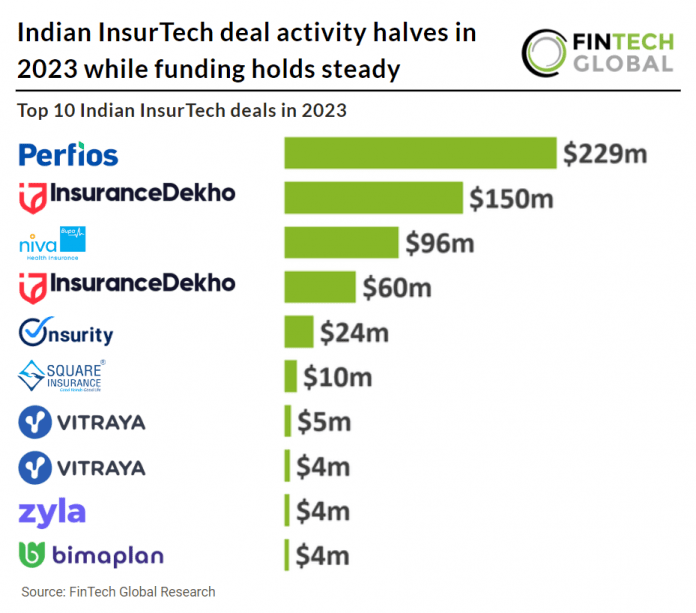

Key Indian InsurTech investment stats in 2023:

• Indian InsurTech deal activity reached 21 transaction in 2023, a 52% drop from 2022

• Indian InsurTech companies raised a combined total of $594m in 2023, a 3% reduction from 2022

• The average InsurTech deal in 2023 was $28.3m, a 93% increase from 2022

In 2023, Indian InsurTech companies experienced a notable shift in their deal activity and funding outcomes. The sector recorded 21 deals throughout the year, marking a 52% decrease compared to the activity in 2022, which was the peak for India’s InsurTech deal activity. Despite this downturn in deal volume, the total capital raised by Indian InsurTech firms amounted to $594m, only a slight 3% decline from the funding levels observed in the previous year. In 2023, the average InsurTech deal amounted to $28.3m, marking a 93% increase from the previous year, 2022.

Perfios, which provide a real-time medical claims processing solution, had the largest InsurTech deal in India during 2023 after raising $229m in their Series D funding round led by Kedaara Capital. Perfios intends to use the money to investigate inorganic growth opportunities in addition to strengthening its global footprint and pursuing further international expansion. Additionally, it will keep making investments in its tech stack to support the entire customer journey in embedded commerce, banking, and insurance. Perfios aids in the compilation and examination of financial data, encompassing credit assessment, fraud detection, monitoring, and banking data aggregation, to generate comprehensive reports. Its services involve analyzing various documents such as tax information, bank statements, and business financials. With a diverse clientele exceeding 100 substantial entities, including banks, NBFCs, digital lending platforms, mutual fund companies, insurance providers, and human resources firms, Perfios has established itself as a trusted partner. Operating across 16 countries, Perfios boasts a substantial presence, empowering over 1,000 financial institutions. Annually, it processes an impressive 1.7 billion transactions, managing assets under management (AUM) worth $36 billion. Moreover, it furnishes banks and other financial entities with 8.2 billion data points annually, facilitating expedited decision-making processes.

The Insurance Regulatory and Development Authority of India (IRDAI) has proposed a series of modifications aimed at enhancing business convenience, reducing stakeholder compliance burdens, and protecting the interests of policyholders. In a circular dated February 14, 2024, the IRDAI announced plans to issue the draft Insurance Regulatory and Development Authority of India (Protection of Policyholders’ Interests and Allied Matters of Insurers) Regulations, 2024, following extensive deliberations.