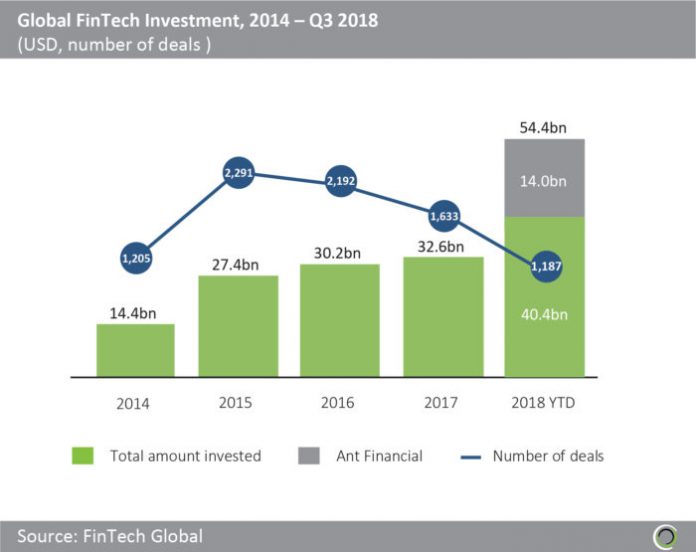

Funding to FinTech companies in 2018 has already seen an increase of 66.9% from last year’s total

- Global FinTech Investment has reached $54.4bn across 1,188 deals in the first three quarters. Capital raised has been increasing year-on-year since 2014 however this year has seen significantly larger growth. So far investment has increased 66.9% from last year compared to just 7.5% from 2016 to 2017.

- This considerable increase can be attributed to the largest deal recorded which was raised by Ant Financial. The FinTech conglomerate based in China raised $14bn in a private equity round which makes up just over a quarter of the total value invested this year. The main investors were Singapore’s sovereign fund GIC Pte Ltd and Temasek Holdings However, even excluding this deal capital invested is currently up 24.0% from last year.

- The second largest deal was $4bn raised by a blockchain company, Block.one, in an ICO.

- In fact, the top 10 deals this year were all valued at $500m or more. The $23.5bn raised between them makes up 42.3% of the total value invested. In contrast, last year the top ten deals raised $8.9bn and contributed just 27% to the total amount invested.

- Deal activity is on course to decrease slightly from 2017. Currently, it is at 72.8% of last year’s level.

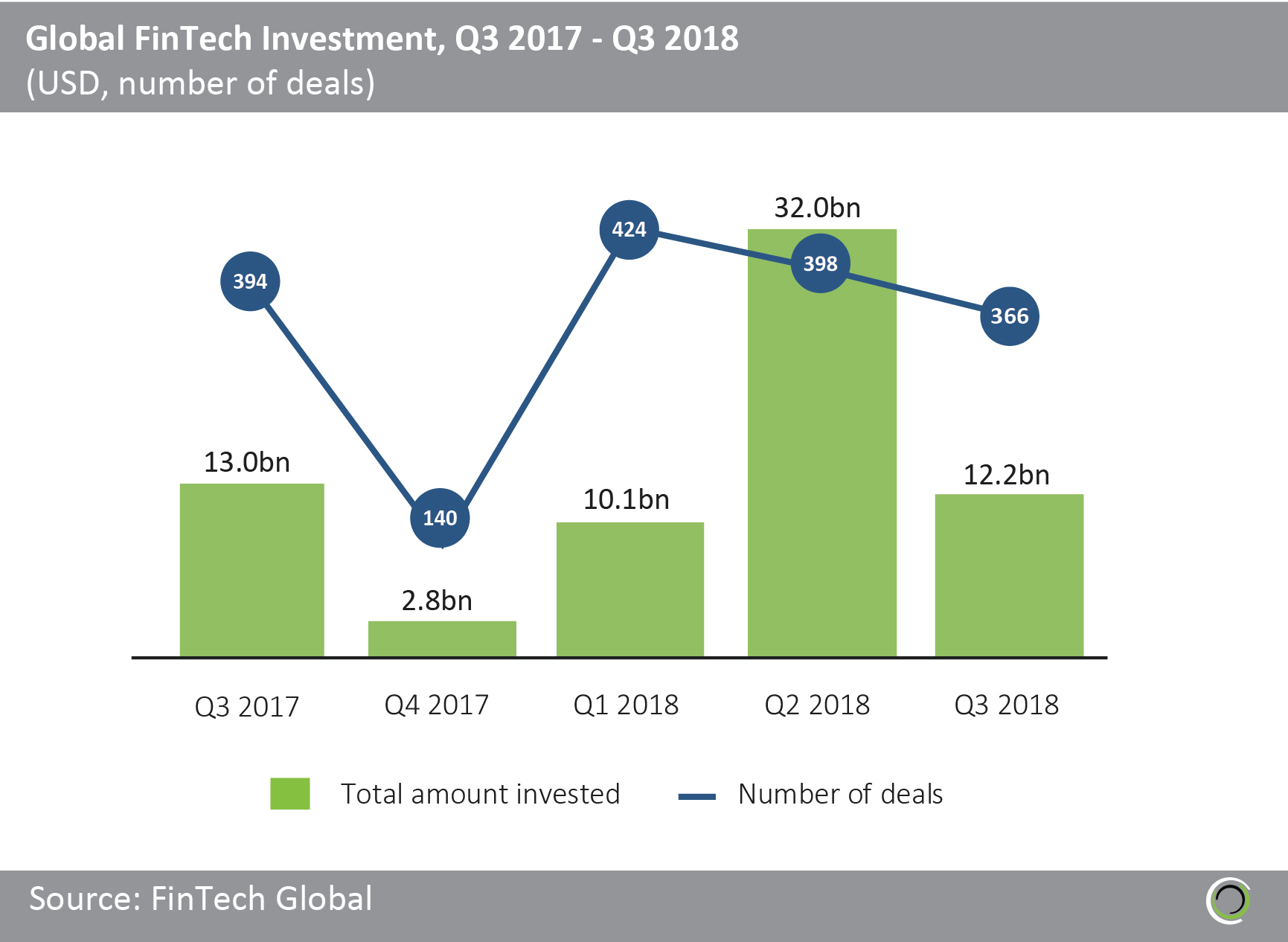

Investment in Q3 2018 is slightly lower than the same quarter last year

- The $12.2bn raised by FinTech companies in the third quarter is $800m lower compared to Q3 2017. Deal activity remains similar to Q3 2017 having decreased by 7.3% to 366 deals last quarter.

- The largest deal in Q3 2018 was $1bn raised by SenseTime; a unicorn company based in China. SenseTime has developed a range of AI technologies such as face recognition, image recognition, object recognition, text recognition, medical image analysis, video analysis, autonomous driving, and remote sensing. The company has become China’s largest AI algorithm provider.

- Q2 2018 is the strongest quarter so far this year, it makes up almost 60% of the total value invested in the first three quarters. This is due to the previously mentioned deal with Ant Financial which makes up 42.3% of the total value invested in the quarter.

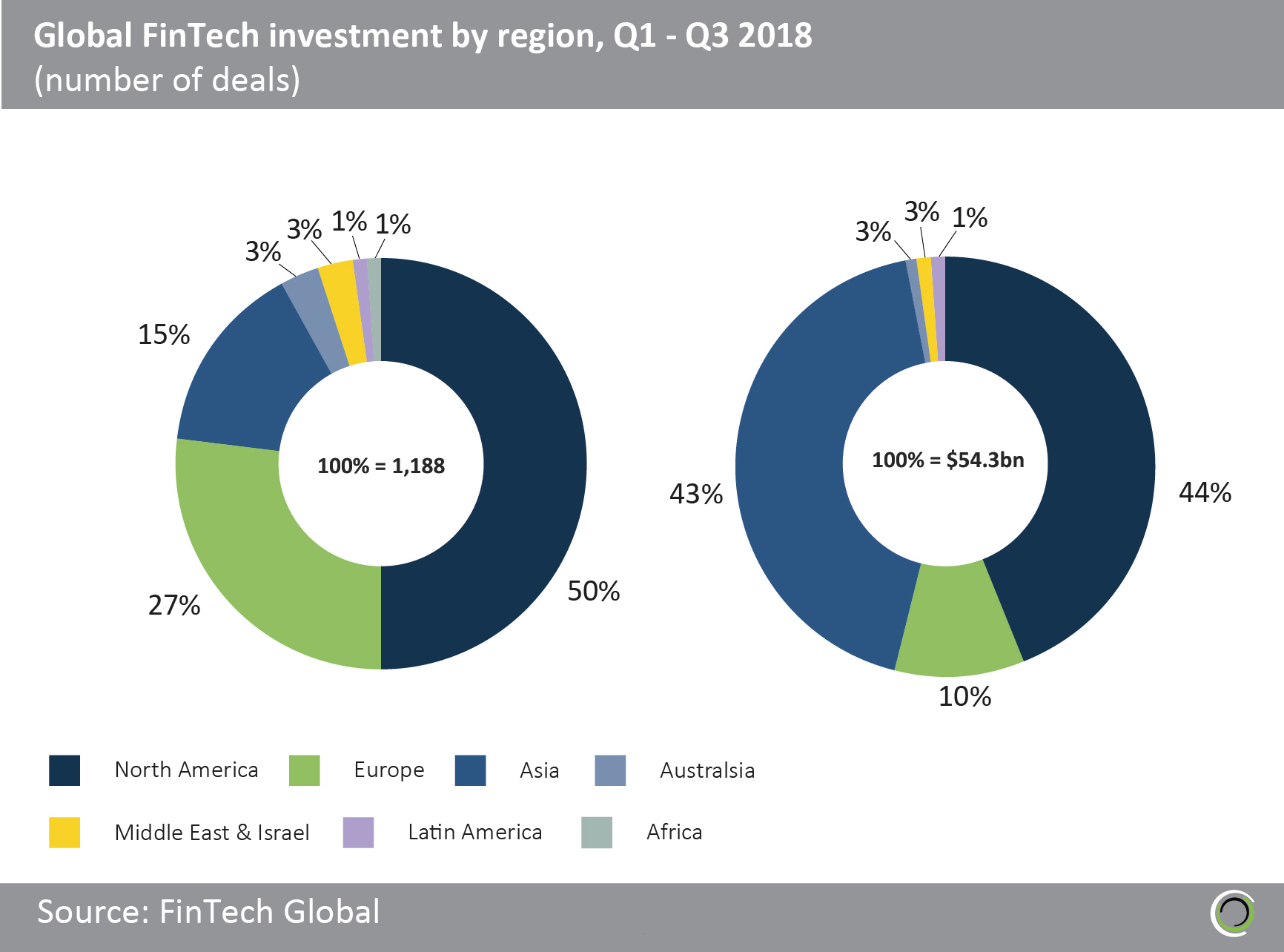

FinTech Companies in North America have attracted half of all deal activity in the first three quarters of 2018

- North American companies continue to dominate global deal activity. 2018 has seen a 7.63 pp (percentage point) increase in North America’s share of overall deal activity from last year. Also, 42% of total value invested has been in North American companies; $23.8bn so far. The biggest deal on this continent was the previously mentioned Block.one.

- Asia makes up just 15.4% of total deal activity. However, the region has a much higher percentage of the value of global investment; 42%. This can be attributed to the numerous large deals which took place in Asia. In fact, six out of 11 deals globally valued at over $500m were completed by companies in Asia, five of which were based in China.

- Overall, these six deals make up almost 75% of the total value invested in Asia in 2018 so far. Three of these rounds were raised by the previously mentioned company SenseTime. The company has so far raised $2.2bn in 2018.

- Deal Activity in Middle East & Israel, Latin America and Africa in 2018 is collectively less than 5%. The biggest deal in these three regions took place in Latin America. Portal Finance, a SME Finance company based in Colombia raised $200m pounds, in a debt financing round.

Payments & Remittances companies have received the highest number of FinTech deals in every region

- The Payments & Remittances subsector has received at least 17% of deal activity in every Region since 2014. The Rest of World combined has the highest percentage of deal activity in the Payments & Remittances subsector out of all the regions since 2014; 27%. There have been 164 deals since 2014, the top 10 deals were all for $22m or more. A noticeable deal was $72m raised by Australian company Tyro Payments, a FinTech institution specialising in merchant credit, debit and EFTPOS acquiring.

- Infrastructure & Enterprise software is the second most popular subsector in North America and Europe. However, it is the fourth most popular subsector in Asia. This is partly due to the fact that financial markets in Asia are less developed and therefore investors focus mostly on Marketplace Lending and Payments & Remittances companies that serve the underbanked people in Asia.

- A big deal in Infrastructure & Enterprise Software was $500m raised by Zenefits in 2015 in a Series C round. Zenefits is a company based in the United States that offers cloud-based software as a service to companies for managing their human resources, with a focus on helping them with health insurance coverage.

- The biggest deal in the Marketplace Lending subsector in Asia was $1bn raised by JD Finance in a private equity round. The financial technology arm of JD.com gives individuals and businesses quick, easy and convenient access to the financial services they need.

- The Rest of World includes Africa, Australasia, Latin America and Middle East & Israel.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global