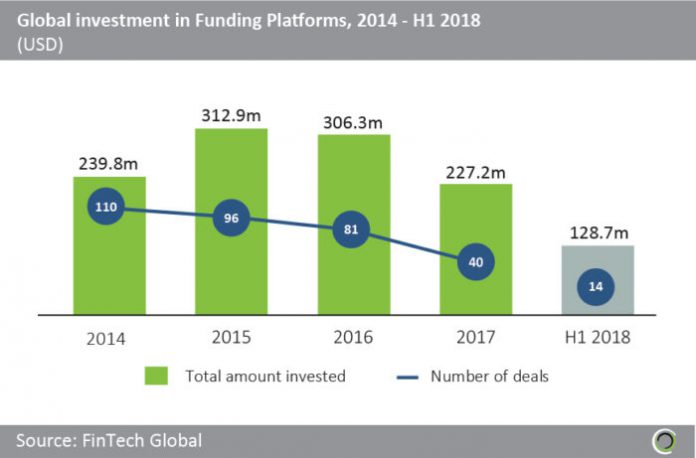

Deal activity in the Funding Platforms sector has been in decline, as the industry consolidates

- More than $1.2bn has been raised by Funding Platforms, across 341 transactions, since 2014.

- Investment peaked in 2015, with almost $313m raised across 96 deals, dipping slightly to $306.3m the following year. OurCrowd, a Jerusalem-based equity crowdfunding platform for accredited investors, raised $72m in Series C funding in Q3 2016. This was the largest deal in the sector in 2016, with OurCrowd raising capital from financial institutions, family offices and private investors across five continents.

- However, deal activity has been declining, falling from 110 transactions in 2014 to 40 last year. The industry has seen increased consolidation as smaller platforms struggle to attract a viable number of investors. San Diego-based GoFundMe acquired YouCaring, a crowdfunding platform for medical expenses, in Q2 2018, bringing further consolidation to the industry.

Investment rebounded in Q2 2018, with investment up four-fold from the previous quarter

- Almost $140m was raised by Funding Platforms across 10 deals in Q3 2017, equal to 60% of the total capital raised in the sector last year.

- London-based equity crowdfunding platform Seedrs, raised $5.2m in Series A funding in Q3 2017. This funding, led by Woodford Investment Management, was the largest deal in the sector in Europe that quarter.

- Investment in Funding platforms rebounded in Q2 2018, setting modest expectations that 2018 funding levels can match the total raised in 2017. Linked Finance, a crowdfunding platform for Irish businesses, raised $57.8m of debt finance from Banco BNI Europa. This was the largest deal in the sector last quarter and complements the funding available from its existing users who are ordinary members of the Irish public.

Almost $270m has been raised in the top 10 Funding Platform deals over the last six quarters

- Just under $270m was raised in the top 10 Funding Platform deals between Q1 2017 and Q2 2018, equal to three quarters of the total capital raised by companies in the sector over that period.

- Patreon, a San Francisco-based crowdfunding platform allowing fans to support artists and creators, raised $60m in Series C funding in Q3 2017. This funding, led by Thrive Capital, valued the company at $450m and the investment was spent on expanding its 80-person team and scaling up growth by recruiting more creators.

- ICO Headstart, a Dutch ICO fundraising platform, raised $10.8m in an ICO in December 2017. ICO HeadStart is the first fundraising platform where backers and project creators pay 0% fees without any additional costs, and this is the largest Funding platform ICO to date. ICO HeadStart™ is a platform that expertly pre-screens ICOs listing the top 3% of the most promising ICOs for users to participate in.

Over $600m has been raised by companies on Crowdcube across more than 700 successful raises

- Crowcube is a UK-based equity crowdfunding platform founded in 2010, with the company having raised $37.2m to date from investors such as Balderton Capital. Almost $640m has been raised on the Crowcube platform across 727 deals, with an average deal size of $877k per successful raise. Monzo, a London-based Challenger bank, raised £1m from more than 1800 investors on Crowdcube in just 96 seconds in 2016.

- Over $500m has been raised on Seedrs’ equity crowdfunding platform since the company started in 2009. The London-based crowdfunding platform has completed 666 successful raises with an average deal size of $774k, and recently received venture funding from Augmentum FinTech in March 2018. Revolut, a digital-only Challenger bank, exceeded its funding target on the Seedrs platform in August 2017, raising over £3.9m at a pre-money valuation of £275.9m.

- Silicon Valley-based Wefunder, founded in 2011, has received $2.3m of investment from investors such as Y Combinator. Users can invest as little as $100 in companies on the platform and more than $65m has been raised by 206 companies on the platform since 2013. HR payroll and insurance platform Zenefits, raised capital on Wefunder at a $9m valuation in May 2013, before the company’s valuation peaked at $4.5bn in May 2015.

There has been a strong shift towards larger deals since 2014

- The global share of Funding Platform deals valued below $1m declined from 65% in 2014 to less than 40% last year, with no transactions in this deal size range recorded in H1 2018, as the investment landscape for Funding platforms shows continued signs of maturity.

- Concurrently, the proportion of deals valued at $10m and above increased from just under 10% in 2014 to almost a quarter of deals last year. A third of deals in the sector during the first half of 2018 were valued above $10m, as the industry consolidates and investors double down on existing larger platforms.

- Previously mentioned Patreon raised $95m across three transactions, Series A through C, between Q2 2016 and Q3 2017. Patreon raised $30m in Series B funding in Q1 2016, again led by Thrive Capital, which funded user growth from 17k creators to 50k by 2017.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global