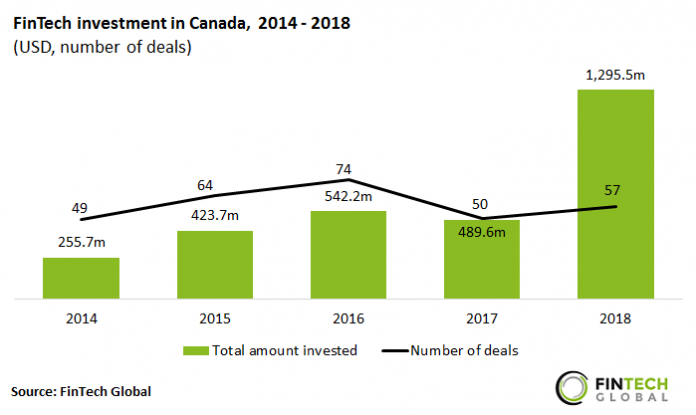

Almost $1.3bn was raised last year by FinTech companies in the country

- Canadian FinTech companies raised over $3bn across 294 transactions between 2014 and 2018, with investment increasing at a CAGR of 50.0% during the period.

- Funding surged to $1,295.5m across 57 transactions last year, which is more than 2.5 times larger than capital raised in 2017.

- Toronto is the largest FinTech hub in Canada and one of the largest financial centers in the world, with growing participation from financial institutions in the FinTech space and access to top tech talent from leading universities in Southern Ontario.

- Wealthsimple, a Toronto-based Robo-advisor, raised $51.4m of venture funding from Power Financial Corporation in Q1 2018 which was the largest WealthTech deal in Canada last year. The company manages approximately $1.9 billion for over 65,000 clients and the capital was raised to explore new financial product offerings and to further develop its B2B platform.

Funding in Q4 2018 has more than doubled compared to the same quarter in 2017

- Funding in Q4 2018 was just above $243m across 15 deals, which is more than double the $114.6m raised in Q4 2017. ClearBanc, a provider of online business loans, raised $70m from investors such as Emergence Capital and Real Ventures in one of the largest deals of the last quarter of 2018.

- FinTech investment jumped in Q2 2018 with almost $500m raised by Canadian companies, across 14 transactions. Toronto-based Flexiti Financial, a provider of POS financing and payment technology, raised a $350m debt round from Credit Suisse in June 2018. This was the largest FinTech deal in Canada last year and the proceeds were used to finance the $250 million acquisition of TD Financing Services’ Canadian Private Label Credit Card Portfolio.

- Funding in Q3 2018 reached almost $350m which is nearly three times the amount of capital raised in the previous quarter, when Flexiti’s $350m debt raise is excluded. Progressa, a Vancouver-based direct-pay lending platform, raised a $72m debt facility from Cypress Hill Partners in August 2018 in addition to a $12m Series B round co-led by Canaccord Genuity and Gravitas Securities. Progressa said that this funding is expected to be its last private round as the company is preparing for an IPO before the end of 2019.

Almost $950m was raised in the top 10 FinTech deals in Canada last year

- The top 10 investments in Canadian FinTech companies in 2018 raised $40.2m, which is equal to 72.6% of the total capital raised in the country last year.

- Previously mentioned Flexiti Financial raised $350m in Q2, followed by an additional $80m of debt from credit Suisse in September 2018. This additional funding will be used to finance future originations and help Flexiti’s merchant partners offer flexible financing options.

- Ottawa-based Assent Compliance is a supply chain management software company that assesses third-party risks and educates stakeholders on regulatory and data program requirements. The company raised $100m of Series C funding from Warburg Pincus in Q4 2018, which will enable Assent to continue the development of its product compliance and vendor management risk platform.

Real Ventures was the most prolific FinTech investor in Canada last year

- Real Ventures is a Montreal-based venture capital firm established in 2007. The firm has invested in over 200 companies across five funds, with $330M under management, and typically invests between $0.25 million and $0.75 million per transaction.

- Real Ventures was the most active FinTech investor in Canada last year, with involvement in five of the 57 deals that occurred in the country in 2018.

- The firm’s first deal of 2018 was the $8.4m Series A round that MindBridge AI, a transaction monitoring solution provider, raised in April for the purpose of scaling-up operations and expanding globally.

- Real Venture’s largest deal last year was the $70m that ClearBanc, an online lender to entrepreneurs, raised in Q4 2018. ClearBanc offers businesses loans in exchange for a steady revenue share of their earnings until it is paid back plus a 6% fee.

- Other deals include investments in Instant Financial, LoginRadius and Kooltra.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global