Up launched in October 2018. However, the founder reveals it was far from clear that the company would ever see the light of day.

Dominic Pym and Grant Thomas are the co-founders behind what is arguably Australia’s first challenger bank – Up. As such, they are spearheading a wave of new neobanks popping up across Oz.

The WealthTech startup is the result of the duo’s original enterprise: the software company Ferocia. This led to them developing a banking platform for Bendigo Bank, which granted them awards as well as recognition. It also led to them working on developing a digital bank in Asia for one of Australia’s biggest banks. “We dedicated around two and a half years into that relationship, but it never made it into the customers’ hands,” Pym tells FinTech Global. “The bank got a new CEO and he decided to scrap the whole project.”

Fortunately, one of the executives at the bank believed in them. When this person left to work at one of the other big four banks in Australia, the executive soon brought in the two entrepreneurs for a similar project. “[We] spent around 18 months or so working with them building a prototype for a new digital bank for the Australian market,” Pym remembers.

But once again, the project was cancelled. “By this stage we’d spent around four years building digital banks and we’d certainly developed a deep understanding of the banking sector, but we never got to see our software in market,” Pym says. “As you can imagine we were deeply frustrated – but also resolutely inspired to launch a truly digital bank here in Australia. And so we did.”

Up began development in September 2017 and launched a little over a year later.

But in that time Australia would go through several changes that meant the country would get several new challenger banks. For instance, in May 2018, the Government introduced new restricted authorized deposit-taking institutions (ADIs) licence. The restricted ADIs enabled new organizations, like neobanks, to enter the market and conduct a limited range of activities.

However, Pym and Thomas opted to not go for this licence. Instead, they turned to the Bendigo Bank, which they had worked with in the past. Working with this organization meant that they could be first to market and leverage some of the trust the bank had built up during its history. “The opportunity to partner with Bendigo Bank also meant we could capture the strategic and competitive advantage of not having to build our own core banking system,” Pym says. “Instead, we could focus on providing exceptional customer experience, with the speed and innovation people have come to expect from technology-led initiatives.”

Despite this collaboration, creating a neobank was still challenging. “Building a bank in Australia, or anywhere in the world for that matter, is not easy,” Pym says. “Nor should it be. Typically, to start a new bank you’d need [more than] $100m at least, a core banking system and a banking license.”

Pym says that one particularly daunting obstacle to overcome was to actually deliver something new and of value to the Australian market. “A digital bank in Australia must be more than just an app, and better than the incumbent banks apps, which are already very good,” he argues. “It’s easy enough to deliver banking products with a fancy new brand or provide a slightly better customer experience. In our view, we needed to do a lot more than that. For example, many of the features that Monzo, N26, Revolut or Starling offer are already offered by the major Australian banks and have been offered for years.”

For instance, he points out that several banks already have apps, web platforms and great banking products. And, like the example of Ferocia shows, they were unafraid to invest in technology. “The incumbent Australian banks certainly set a higher bar for local neobanks to meet, compared to overseas markets,” Pym continues.

He adds, “Therefore, being different enough, offering better products, constantly innovating, delivering a better customer experience and better customer support, whilst also building a new brand from scratch against formidable competition has probably been the biggest challenge so far. And we’re really just at the start of the journey, so I’m sure there will be plenty more challenges to overcome.”

To stand out from underneath the shadow of traditional banks, Pym states that Up has focused on delivering “super powers” to its customers and “banking services rather than products” to do so. “[It’s] a subtle difference, but it makes a big difference to customers,” he argues. “No one wants to buy or use banking ‘products’; they want the outcome for their own life – like saving for a house or donating to a charity, community [or a] cause or buying something easily, etcetera. And banking is the utility that helps power that outcome.”

To back that up, Up has aimed to create a cloud-hosted retail bank that “is extremely easy to use” and is constantly evolving. For instance, Pym states that Up’s software is updated five or more times per day. “From day one, we’ve delivered technology-led banking, rather than bank-led technology,” he says. “It might sound like a subtle difference, but our ability to move fast, innovate, and respond to customer needs and new technologies is light-years ahead. This manifests in our ability to implement technology-based services and benefits and innovations before others, and then rapidly improve them over time. “

Since Up launched, the company claims to have attracted over 100,000 customers. But the venture has also seen faced more competition.

A slew of either domestic or foreign challenger banks has sprung up in Australia recently. For instance, in July startup 86 400 acquired an Australian banking licence and tapped Morgan Stanley for a $100m funding round. Similarly, Judo Bank has raised a $270.62m round and Xinja closed a AUS$2.6m crowdfunding round in January. “[There’s] no doubt the banking market is rapidly evolving and currently in flux in Australia,” Pym states.

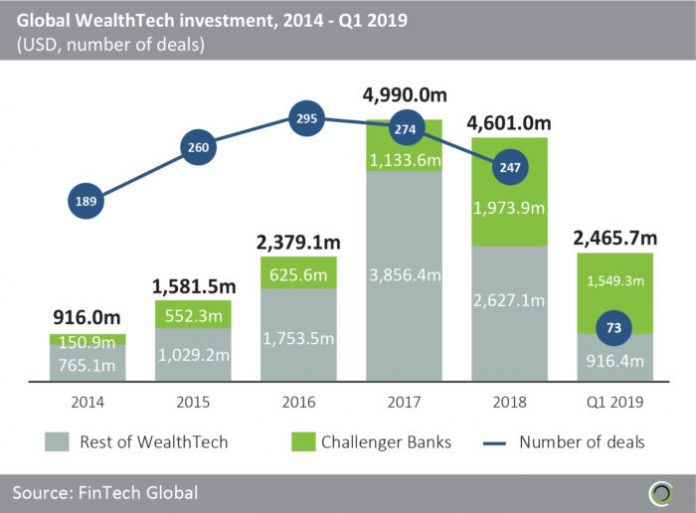

This follows a global trend of challenger banks attracting massive investment rounds, according to FinTech Global’s own research. Investment in the sector has jumped from $150.9m in 2014 to $1.97bn in 2018. Moreover, the first quarter of 2019 alone saw $1.54bn being invested in challenger banks around the world.

Nevertheless, Pym believes that to be successful, these banks must offer something unique. “[We] believe the younger generation wants their bank to be as easy to use as the other world-class apps on their smart phones such as Uber, Instagram, AirBnB [and] Deliveroo,” he says. “In general, people have come to expect excellence with apps, so if a banking app doesn’t match up to the leading apps in the world, then it’s unlikely that broad adoption will follow.”

Pym also believes that the future of banking will be about catering to customers that are not as faithful as the ones of the past. “Consumers no longer do all their banking with one bank only,” he states. “There’s a different trend now – people are choosing the best mortgage with one provider, the best deposit account with another provider, the best travel account with another provider, so if a challenger bank wants to win all of their customer’s financial life that’s going to be a really big challenge. Our objective is not to have people switch banks, so much as it is to give them an alternative to try something new and different.”

So what’s next for his own startup? “One of the ways Up will stay ahead of larger banks and the new neobank competitors is through speed to market and constant improvement,” Pym answers. “Because we are technology-led and truly customer focused we deliver software updates to our customers at a rate most banks can only dream of.”

Copyright © 2019 FinTech Global