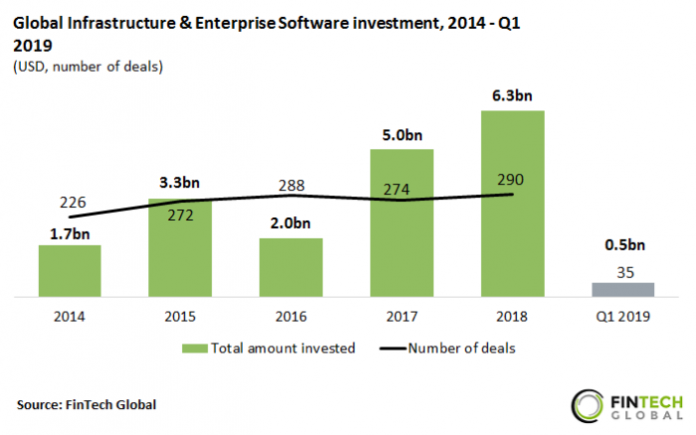

Funding dropped in Q1 2019 after topping $6bn last year

- Just over $18.4bn has been invested in Infrastructure & Enterprise Software companies globally since 2014, across 1,385 transactions.

- Investment increased at a CAGR of 38.8% between 2014 and 2018, reaching $6.3bn last year, with $0.5bn raised across 35 deals in the first quarter of 2019.

- OneConnect, a banking software provider and subsidiary of Ping An, raised a $650m Series A round at a $6.8bn pre-money valuation from SoftBank Vision Fund in Q1 2018. This was the largest deal in the subsector last year and OneConnect, which has almost 500 banking and insurance clients, is now preparing for a potential IPO.

Funding in Q1 2019 fell to a quarter of the investment raised in Q1 2018

- Almost $4bn was raised in the first two quarters of 2018, equal to 62.7% of the total capital raised last year.

- Deal activity declined quarter on quarter from 87 transactions in Q1 2018 to 35 in Q1 2019 and just under $0.5bn was invested in Q1 2019, less than 25% of the funding raised in the corresponding quarter in 2018.

- Funding in Q1 2018 and Q2 2018 was boosted with five and six deals valued at $100m and above respectively compared to none in Q1 2019.

- Previously mentioned OneConnect raised $650m in Q1 2018, and enterprise security software provider CrowdStrike raised a $200m Series E round from investors including Accel, IVP and General Atlantic in Q2 2018. This was the largest deal in the subsector that quarter and enables California-based CrowdStrike to accelerate global demand for its Falcon endpoint protection platform.

More than $340bn was raised in the top 10 deals in Q1 2019

- Just over $340bn was raised in the 10 largest Infrastructure & Enterprise Software  deals in Q1 2019, which is equal to 69.2% of the total capital raised by FinTech companies in the subsector globally that quarter.

- Boston-based TaxJar, a technology solution provider enabling ecommerce platforms to manage sales tax, raised a $60m Series A round from Insight Venture Partners. This was the largest deal last quarter and will enable TaxJar to continue to aggressively hire and accelerate product development.

- Companies in North America dominated, with seven deals listed in the top 10 followed by two in Europe and one in Latin America.

- Personio, a Munich-based HR management platform for startups and SMEs, raised a $40m Series B round led by Index Ventures. This was the largest deal in the subsector in Europe last quarter and Personio now has more than 1,000 clients in 35 countries, with more than 150,000 employees currently being managed within the Personio platform.

- Curitiba-based Contabilizei, a Brazilian provider of online accounting solutions, raised $20m in a Series B round from investors including Point72 Ventures, FinTech Collective, e.Bricks Ventures and Quona Capital. This was the only deal outside of North America and Europe last quarter and Contabilizei already has 200 employees and more than 10,000 customers throughout Brazil, having audited more than 2 billion reais in customer revenue.

Security Technology companies have attracted the greatest share of deals since 2014

- There have been 1,385 Infrastructure & Enterprise Software deals completed since 2014, with transactions distributed across the value chain of this FinTech subsector.

- Over 27% of deals involved companies offering Security Technology solutions which is the largest proportion of any other category in the Infrastructure & Enterprise Software value chain. Symantec, a cybersecurity and data storage solution provider, raised $500m of post-IPO equity which was the largest deal in the entire subsector in 2017.

- Accounting solution providers followed, claiming 23.6% of deals (327 transactions) between 2014 and Q1 2019. Online accounting software provider Xero, also raised $110.8m of post-IPO equity, led by Accel in Q1 2015, which was the largest investment raised by an accounting solution provider to date.

- There have been 176 transactions involving HR/Payroll solution providers since 2014, equal to 12.7% of all Infrastructure & Enterprise Software deals completed during the period. London-based Hibob, a cloud-based human resources management platform, raised a $20m Series A round led by Bessemer Venture Partners in March 2019. This was the largest deal in the Infrastructure & Enterprise Software deal in the UK in Q1 2019 and will accelerate Hibob’s expansion into the U.S. and Europe.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global