Key AML & FinCrime investment stats in Q1 2023:

• AML & FinCrime deal activity reached 15 deals in Q1 2023, a 62% drop YoY

• AML & FinCrime investment totalled at $124m in Q1 2023, a 69% reduction from Q1 2022

• The USA was home to the most AML & FinCrime deals with four transactions completed in the country during Q1 2023

In the first quarter of 2023, there was a 62% decline in AML & FinCrime deal activity compared to the previous year. A total of 15 deals were recorded during this period, reflecting the subdued market conditions in this FinTech subsector. During the first three months of 2023, investments in AML & FinCrime solutions amounted to $124 million, indicating a significant decrease of 69% compared to the investment total in Q1 2022.

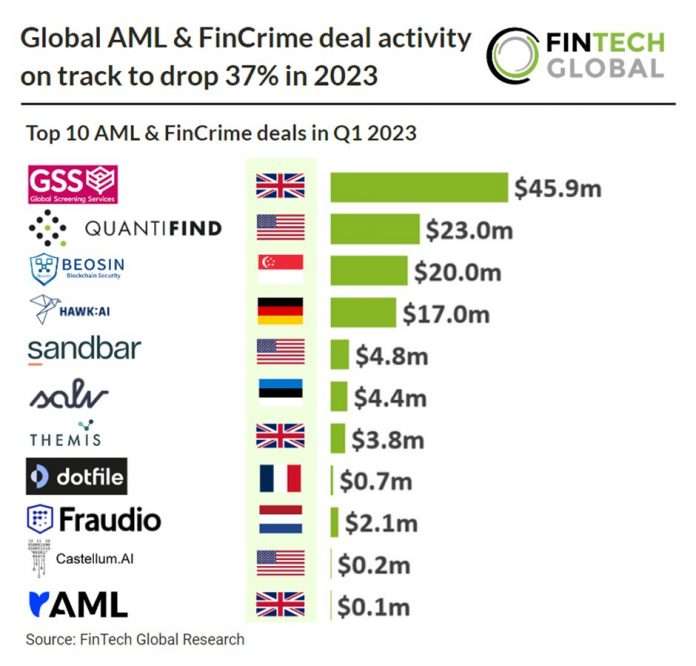

GSS, a global screening service, was the largest AML & FinCrime deal in Q1 2023, raising $45.9m (£37m) in their first Venture funding round, led by AlixPartners, The Cynosure Group, and MUFG. The company intends to use the funds to accelerate growth, expand operations and its business reach. GSS provides an industry collaboration platform to improve compliance standards, by enhancing and exchanging information. The platform leverages technology, including artificial intelligence, and an ecosystem of financial institutions and industry partners to provide streamlined compliance screening for sanctions.

The USA was the most active AML & FinCrime country in Q1 2023 with four deals, a 27% share of deals. The UK was the second most active with three deals, a 20% share of deals.

In March 2023, MEPs from the Economic and Monetary Affairs and Civil Liberties, Justice and Home Affairs committees adopted their position on three pieces of draft legislation concerning the financing provisions of EU Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) policy. The package includes a regulation on conducting due diligence on customers, transparency of beneficial owners, and the use of anonymous instruments such as crypto assets. It also addresses new entities like crowdfunding platforms and “golden” passports and visas. Additionally, there is a directive focusing on national provisions for supervision and Financial Intelligence Units, as well as access to reliable information such as beneficial ownership registers and assets in free zones. Lastly, a regulation establishing the European Anti-Money Laundering Authority (AMLA) with supervisory and investigative powers has been adopted. The adoption of these texts garnered significant support from MEPs.