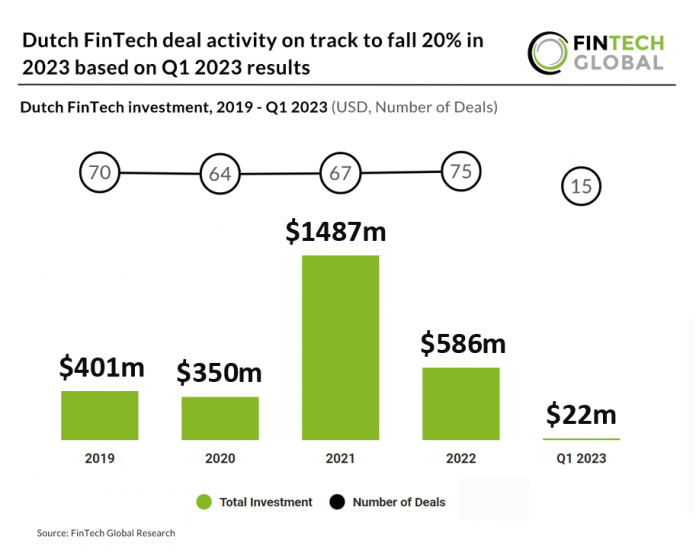

Dutch FinTech investment stats in Q1 2023:

• Dutch FinTech companies raised a combined total of $22m in funding during Q1 2023, a 49% drop from the same period last year

• Dutch FinTech deal activity in Q1 2023 totalled at 15, a 12% drop compared to Q1 2022

• Amsterdam was the most active FinTech city during Q1 2023 with nine deals

Dutch FinTech saw a slow start in 2023 with Q1 recording a drop in both funding and number of deals. FinTech deal activity in the Netherlands dropped 12% in Q1 2023 YoY. Dutch FinTech companies raised a combined $22m in Q1 2023, a 49% reduction from the same period last year.

Sprinque, a B2B payments platform, had the largest FinTech deal during Q1 2023 in the Netherlands, raising $6.5m to extend their seed funding round, led by Connect Ventures. The startup is initially targeting merchants in the Netherlands, Spain and Germany, but is looking to expand to other countries. It also plans to use the new funding to build functionality outside the pay-by-invoice product. Dutch B2B payments platform Sprinque has raised €6 million in seed funding to expand its pay-by-invoice technology across Europe. Sprinque’s B2B payments platform enables merchants and marketplaces to offer pay-by-invoice with net payment terms to buyers online, without taking on additional risk or increasing operational overhead. The technology is white labelled and can be fully embedded via APIs, Magento, Prestashop and WooCommerce plugins, or operated offline via a merchant control centre. Juan Espinosa, CEO, Sprinque, says: “We’ve identified this problem across every B2B industry. Buyers won’t convert and be retained if the ability to Pay by Invoice is not given to them, but the existing offline and manual processes B2B merchants rely on are not adequate to manage risk and serve hundreds of online buyers across multiple geographies. “Sprinque has been built to enable merchants and marketplaces to offer Pay by Invoice with payment terms in the most seamless way possible for the most ambitious merchants.”

Amsterdam was the most active city in the Netherlands with nine deals, a 60% share of total deals raised in Q1 2023. Rotterdam and Utrecht were the joint second most active FinTech cities with two deals each.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global