UK-based challenger bank Masthaven has received a £60m equity investment from Värde Partners.

Through this line of funding, the company will be able to ‘significantly increase’ lending to consumers and SMEs over the next three to five years. It will also offer innovative deposit solutions to customers.

Masthaven launched as a bank in 2016, having previously acted as a personalised provider to bridging loans and secured lending since 2004. The bank offers customers flexible and fixed-term savings accounts, bridging loans, development finance and mortgages.

Through the business savings accounts, customers can save between £5,000 and £500,000 and can decide when it matures over terms from one to five years.

Masthaven founder and CEO Andrew Bloom said, “Masthaven has made tremendous strides in the past few years and, since our launch of the bank two years ago, we have successfully launched specialist residential and buy-to-let mortgages plus bolstered our savings suite by entering the SME savings market, all while growing our team to above 170 people and generating over £0.5bn of deposits.

Now it’s time for us to further enhance our propositions for both our existing customers and intermediary partners as well as our future clients.”

Earlier in year, fellow UK-based challenger Atom bank raised a £149m investment round led by BBVA and Toscafund. The mobile banking platform raised the capital to support its growth and technology development.

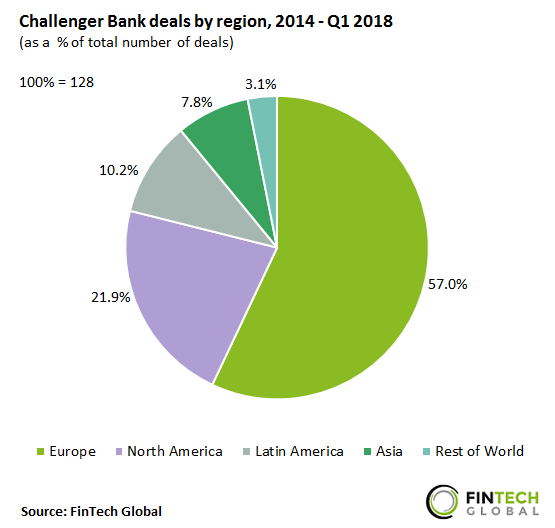

European challenger banks have witnessed the biggest share of investments, according to data by FinTech Global. Of the total deals into the new banks since 2014, 55 per cent have been into ones based in Europe.

Copyright © 2018 FinTech Global

Copyright © 2018 FinTech Global