Over $10bn was invested in Marketplace Lending companies in Asia between 2014 and Q1 2019

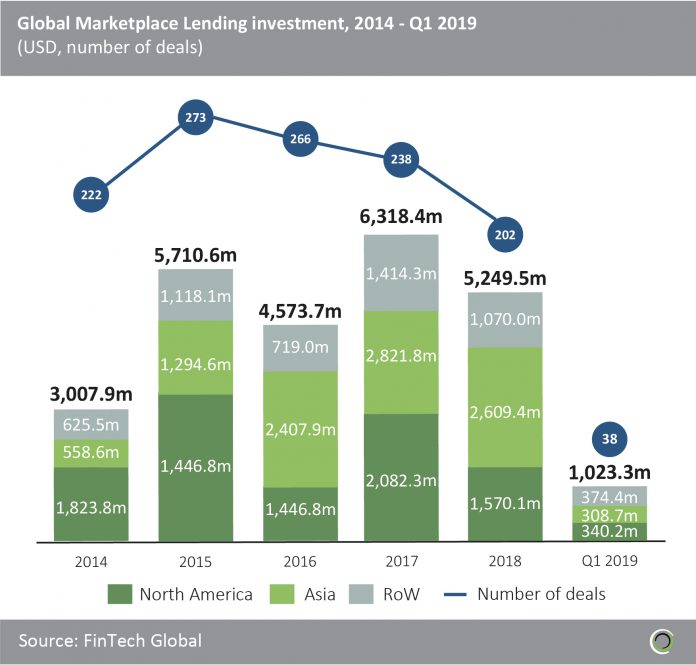

- Almost $25.9bn was raised by Marketplace Lending companies between 2014 and Q1 2019 across 1,239 deals, with two fifth of this invested in companies in Asia.

- Growth in the sector has been driven by the increase in the number of non-bank lenders following the great financial crisis of 2008.

- There has been a shift in funding from North America, which received the largest proportion of capital in 2015, towards Asia over the past three years, with 47.5% of the capital raised between 2016 and Q1 2019 going to companies in the region.

- Funding surpassed $1bn in Q1 2019 which pushed the average deal size to $26.9m, up from $26m in 2018, as the subsector continues to mature.

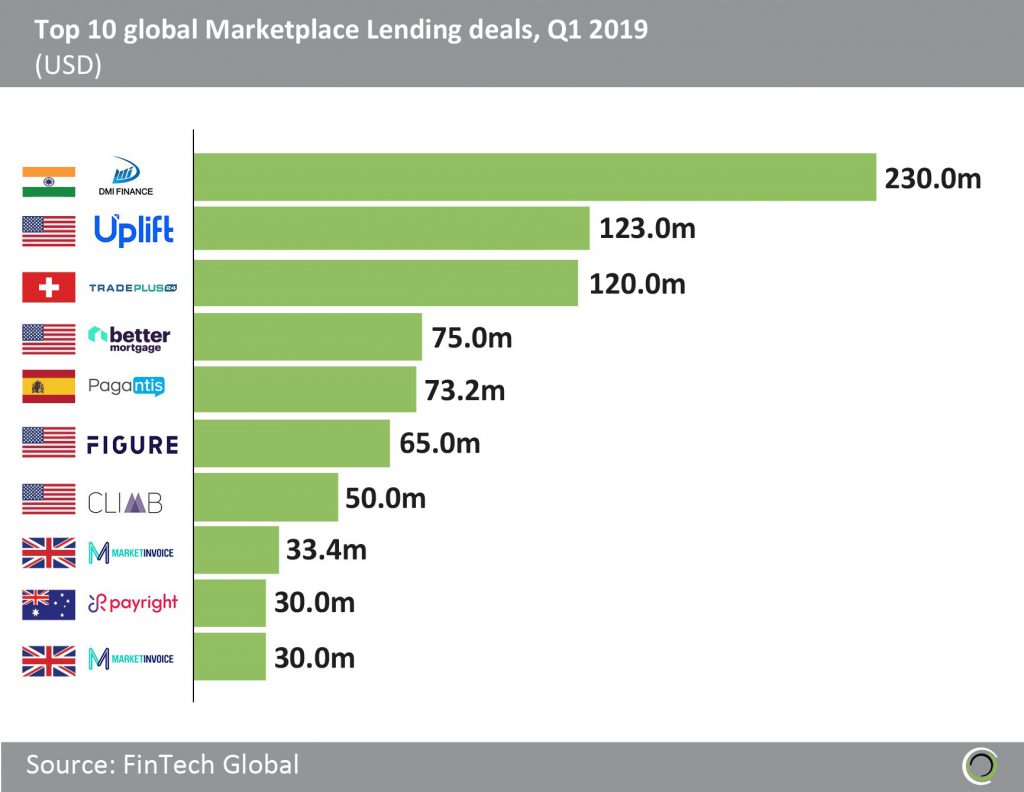

Almost $800m was raised in the top Marketplace Lending deals last quarter

- Just under $800m was raised in the top 10 Marketplace Lending deals last quarter, equal to 73.5% of the total capital invested in the subsector globally during that period.

- DMI Finance, a pan-Indian credit platform based in New Delhi, raised $230m from New Investment Solutions in January making it the largest Marketplace Lending deal of Q1 2019. The company is growing at a rate of 30% month on month and the investment will be used to fund the growth of DMI Housing Finance.

- The share of deals in the ‘RoW’ (outside of North America, Asia and Europe) increased from just 6.8% of deals in 2014 to 10.5% of transactions in the first three months of 2019.

- PayRight, an Australian payment plan provider that enables merchants to extend interest free credit to their customers, raised $30m in a venture round from Escala Partners and Henslow. This was the largest deal in ‘RoW’ last quarter and capital raised will be used to fund international expansion.

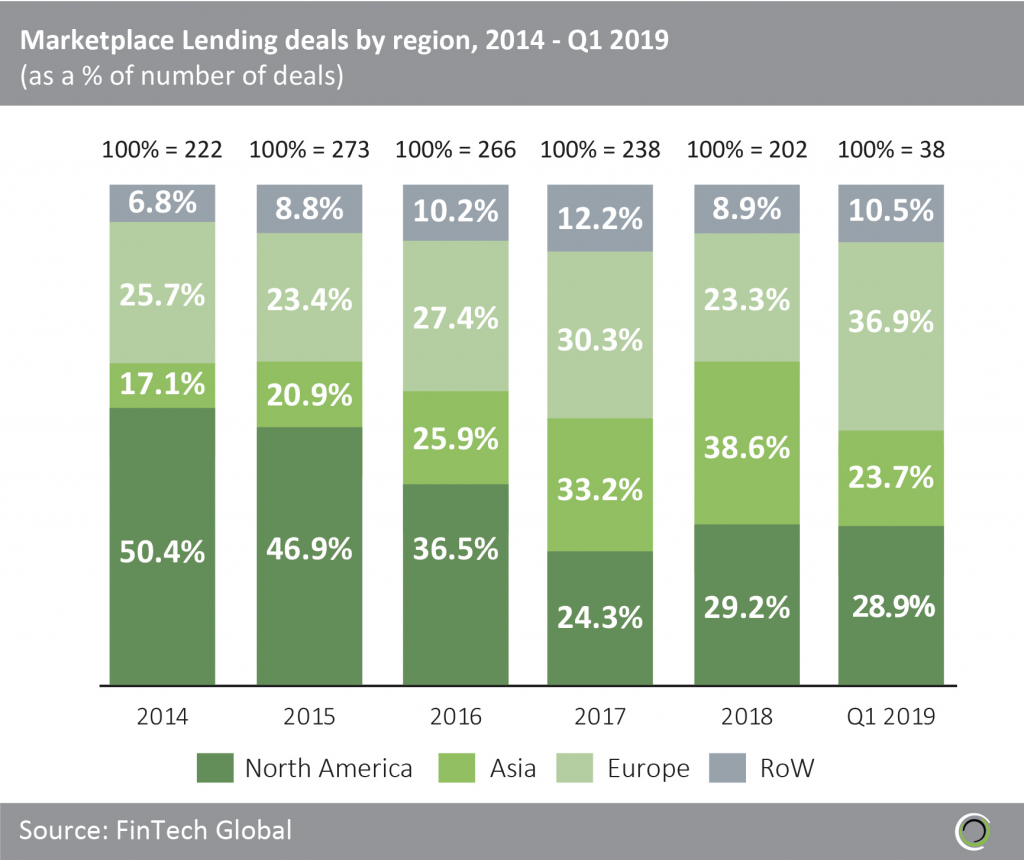

Deal activity has been shifting from North America to Asia and Europe over the past five years

- The proportion of deals involving North American companies fell from half of the transactions in 2014 to just 28.9% last quarter, as investor appetite has shifted towards deals in Europe and Asia.

- European-based marketplace Lending companies increased their share of deals from 25.7% in 2014 to 36.9% in 2019, the greatest share of any other region last quarter. The growth of Marketplace Lending companies in Europe can be attributed to alternative lenders filling the funding gap created by regulations such as Basel III, that have impacted SME lending from tradition banks.

- London-based Greensill Capital provides working capital finance to SMEs and raised $250m of private equity funding from General Atlantic in July 2018. This was the largest Marketplace Lending deal in Europe between 2014 and Q1 2019, with funding used to deepen Greensill’s existing client relationships, and to further develop its technology to deliver best-in-class products and services to customers.

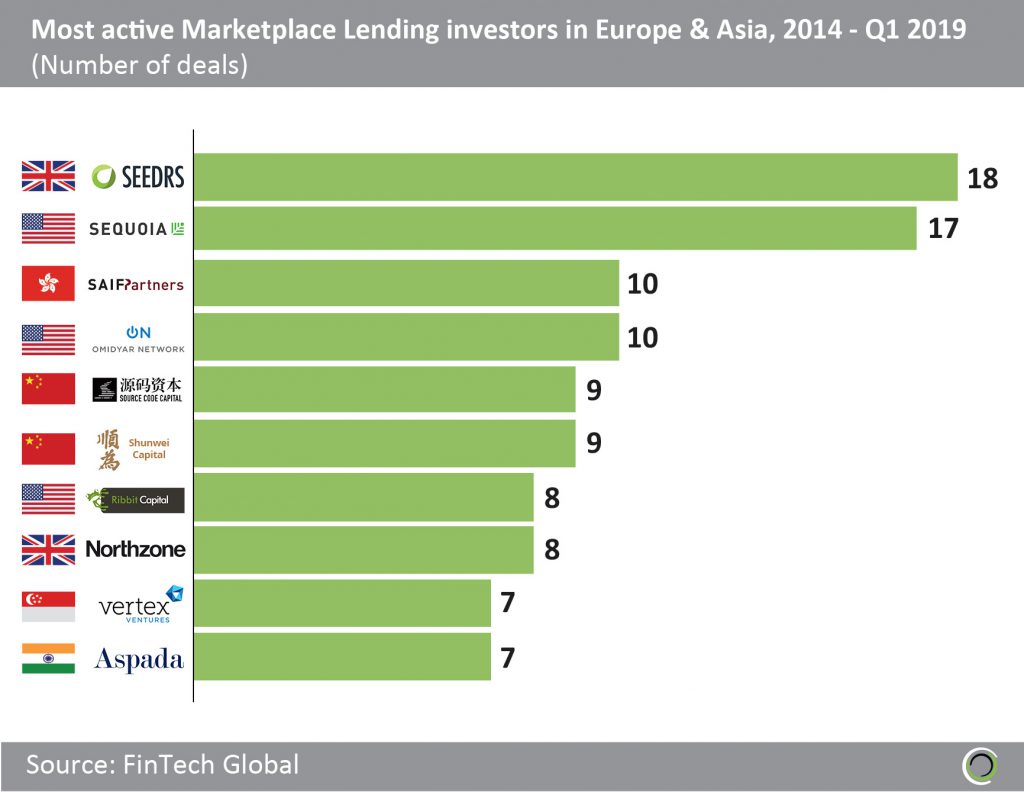

The most active Marketplace Lending investors in Europe and Asia have been involved in more than 100 deals between them since 2014

- There have been 656 Marketplace Lending deals in Europe and Asia over the past five years, with more than $14bn raised across these transactions.

- The 10 most active Marketplace Lending investors in Asia and Europe completed 103 deals between 2014 and Q1 2019.

- Seedrs, an equity crowdfunding platform operating from London, has been the most active investor in Marketplace Lending in Europe and Asia, completing 18 transactions over the past five years, one more than US-based Sequoia Capital in second place.

- Seedrs most recent investment in these regions was a $1m investment in Crowdstacker, a London-based P2P business lending platform, in Q3 2018. Crowdstacker aims to assist British businesses in accessing alternative finance via P2P loans and is among the earliest platforms to gain permission for this from the FCA.

- SAIF partners has been the most active Asian-based investor in the subsector since 2014, having completed 10 transactions. SAIF is a leading private equity firm with local teams in Hong Kong, China, and India. The firm’s largest Marketplace Lending deal to date was a $45m Series C investment in Capital Float in Q3 2018, led by Ribbit Capital with participation from Sequoia Capital. Capital float is a leading provider of working capital to Indian SMEs with coverage across 300 cities in the country.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global