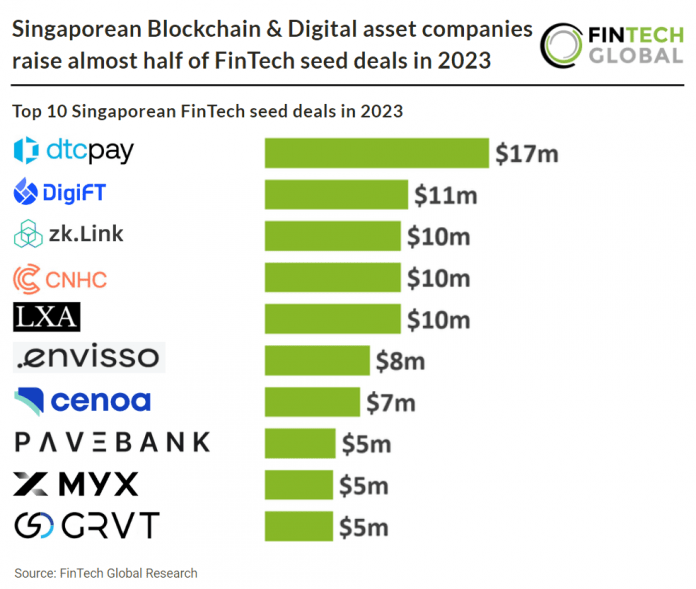

Key Singaporean FinTech seed investment stats in 2023:

• Singaporean FinTech seed funding totalled at $191m in 2023, a 49% drop from 2022

• Singaporean FinTech seed deal activity reached 102 deals in 2023, a 42% reduction YoY

• Blockchain and Digital assets companies raised 46% of all FinTech seed deals in the country during 2023

In 2023, the total seed investment in Singaporean FinTech amounted to $191m, marking a notable decline of 49% compared to the previous year. Concurrently, the number of seed deals in Singaporean FinTech saw a significant reduction, reaching 102 deals, which represented a YoY decrease of 42%.

dtcpay, a regulated payment service provider, had the largest Singaporean FinTech seed deal in 2023 after raising $17m in their latest seed deal, led by Kwee Liong Tek. dtcpay is set to unveil a new payment system that will support both fiat and cryptocurrencies for in-store and online transactions. In their announcement, the company referenced Tether (USDT), Ether (ETH), and Bitcoin (BTC). The company is partnering with open-source blockchain PlatON for privacy-protected digital infrastructure and Allinpay International to create smart terminals and a digital interface. Both PlatOn and Allinpay are based in China. Dtcpay and Allinpay are registered with the Monetary Authority of Singapore (MAS) as major payment institutions.

The Blockchain and Digital assets subsector had 47 deals in 2023, accounting for 46% of Singapore’s seed deal activity. Second was PayTech with 12 transactions, a 11% share of total deals and Lending Technology was third with 10 deals, a 9% share of total deals.

The latest Singaporean Fintech regulation comes from the PayTech sector. The Monetary Authority of Singapore (MAS) has issued a Notice on December 18, 2023, instructing licensed payment service providers offering cross-border money transfer services (remittance companies) to temporarily halt the use of non-bank and non-card channels when sending money to individuals in China. This suspension will be in effect for three months, from January 1, 2024, to March 31, 2024. The decision comes in response to reports of funds sent by individuals (mostly Chinese nationals working in Singapore) through remittance companies being frozen in their recipients’ bank accounts in China. Although most remittances using these channels are successful, a small portion has faced freezing in China, prompting MAS to take this precautionary measure to protect consumers. Remittance companies have been instructed to assist affected customers, improve complaint handling processes, and review their arrangements with partners for the China remittance corridor. The suspension aims to safeguard consumers and will commence on January 1, 2024, following a 14-day notice period. MAS advises the public to use alternative channels like banks or card networks during this period to avoid any potential freezing of funds. The situation will be closely monitored, and the suspension may be extended or terminated as deemed necessary after March 31, 2024.