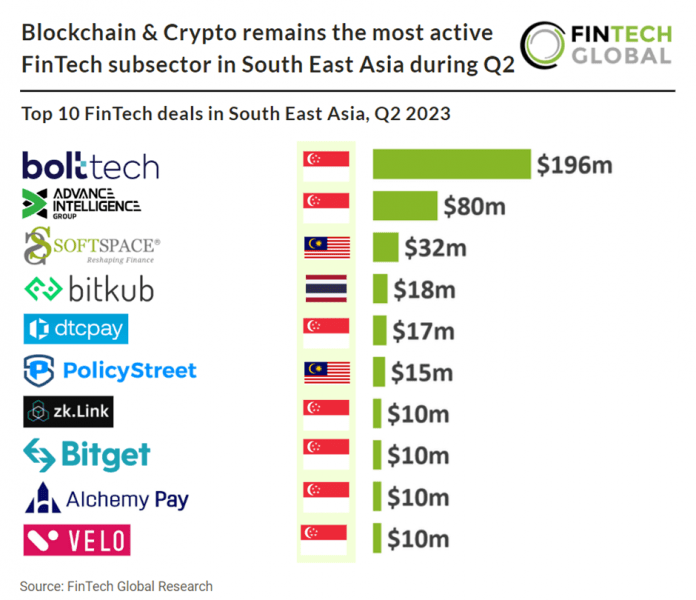

Key South East Asian FinTech investment stats in Q2 2023:

• South East Asian FinTech deal activity reached 67 transactions in Q2 2023, a 48% drop YoY

• South East Asian FinTech companies raised a combined $476m in fresh capital during the second quarter, a 68% decrease from the same period in 2022

• Blockchain & Crypto was the most active FinTech subsector with 17 deals, a 25% share of total transactions

The FinTech sector in South East Asia has suffered in Q2 2023 with both deal activity and investment dropping YoY, although this is inline with global trends. In the second quarter of 2023, the number of FinTech deals in the South East Asian region totalled 67, reflecting a significant 48% decrease compared to the same period in 2022. South East Asian FinTech deal also fell from Q1 2023, dropping 9% despite a 15% increase from Singapore, the regions most active FinTech nation, over the same period. During Q2 2023, South East Asian FinTech enterprises collectively secured $476 million in funding, marking a notable 68% decline when contrasted with the funding raised in the second quarter of 2022.

bolttech, an international InsurTech, raised the largest Singaporean FinTech deal in Q2 2023, raising $196m in their latest Series B extension funding round, led by Tokio Marine. The fresh capital sets bolttech’s valuation at $1.6bn. bolttech will use the proceeds of Series B to further fuel its organic growth, including investments in proprietary technology, digital capabilities for business partners and end consumers as well as talent across bolttech’s 30+ markets. In addition, the funds will be used to explore inorganic opportunities to accelerate international growth. Rob Schimek, bolttech’s Group Chief Executive Officer, said, “Having just celebrated our third anniversary since our launch in 2020, we are incredibly proud of what we have achieved so far on our mission to build the world’s leading, technology-enabled insurance ecosystem. We are now one of the fastest growing InsurTechs in the world, enabling our partners to find new revenue streams, accelerate their digital transformation, and deepen their customer relationships. We thank all our Series B investors for their support, and we are excited to welcome our new investors, reputable leaders in their respective spaces, and look forward to strong partnerships that will fuel bolttech’s continued growth on our path to profitability in 2024.”

Blockchain & Crypto was the most active FinTech subsectors in South East Asia with 17 deals, a 25% share of total deals. PayTech and WealthTech were the regions second most active FinTech subsectors with 11 deals each.

Countries with a substantial unbanked population have shown greater interest in cryptocurrency adoption. Unlike China and India, which have imposed strict regulations on crypto due to their higher banking access rates, emerging Southeast Asian nations such as Vietnam, Indonesia, and the Philippines have been more open to crypto.

Vietnam, for instance, although lacking specific regulations, allows its citizens to hold virtual assets, leading to a thriving crypto space. Approximately 17% of Vietnam’s population owns cryptocurrency, with bitcoin being the most popular. This might be attributed to the practical uses of crypto, especially for remittances from Vietnamese working abroad, which can be cheaper and more efficient compared to traditional methods.

Indonesia’s stance is supportive of crypto as an investment class but not for payments. Despite a previous ban on using crypto for transactions, Indonesia plans to establish a cryptocurrency exchange, signalling a more favourable approach. Transaction volumes of crypto assets in the country surged over 1,000% in 2021.

The Philippines stands out as the most crypto-friendly country in Southeast Asia, aligning with its central bank’s financial inclusion goals. Regulatory tolerance and initiatives such as creating a payments-focused stablecoin have boosted crypto adoption. The country has a substantial remittances market, and digital payment firms like Strike have expanded into the Philippines.