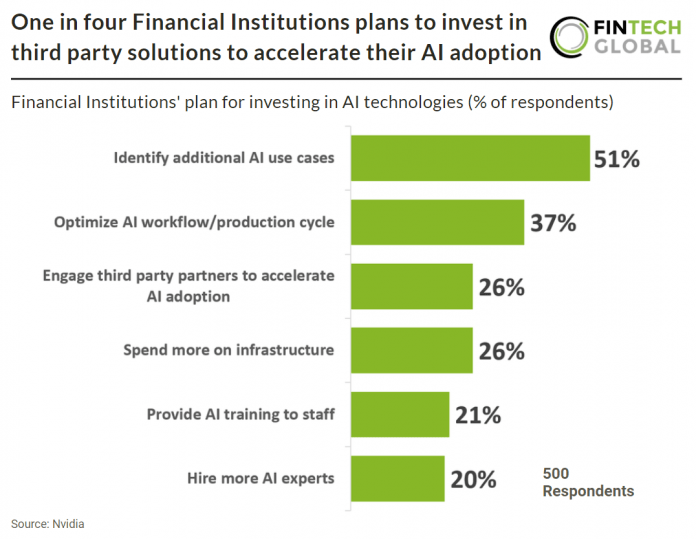

As financial services organizations transition from proof of concept to real-world impact with AI projects, there is a growing consensus to continue investing. Key areas of focus include identifying new AI use cases, partnering to accelerate adoption, optimizing workflows, and expanding computing infrastructure. Although the intention to hire more AI experts has decreased by 8 percentage points (from 28% in 2023 to 20% in 2022), there has been a 28% positive change in plans to invest in additional AI use cases (from 40% to 51%). This increase may be attributed to the wider availability of pretrained models and frameworks, making it easier for organizations to tailor AI applications to their needs.

As organizations seek to broaden their AI use cases, they will require additional computing infrastructure, necessitating investments in hardware and software. Despite this, only 34% of respondents agree that their company invests enough money in AI, with 39% feeling that their company is underinvesting. However, this sentiment might change soon, as 97% of respondents indicate that their company will increase spending on AI infrastructure this year.

More than half of financial services professionals are convinced that AI will play a crucial role in business success, and 91% of organizations are already assessing or deploying AI in production. From enhancing fraud detection to powering algorithmic trading and personalized customer interactions through chatbots, AI can help organizations control costs while providing higher-quality services to customers and partners.