Tag: fraud detection

Featurespace and OrboGraph unite to combat rising check fraud with advanced...

Featurespace, a global fraud and financial crime prevention firm, has entered into a strategic partnership with OrboGraph, a leading provider of check processing automation and fraud detection software and services.

Kuady targets Bulgarian FinTech talent with new office opening

Kuady has announced the establishment of a new office in Sofia, Bulgaria, designed to accommodate over 100 employees.

Pindrop secures $100m to fortify voice security against rising cyber threats

Pindrop, a pioneer in voice security and fraud detection, has announced a significant milestone, securing $100m in debt financing from Hercules Capital.

TrackLight Raises $3M for AI Fraud Tech

TrackLight, a pioneering firm in AI-assisted fraud detection and prevention, recently secured a $3m seed investment.

Safeguarding financial integrity through advanced AML compliance strategies

In today's financial landscape, AML transaction monitoring is key for protecting the integrity of financial institutions and the global financial system. This continuous surveillance of...

Combating generative AI fraud: Effective strategies for detecting fake documents

Fraudsters can now easily create fake documents online or purchase forged ones with just a few clicks. As a result, detecting document fraud has become...

NVIDIA and bunq join forces to combat financial fraud with AI

NVIDIA and bunq, a prominent European neobank, have partnered to enhance fraud detection and combat financial fraud using generative AI.

How machine learning is transforming AML controls in payments

The future of anti-money laundering (AML) controls in the payments industry is increasingly being shaped by machine learning technology. Paysafe’s Giacomo Austin recently spoke with Napier AI to offer valuable insights into this transformation.

Navigating the hype: Is generative AI the future of InsurTech

The buzz around Generative Artificial Intelligence (AI) in the insurance sector is undeniable. Each keynote, panel, and networking break at business conferences seem to orbit the potential of AI to revolutionise the industry by generating content, streamlining processes, and enhancing efficiency. Yet, this growing excitement begs a critical question: Is Generative AI truly the breakthrough the insurance sector needs?

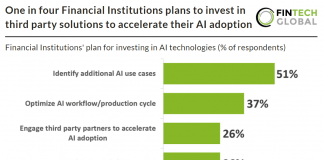

One in four Financial Institutions plans to invest in third party...

As financial services organizations transition from proof of concept to real-world impact with AI projects, there is a growing consensus to continue investing. Key...