More than $2.8bn has been raised by Challenger Banks globally since 2014

- The WealthTech subsector has seen a proliferation of Challenger Banks spring up across the world over the past five years, with the aims of disrupting traditional banking in pursuit of growing a millennial customer base.

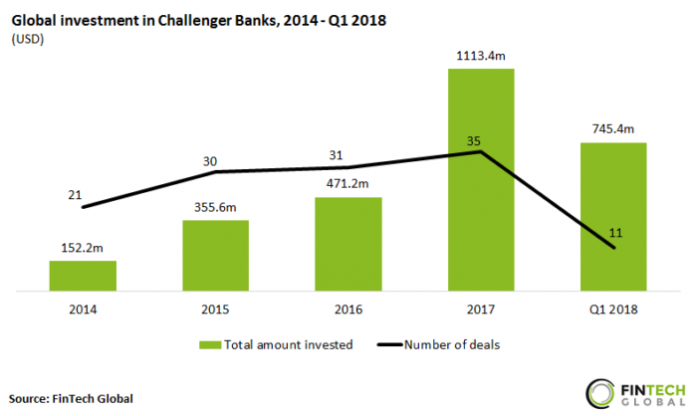

- Deal activity in the industry grew from 21 transactions in 2014 to 35 last year, with capital invested increasing 7x over the same period. However, these start-up banks still face challenges including the reluctance of customers to switch from traditional banks and intense competition caused by an increase in the number of challengers. Consequently, the average deal size grew from $7.2m in 2014 to $31.8m last year, as Challenger Banks require more capital to fund customer acquisition costs and to pursue banking licenses.

- Almost 67% of the total capital raised by Challenger Banks globally last year has already been raised in Q1 2018, setting strong funding expectations for the rest of the year.

The top two deals to Challenger Banks were both completed in Q1 2018

- The 10 largest investments in Challenger Banks between 2014 and Q1 2018 raised over $1.2bn, 43.5% of the total capital raised by banks in the sector during the same period.

- UK-based Atom Bank raised $207.1m of venture funding from BBVA and Toscafund Asset Management in Q1 2018, the largest single investment in a Challenger Bank to date. Since inception, Atom Bank has raised over $500m and also has lent out more than £1.2bn.

- N26, a Berlin-based Challenger Bank, raised $160m in Series C funding from Allianz X and Tencent Holdings in Q1 2018. This was the largest FinTech deal in Germany last quarter and the second largest investment in a Challenger Bank so far. The company plans to use the funding to accelerate growth in the US and UK.

European Challenger banks have claimed more than half of the deal activity in the space since 2014

- Although Challenger Banks have sprung up across different regions of the world in the past few years, the lion share of deal activity has been taking place in Europe.

- European Challenger Banks have claimed 57% of deal activity since 2014, with 44 transactions involving Challenger Banks based in the UK. The UK boasts some of the most well-funded Challenger Banks with Atom Bank, Starling Bank, OakNorth, Monzo, Tandem Bank and Revolut all having raised over $1bn combined.

- Challenger Banks in Asia have been involved in just under 8% of deals since 2014, with Singapore-based WB21 raising $79.5m across six transactions. The digital bank now has more than one million customers and over $1.8bn in monthly payment volume.

Revolut doubles its user base without breaking the bank

- Sao Paulo-based Nubank has raised over $600m across eight transactions. The Brazilian Challenger Bank most recently raised $150m in Series E funding in Q1 2018 led by DST Global. Since inception in 2013, the bank has received over 13 million customer applications and currently has over 2.5m credit card customers. The higher levels of underbanked population in emerging markets might be one of the reasons why Nubank has seen such a rapid adoption rate.

- Despite raising over $500m to date, Atom Bank is lagging some of its competitors with regards the number of user accounts it has opened. However, CEO Mark Mullen believes that the “significant injection of capital secures the bank’s place as a disruptive force in the mainstream of UK banking”.

- Revolut has grown its customer base much faster than competing Challenger Banks by focusing on rapidly launching products and quickly onboarding users, rather than using resources to pursue a bank license. Revolut doubled its user base from 750k in two months, has reached breakeven point and is now valued at £300m.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global