UK FinTech funding is set for another record year with companies already raising nearly £2.7bn

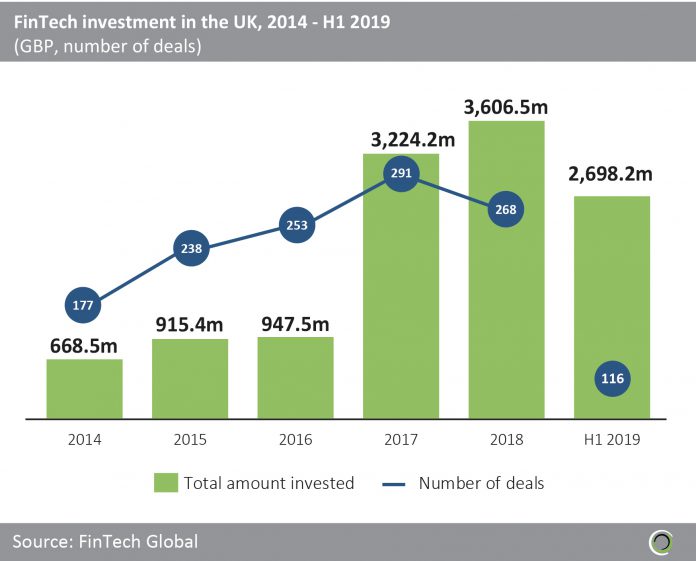

- UK FinTech companies raised more than £12bn over the past five years, with £2.7bn of this invested in the first half of 2019.

- Additionally, London has consistently held the lion’s share of deals since 2014, with FinTech companies in the capital capturing 85.2% of deal activity in the country.

- Despite FinTech investment in the UK increasing at CAGR of 52.4% between 2014 and 2018, the number of transactions declined by 7.9% from 291 deals in 2017 to 268 last year. From 2016 to 2017, the average deal size saw the most sizable increase, almost trebling from £3.8m to £11.1m.

- In the first half of 2019, funding in the UK FinTech space has already surpassed three quarters of the total capital raised last year, setting strong expectations for the final two quarters of the year.

UK FinTechs are increasingly using crowdfunding as a source of capital

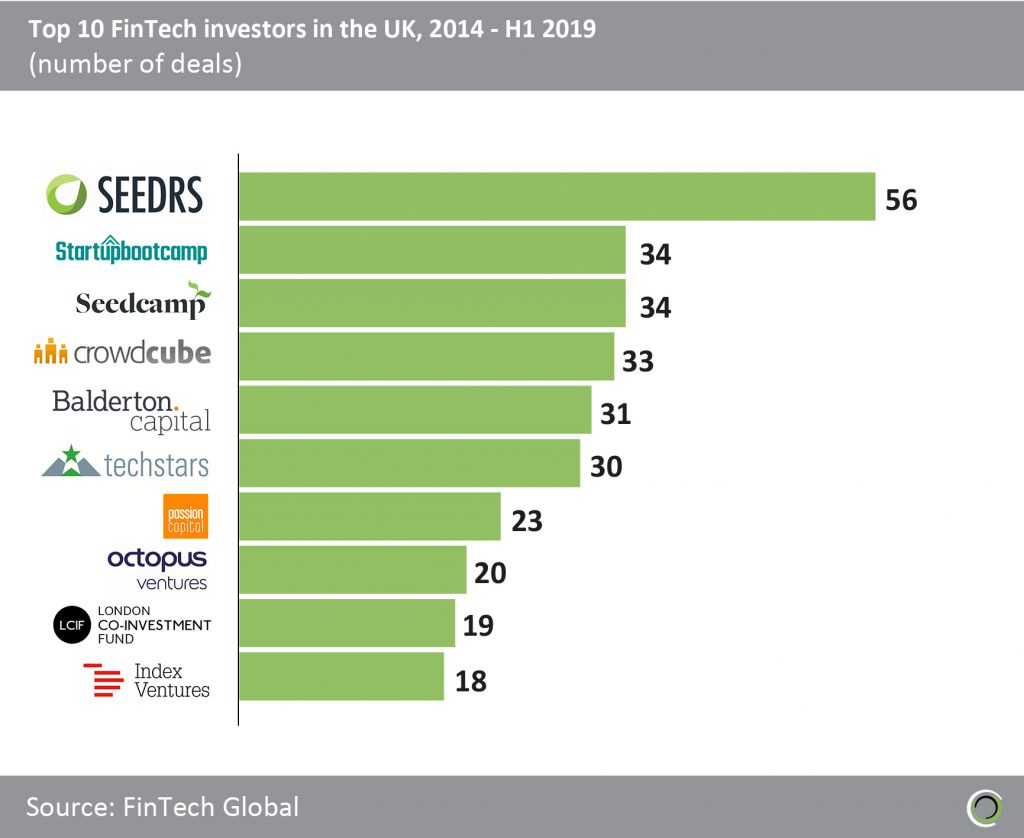

- The top 10 investors have collectively participated in almost 300 funding rounds since 2014, with eight of these investors based in London.

- Both the first and fourth top investors, Seedrs and Crowdcube respectively, are Crowdfunding platforms. FinTech companies in the UK have been launching crowdfunding campaigns, on platforms such as Seedrs and Crowdcube, as to raise capital and bring products to market faster, whilst building greater brand equity by making their customers their investors too.

- Curve, an app that allows the consolidation of multiple bank cards into one, recently announced the launch of its crowdfunding campaign on Crowdcube in August, following in the footsteps of other UK FinTech companies such as Monzo and Revolut that have gone down this route.

- The top 10 investors also include three Accelerator/Incubators (Startupbootcamp, Seedcamp and Techstars. One notable investor is Seedcamp, which has been in 34 FinTech deals in the UK over the past five years. Seedcamp most recently invested in TaxScouts’ £1.2m Seed round in January 2019. TaxScouts is a digital tax advisor that provides online tax preparation services and plans to use the funding to quadruple its network of accountant partners by the end of 2019.

- The rest of top 10 investors are London-based venture capital firms, which include Balderton Capital, Passion Capital, Octopus Ventures, London Co-Investment Fund and Index Ventures. Balderton Capital is the most active venture capital investor in UK FinTech having completed 31 deals since 2014, and recently participated in the £33.4m Series B round that InsurTech company Zego raised in June 2019.

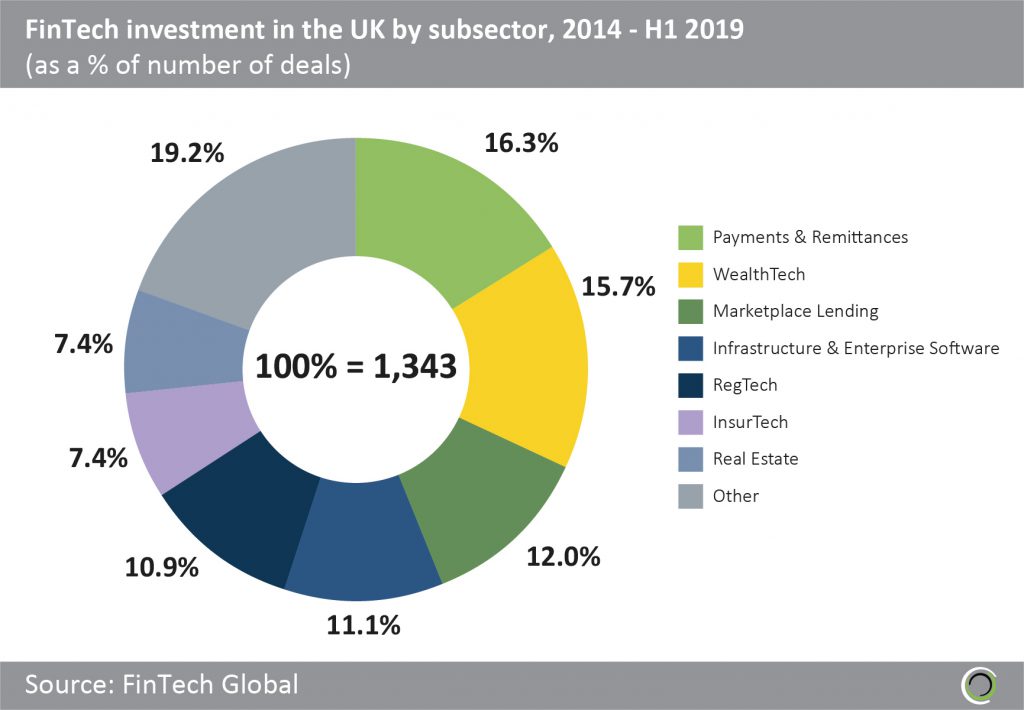

A wide variety of subsectors in the UK FinTech ecosystem are attracting a healthy share of deal activity

- Payments & Remittances companies and WealthTech companies have captured almost a third of total funding rounds since 2014, which can be explained by growing investor and consumer demand for digital banking across the UK, and the early adoption rates of tech savvy consumers in the UK with respect to payments innovations, such as contactless payments and digital money transfers, when compared to consumers in other markets such as the US.

- Despite the InsurTech subsector claiming only 9.0% of all deal activity, it attracted one of the largest FinTech investments in the past five years. BGL group, a digital distributor of insurance products based in Peterborough, raised £525m of private equity funding from Canada Pension Plan Investment Board in November 2017. BGL owns brands including comparethemarket.com, LesFurets.com and online life insurer BeagleStreet.com, and decided not to pursue an IPO after this investment.

- The ‘Other’ category includes Data & Analytics, Cryptocurrencies, Funding Platforms, Institutional Investments & Trading and Blockchain companies, which together have accounted for almost a fifth of all deals since 2014.

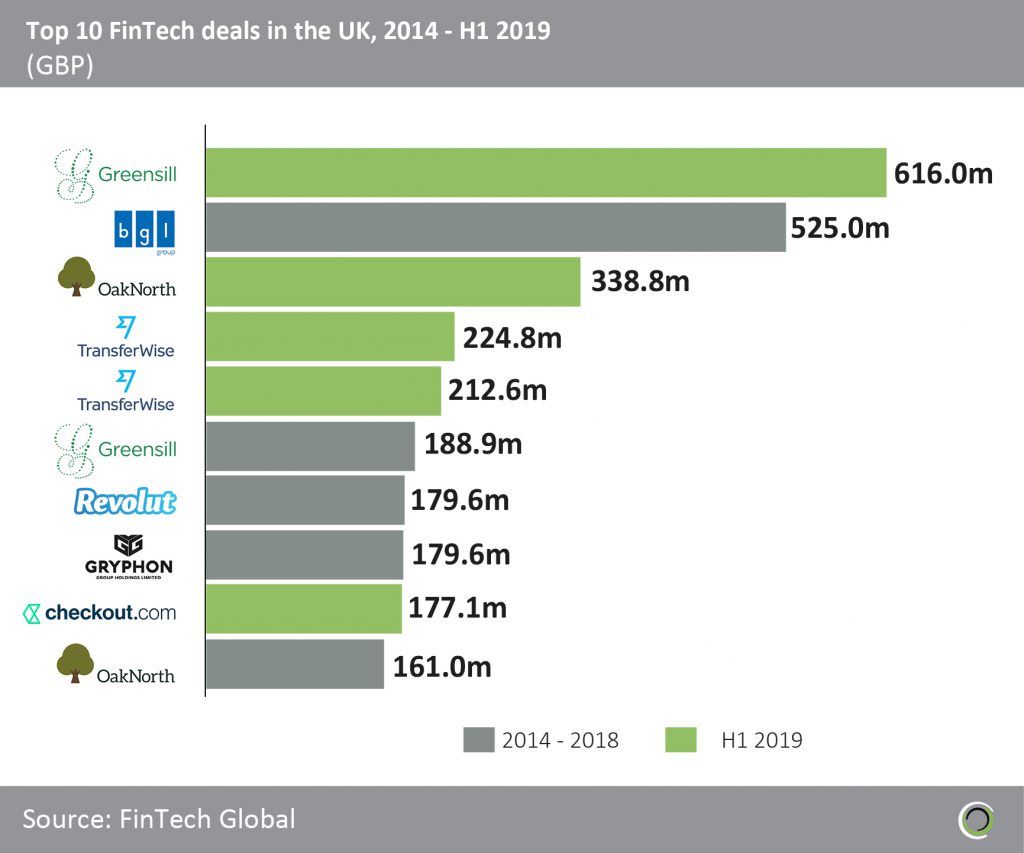

Five of the largest FinTech deals in the UK to date took place in H1 2019

- The breakdown of the top 10 deals by subsector shows two Payments & Remittance companies (TransferWise and checkout.com), a Marketplace Lending company (Greensill Capital), two InsurTech companies (BGL Group and Gryphon Insurance) and two WealthTech companies (OakNorth and Revolut).

- From 2014 to H1 2019, the top 10 deals raised over £2.8bn, which makes up almost a quarter of total capital invested in FinTech companies during the period. There are already five funding rounds in H1 2019 that have entered the top deals list since 2014.

- The largest deal so far this year is Greensill Capital’s £616m Venture round led by SoftBank Vision Fund, accounting for 22% of funding raised in the first half of 2019. Additionally, Greensill Capital plans to use this capital injection to enter multiple global markets including China and India. The company is a non-bank provider of working capital finance for more than eight million businesses in over 60 countries.

- Payments & Remittances is the most represented subsector in the list, with three of the top 10 funding rounds involving payment solutions providers. Money-transfer service TransferWise raised £224.8m from Lead Edge Capital, Lone Pine Capital and Vitruvian Partners in May 2019. This is the biggest Payments & Remittances deal in the UK to date and TransferWise is now one of the most well-funded FinTech companies in the UK.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global