There was over $1.8bn in investment raised across the FinTech sector this week, with a FinTech and InsurTech pulling in the largest deals over the last seven days.

The top two deals this week saw African FinTech M-KOPA bring in $250m in new debt and equity funding and SageSure, an independent managing general underwriter, bagging $250m in equity financing,

Across the sectors, the FinTech sector saw the most deals with 6 in total. CyberTech followed in second with 5 and InsurTech and Crypto in third with four-a-piece. WealthTech, PayTech and ESG-focused businesses pulled in 3 deals while RegTechs companies pulled in 2.

Geographically, the US dominated once again with 16 deals across this week. Following far behind in second was the UK, with 3 deals, and Singapore in third with 2 deals. Germany, Kenya, Australia, Israel, Spain, Sweden, Finland, India and Lithuania all recorded one deal.

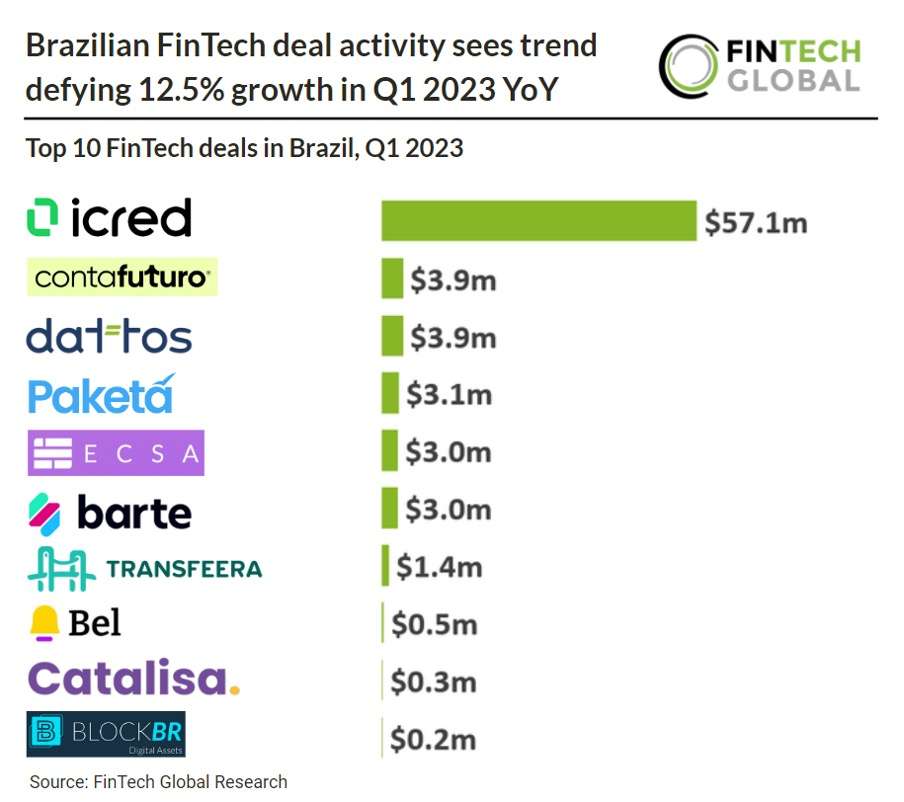

While the FinTech sector has seen peaks and troughs so far this year, one surprising finding this week has been an upturn in the Brazilian FinTech market. Recent research by FinTech Global found that the market has bucked the global trend with 12.5% growth in deal activity in the first quarter of 2023.

Despite this, Brazilian FinTech companies raised a combined $76.5m in Q1 2023, down 25% YoY.

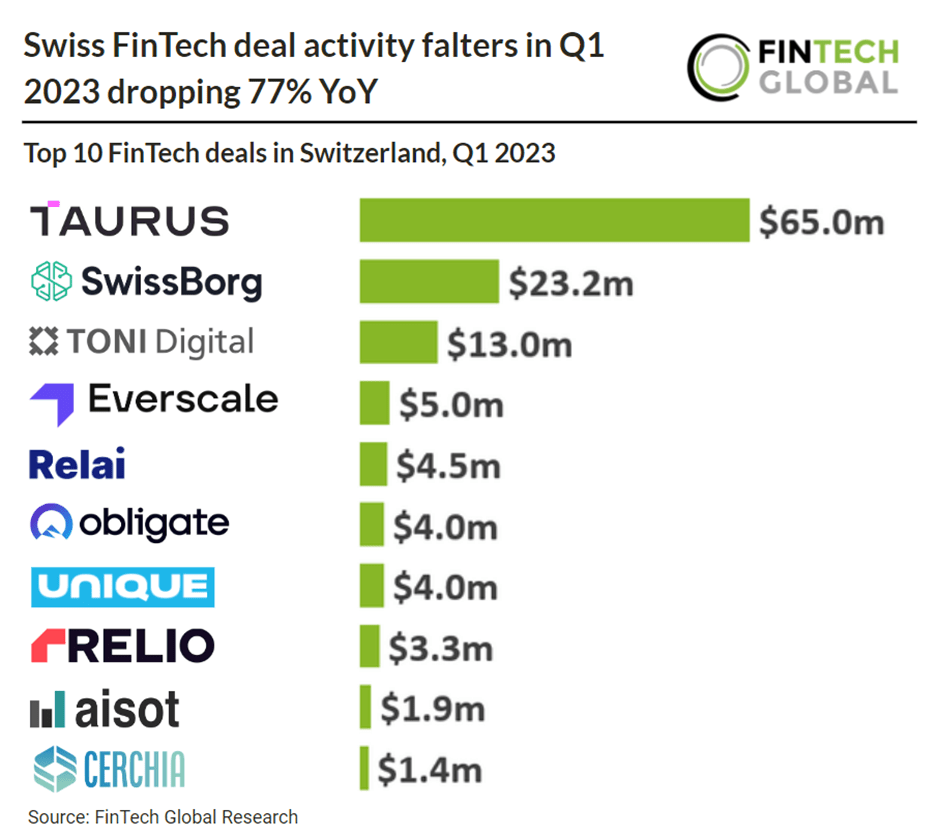

A particularly weak Q1 for FinTechs was seen in Switzerland, with FinTech Global research finding that FinTech deal activity in the country fell 77% year-on-year.

Here are this week’s deals.

M-KOPA raises over $250m in debt and equity

African FinTech M-KOPA has raised over $250m in new debt and equity funding to expand its offering to underbanked consumers in Sub-Saharan Africa.

According to FinTech Finance, over $200m in sustainability-linked debt financing was led and arranged by Standard Bank Group.

Other participating lenders include The International Finance Corporation (IFC), funds managed by Lion’s Head Global Partners, FMO: Dutch Entrepreneurial Development Bank, British International Investment, Mirova SunFunder and Nithio.

SageSure locks in $250m in equity financing

SageSure, a leading independent managing general underwriter specialising in providing catastrophe-exposed property insurance, has closed a $250m equity financing round.

This investment was led by Amwins and Flexpoint Ford, with participation from Ares Management Corporation.

Boltech scores successful Series B at $196m

Bolttech, an international InsurTech company, recently announced a successful Series B fundraising round, achieving a valuation of $1.6bn.

The firm raised $196m in the round, which was led by Tokio Marine, Japan’s premier insurance company boasting a 140-year history. Other significant investors included MetLife, through its subsidiary MetLife Next Gen Ventures, Malaysia’s sovereign wealth fund Khazanah Nasional, and a mix of new and existing shareholders.

Cyber firms secure $192m

Eagle Eye Networks and Brivo, two independent companies leading the charge in cloud video surveillance and cloud-based access control respectively, have announced a significant investment deal.

The companies have secured a hefty sum of $192m from SECOM, a titan in the world of security integration and a $15bn enterprise. Eagle Eye Networks is set to receive $100m, while Brivo will benefit from the remaining $92m.

Offering comprehensive services, Eagle Eye Networks excels in delivering cyber-secure, cloud-based video with artificial intelligence (AI) and analytics to enhance business efficiency and global safety. On the other hand, Brivo provides smart space technologies, primarily focusing on cloud-based access control.

Global payables automation platform Tipalti snares $150m

Tipalti, a payables automation platform, has scored $150m in incremental growth financing from JPMorgan Chase Bank and Hercules Capital.

Tipalti’s cloud-based platform automates the entire accounts payable process, making it easy for its more than 3,000 mid-market customers to pay suppliers across over 196 countries. With the support from these new partners, Tipalti will be able to help even more companies that need to manage complex payables operations at scale.

German InsurTech wefox lands $110m

Berlin-based InsurTech firm, wefox, has successfully completed a funding round that has solidified its position as a leading force in the insurance technology industry.

The company has raised a total of $110m in this round. Notably, J.P. Morgan and Barclays have provided a $55m revolving credit facility, while the remaining $55m in equity was raised from both new and existing investors as a second closing of the Series D funding at a valuation of $4.5bn.

Intake-to-pay platform Zip nets $100m in Series C

Zip, an intake-to-pay platform, has secured $100m in a Series C funding round as well as launch its Zip Intake-to-Pay product.

The funding round saw participation from Y Combinator, CRV and Tiger Global. The post-money valuation of the round was $1.5bn.

Smart bags $95m in bid to transform global retirement savings market

Smart, a London-headquartered FinTech aiming to transform the global retirement savings market, has raised $95m in Series E funding.

The round was led by Aquiline Capital Partners LLC, a private investment firm based in New York and London.

Existing investors also participated in the round including Chrysalis Investments, Fidelity International Strategic Ventures, DWS, Barclays and Natixis Investment Managers.

Auradine lands $81m funding

Auradine, a firm that specialises in web infrastructure solutions including blockchain, security and privacy has raised $81m in funding.

The Series A round was led by Celesta Capital and Mayfield and saw participation from Marathon Digital Holdings, Cota Capital, DCVC, and Stanford University.

Auradine is developing disruptive infrastructure solutions leveraging cutting-edge technologies such as energy-efficient silicon, zero-knowledge proofs and AI to deliver an unmatched value proposition for decentralized applications.

FinTech Cardless nets $75m credit facility

San Francisco-based FinTech firm Cardless a pioneer in the creation of custom co-branded credit card products, has announced securing a substantial credit facility.

The company has successfully raised a three-year $75m credit facility from the investment firm, i80 Group. In addition to this, an angel investment has also been received from Brian Kelly, the founder of The Points Guy.

Cardless has developed a digital-first approach to consumer credit, making it more accessible and engaging. The firm is dedicated to meeting the needs of consumer credit, offering co-branded credit card products that provide users with unique experiences and perks tailored to their interests.

Huntress secures $60m in Series C haul

Huntress, a pioneer in managed security platforms for small and mid-sized businesses (SMBs), has successfully garnered $60m in a Series C funding round.

The funding round saw contributions from prominent investors including Sapphire Ventures, Forgepoint Capital and JMI Equity, with Sapphire Ventures leading the charge. As a result of the investment, Sapphire Partner Casber Wang and Operating Partner Mahau Ma will join the board of Huntress as director and board observer, respectively.

Bitcoin firm River raises $35m

River, a Bitcoin technology and financial services startup, has successfully raised $35m in a Series B funding round.

Kingsway Capital led the investment, with notable contributions from investors like Peter Thiel, Goldcrest, Cygni, M13, Valor Equity Partners, Esas Ventures, and Alarko Ventures.

River aims to create a robust financial system through Bitcoin, a unique incorruptible digital currency. To this end, they offer a range of services, including Bitcoin brokerage, full-reserve custody, mining, and a Bitcoin wallet that supports both on-chain and Lightning Network transactions.

Bitcoin miner Cormint amasses $30m Series A

Cormint Data Systems, a burgeoning Bitcoin miner that aims to mine cost-effective Bitcoin at scale while supporting a sustainable and dependable power grid, has announced a successful $30m Series A equity raise.

The funding round was co-headed by Cormint’s President, Jamie McAvity, and Silicon Laboratories, Inc’s Chairman Nav Sooch. The round also saw significant participation from existing investors. Silicon Labs’ former CTO, Alessandro Piovaccari, joined the round as an advisor to Cormint alongside Sooch, while also investing in the company.

Private credit market platform Percent scores $29.7m

Percent, the company behind the groundbreaking private credit market platform, has successfully wrapped up an oversubscribed Series B funding round, generating nearly $30m.

This investment, totalling $29.7m, comes from a pool of investors both existing and new. White Star Capital spearheaded the round, with B Capital Group continuing its support for the company. Fresh backers included noteworthy players such as Susquehanna Private Equity Investments LLLP, BDMI, Forte Ventures, and Vectr Fintech. This round sees Percent’s total funding more than double to $48.2m.

Founded in 2018, Percent operates an innovative platform designed to restructure private capital markets. This is achieved by promoting transparency and data-driven infrastructure for this traditionally murky asset class. The platform targets three key market participants: borrowers, underwriters, and investors.

InsurTech Obie pulls in $25.5m

Obie, a leading InsurTech startup, has today declared the successful raising of $25.5m in a Series B funding round.

This marks a significant milestone for the company, illustrating the increasing confidence of investors in embedded insurance solutions, specifically tailored for real estate investors.

The recent round of funding was spearheaded by Battery Ventures, with notable contributions from Brick and Mortar VC, DivcoWest, and several real estate funds and investor groups. The round confirms Obie’s prominence within the InsurTech sector, as it continues to innovate and disrupt traditional insurance provision methods.

Spanish climate tech firm Mitiga lands €13.25m

Barcelona-based Mitiga Solutions, a climate-tech firm harnessing scientific methods and avant-garde technology to fortify resilience and adaptive capabilities against climate-related hazards, has managed to raise a significant €13.25m in a Series A round.

This fundraising effort was spearheaded by Kibo Ventures and saw participation from investors including Microsoft Climate Innovation Fund, Nationwide Ventures, Faber Ventures, and CREAS Impacto.

Transfer pricing platform Aibidia lands €13m Series A

Aibidia, a transfer pricing platform, has scored €13m in a Series A round co-led by DN Capital and FPV Ventures.

Also taking part in the funding round were Icebreaker.vc and fellow investor Global Founders Capital.

Cable secures $11m for financial crime control automation

Cable, the purveyor of an integrated platform for effectiveness testing in financial crime control, has amassed $11m in a Series A funding round.

The investment was brought forward by Stage 2 Capital and Jump Capital, along with continued contributions from CRV. This significant cash influx underscores the escalating need for effective platforms like Cable’s, particularly amidst a rapidly evolving regulatory and banking environment.

Climate tech firm Pledge secures $10m for logistics decarbonisation

Pledge, a climate technology leader headquartered in London, has successfully garnered $10m in a Series A funding round.

The firm is known for its dedication to helping businesses in the logistics and supply chain industry achieve net-zero emissions.

Singapore-based Jenfi raises $6.6m for growth capital

Jenfi, a Singapore-based FinTech startup specialising in providing online businesses with revenue-based financing, has raised $6.6m in a pre-Series B funding round.

Known for its innovative “growth capital as a service” model, Jenfi has become an integral part of the financial services landscape in the region.

Dorsey-backed Azteco lands $6m funding

Azteco, the sole provider of bitcoin vouchers for everyday microtransactions, has made a significant stride forward with a $6m funding round.

Jack Dorsey led the funding round, with participation from other esteemed investors like Lightning Ventures, Hivemind Ventures, Ride Wave Ventures, Aleka Capital, Visary Capital, Gaingels, David Van Der Weele, and Sunil Rajaraman.

Azteco aims to bring financial stability to those who face unreliable or volatile economic conditions by offering them a unique solution – bitcoin vouchers. These vouchers can be fulfilled online and at hundreds of thousands of retail locations across 195+ countries, allowing people to send, save, and spend small bitcoin amounts.

Israel cyber firm Entro bags $6m seed

Entro, a cybersecurity firm hailing from Israel that specialises in secrets security and management, has just announced the successful completion of its seed funding round.

Founded by CEO Itzik Alvas and CTO Adam Cheriki, Entro is a novel player in the cybersecurity arena, addressing a growing threat in the digital landscape – secret-based breaches.

SaveMoneyCutCarbon lands £5m in growth financing

SaveMoneyCutCarbon, a firm being labelled as the UK’s leading money-saving platform through sustainability, has scored £5m in growth funding.

Barclays Sustainable Impact Capital and IW Capital have been joined by new parties including the Low Carbon Initiative Fund 2 and Dominic Christian, global chairman of Aon’s reinsurance solutions business, and former deputy chair of Lloyds of London.

The new investment will support the company’s strong growth profile and development as it builds to achieve its vision of becoming the “one-stop shop” for sustainability.

Jia scores $4.3m

Jia, a FinTech startup focused on blockchain-based lending, raised an impressive $4.3m in seed funding.

Established by former Tala executives, Jia’s unique business model aims to bring financial inclusivity to sectors often overlooked by traditional banking systems.

The funding round was led by TCG Crypto, with contributions from BlockTower, Hashed Emergent, Saison Capital and Global Coin Research, according to a report from Tech Crunch.

Australian mortgage broker Finspo snares $2.55m Series D

Melbourne’s online mortgage broker, Finspo, has reportedly secured a $2.55m Series D funding round.

This four-year-old company, launched by ex-bankers in 2020, has continued to make strides in the FinTech industry since its inception.

The recent investment was earmarked for upgrades to Finspo’s digital platform, although the investors involved in this round remain undisclosed, according to a report from Startup Daily.

Lithuanian RegTech Amlyze lands $1m pre-seed

Amlyze, a RegTech startup based out of Vilnius, has scored $1m in a pre-seed investemtn rounded headed by Practica Capital.

Also participating in the raise were Lithuania’s Firstpick accelerator as well as its venture capital fund.

Founded in 2019, Amlyze offers fully integrated solutions that aims to make the compliance process for users much more accessible, smoother, and efficient.

Payments startup Hands In lands $550k funding

Payments company Hands In has scored $550,000 in a funding round to speed up the commercialisation of its group payment services.

Taking part in the funding round were representatives from firms such as GoCardless, Thredd, Elavon, FIS, Pay.com, PayU, Curve, and Free Trade.

Swedish cyber enterprise Curity scores funding

Curity, a Stockholm-based cybersecurity company, has announced a sizeable investment, but did not disclose its size.

Specialising in API-driven identity management, Curity provides solutions to many enterprises looking to secure access to their digital services.

The financial details of the investment remain undisclosed, but the benefactor is GRO, a Danish private equity fund. GRO has chosen to support Curity’s quest to scale their global operations, acknowledging the company’s expertise and growth potential in the expanding cybersecurity landscape.

CapitalSetu bags £350k seed

CapitalSetu, an ambitious start-up in the burgeoning financial technology industry, has reportedly raised £350,000 in its seed round.

As a hub for small and medium-sized manufacturing firms, it leverages top-of-the-line technology to offer unique financial solutions in India.

The investment was led by Real Time Angel Fund, with participation from a roster of high-profile investors such as Ashish Kacholia, Vikas Khemani, Rajat Mehta, and Sunaina Bhattacharya among others, according to a report from Indian Startup News.

CyberTech SpiderOak secures investment

In a move poised to fortify its position as a leading provider of zero-trust cybersecurity and resiliency solutions for space systems, SpiderOak recently announced securing a considerable investment.

The undisclosed amount was contributed by a trio of influential industry players, namely Accenture Ventures, RTX Ventures – a subsidiary of Raytheon Technologies, and Stellar Ventures.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global