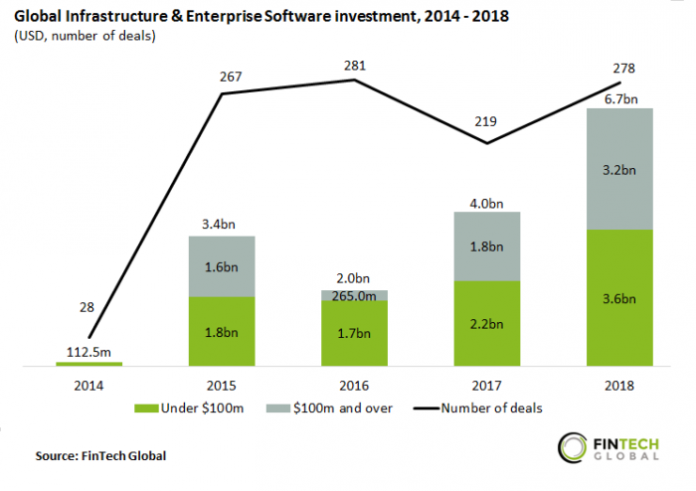

The total amount invested in this sector last year was 60.7% higher compared to 2017

- In 2018, Infrastructure & Enterprise Software investment raised $6.7bn across 278 deals. The capital raised by deals $100m and over makes up 47.1% of the total investment. There were 14 deals in this bracket last year, compared to ten in 2017.

- The biggest deal last year was a $650m Series A round raised by Shanghai-based unicorn OneConnect. The company is a subsidiary of Ping An Insurance, a holding conglomerate whose sub-organizations operate in the insurance, banking and financial services sectors. OneConnect is a SaaS provider of technology-enabled business solutions to small and medium-sized financial institutions.

- Another large deal to close last year was Plaid’s $250m Series C round. The San Francisco-based company builds infrastructure which allows consumers to interact with their bank account online through third-party Open Banking enabled services. The start-up claims that 25% of people living in the US and Canada with bank accounts have used an app that utilises their APIs.

- Deal activity in 2018 was 26.9% higher than the previous year and returns to similar levels from 2016.

Global Infrastructure & Enterprise Software investment in the last quarter of 2018 is almost double as compared with Q4 2017

- Capital raised by Infrastructure & Enterprise Software deals in the last quarter reached $1.2bn. This is a 92.5% increase compared with the corresponding quarter in 2017. However, Q4 2018 makes up only 17.2% of total value invested last year. The quarter also registered the lowest number of deals.

- The largest deal in Q4 2018 was the previously mentioned Plaid funding round. The second biggest deal was $200m raised by Tanium. The US platform offers end point security and system management for large enterprises and governments. Since the inception of their technology five years ago, they have helped over half of Fortune 100 companies to become more secure.

- The second quarter in 2018 saw the highest value of investment. When capital raised in Q2 reached $2.1bn. There were seven rounds or $100m or more in this quarter which collectively raised $876m.

Companies in the Security Technology subsector are attracting the most interest from investors in Infrastructure & Enterprise Software businesses

- More than a quarter of Infrastructure & Enterprise Software deals since 2014 have been in the Security Technology subsector. The two biggest recorded funding rounds in this subsector were both raised last year. They consist of the previously mentioned Tanium deal and $200m raised by Crowdstrike in a Series E round. The US company, Crowdstrike, offers a SaaS cloud-based endpoint protection platform. The CEO George Kurtz reported that, “this round of funding will accelerate the growth of our operations and the pace of our innovation and technology development.” Crowdstrike is now planning to open a new Centre of Innovation in Bucharest and hire 80 additional employees.

- Companies in the Accounting and Banking Infrastructures subsector had 23% of total deal activity each. Only one of the 20 largest funding rounds in the last five years was raised by a company in the Accounting subsector. In September this year Xero raised $300m in post IPO equity. The New Zealand-based company provides accounting software for SMEs.

- In 2018, the two largest funding rounds in the Banking Infrastructure subsector were the previously mentioned OneConnect and Plaid deals.

- The HR/Payroll and Invoicing subsectors have both received a healthy proportion of deals; 14% each. One of the largest deals in the HR/Payroll subsector this year was $140m raised by US company Gusto in a Series C round. Gusto offers payroll services to business with less than 200 employees. It counts over 60,000 companies as customers.

The 10 most active investors in Infrastructure & Enterprise Software have completed 141 deals since 2014

- The top 10 most active investors in the Infrastructure & Enterprise software subsector are all US firms. Nine out of the ten companies are venture capital firms.

- The most active investor in the last five years, Accel Partners, has completed 24 funding rounds. In 2018, the venture capital firm took part in seven deals including the previously mentioned Crowdstrike Series E round.

- The second top investor Y Combinator, which has taken part in 17 funding rounds in the last five years, is the only non venture capital firm out of the top 10. This year the seed accelerator participated in the previously mentioned Gusto funding round. Y Combinator has funded 1,900 start-ups since 2005 which have a combined valuation of over $100bn.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global