copyright ? 2018 FinTech Global

Copyright ? 2018 FinTech Global