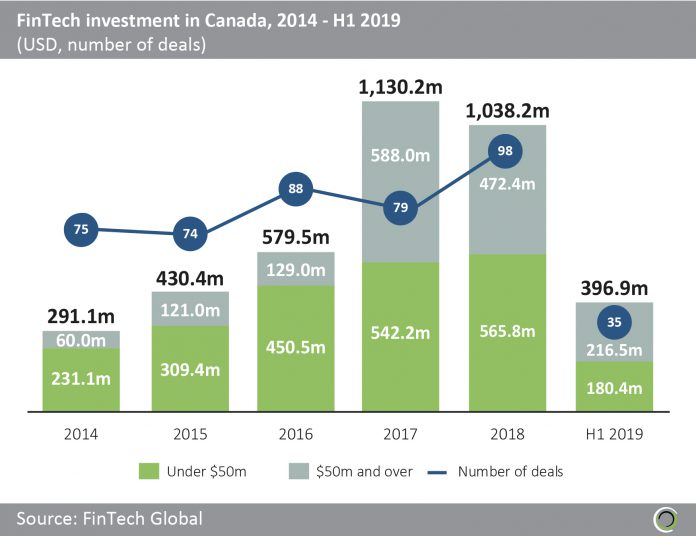

Over $3.8bn was invested in Canadian FinTech companies between 2014 and H1 2019

- FinTech companies in Canada raised over $3.8bn across 449 deals between 2014 and H1 2019, showing a CAGR of 29% in annual funding. The average deal size has grown by over 2.9x between 2014 and 2018, from $4.9m to $14.2m, as we see the annual investment in Canadian FinTech companies increasing at a higher rate than the actual volume of deals.

- The first half of 2019 experienced a slowdown from the previous year in terms of both deal volume and total investment. Deals in H1 have been largely top-heavy, with the three deals in excess of $50m accounting for 55% of total investment, out of 35 transactions.

- Vena Solutions, which provides financial reporting and analytics solutions for medium to large size organizations, raised $115,000,000 CAD in a Series D venture round led by JMI Equity, which has been the largest deal in 2019 to date.

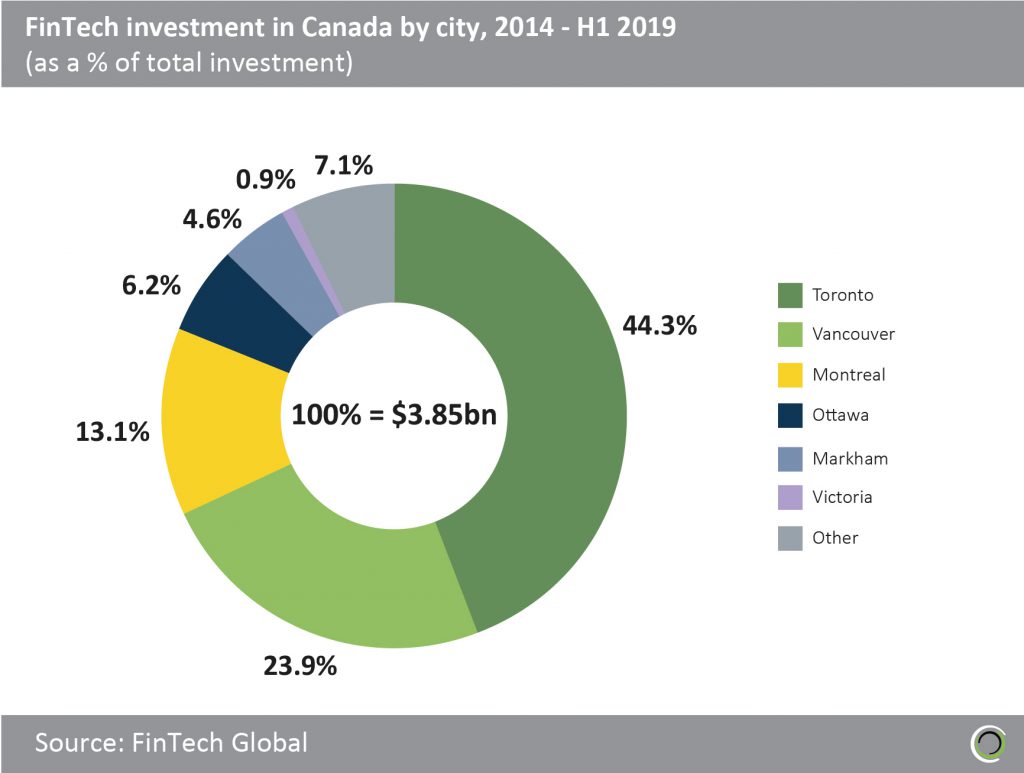

Companies located in Toronto and Vancouver account for over two thirds of total FinTech investment in Canada

- FinTech companies in Toronto account for 44.3% of total investment in Canadian FinTech, with companies located in the city raising $1.7bn over a total of 196 deals since 2014. Vancouver is Canada’s second largest city in the FinTech industry in terms of both deal volume and investment, with $918m raised over a total of 131 deals.

- Wealthsimple, a Toronto-based provider of portfolio management and robo-advising solutions, has raised $203m over seven funding rounds in the past five years, including a $74.4m round in Q2 2019, the largest deal of that quarter.

- Since 2014, early stage funding has been the most prominent investment stage for FinTech firms in Toronto- the number of seed rounds raised by early stage FinTechs totals 77. Toronto’s dense financial ecosystem provides early stage FinTech firms with a healthy supply of resources, including capital. Indicative of this is the large number of seed stage investors with investments in Toronto, 421, a significant figure in comparison to Vancouver, Canada’s second most dominant city in the FinTech industry, which boasts 231 investors.

- The ‘Other’ category consists of over 20 cities throughout Canada including Kitchener/Waterloo, Halifax, Winnipeg, Calgary, etc, which, in aggregate, account for 7.1% of total FinTech investment. Verafin, a leading provider of compliance, AML, and fraud detection software and based out of St. John’s, Newfoundland with a secondary office in Toronto, raised $60m in a private equity deal led by Spectrum Equity in Q2 2014. This has been the largest deal in the ‘Other’ category to date, and the only funding round to occur for a FinTech company headquartered in St. John’s.

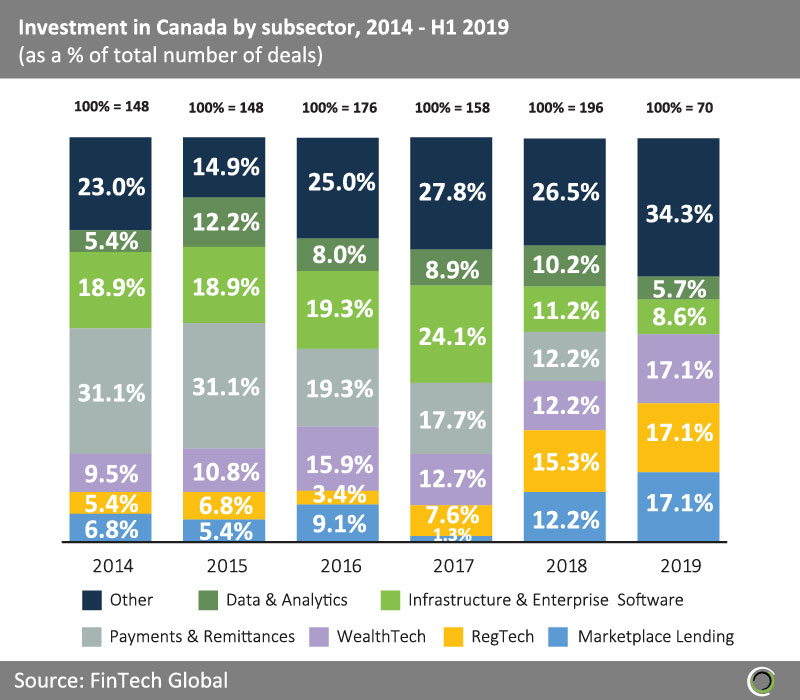

Investors have been diverting capital away from Payments & Remittances and Infrastructure & Enterprise Software companies in recent years

- In the past five years, capital allocation for Canadian FinTech firms has been widely distributed amongst all subsectors, with companies offering Payments & Remittances solutions experiencing a dramatic reduction in deal flow since 2014.

- Companies within the RegTech and WealthTech spaces have begun to pick up the slack in recent years, with each subsector experiencing a CAGR of 24.6% and 11.4% in transaction volume between 2014 and 2018, respectively.

- Assent Compliance, a RegTech company offering supply chain regulation and compliance management solutions, raised $131m in a Series C venture round led by Warburg Pincus in Q4 2018. This has been the largest investment in a Canadian RegTech company in the last five years and was the largest deal to occur in 2018.

- The ‘Other’ category includes Funding Platforms, Institutional Investments & Trading, InsurTech, Real Estate, Cryptocurrency and Blockchain companies. Companies within these subsectors have experienced an overall surge in deal volume since 2014. Over a third of all the deals raised in H1 2019 have involved companies offering solutions in one of these six subsectors.

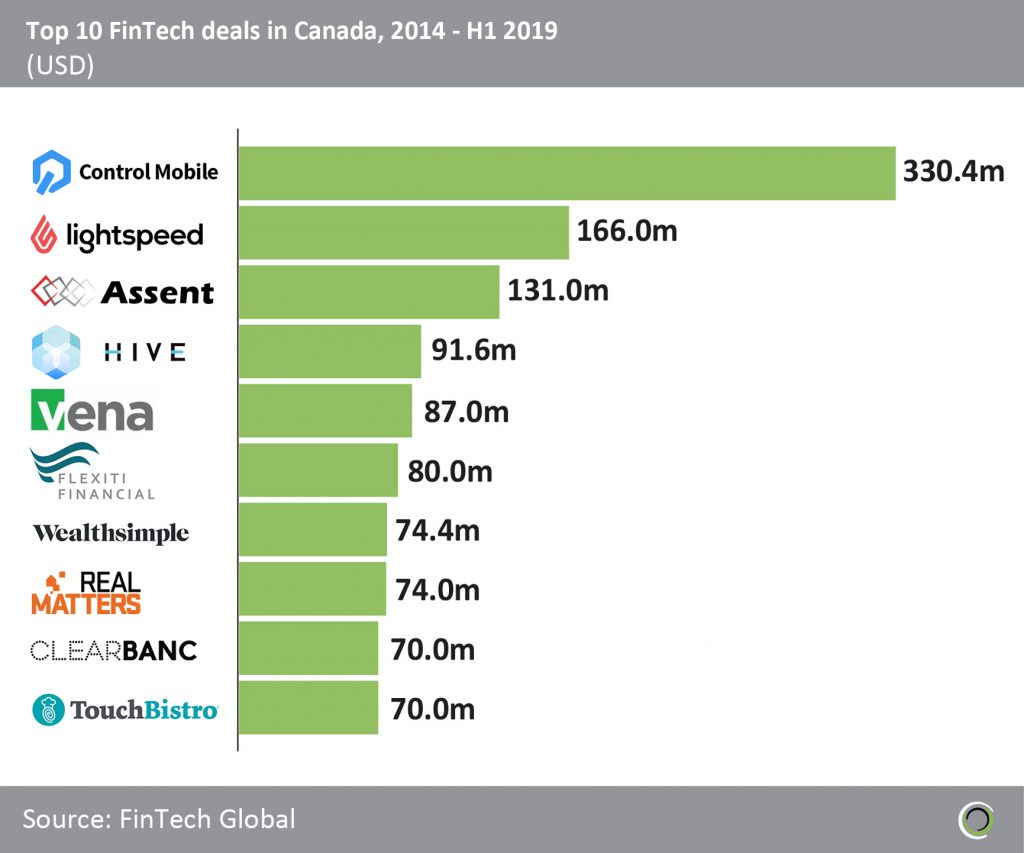

All top 10 FinTech deals in Canada have occurred between 2017 and H1 2019

- The top 10 FinTech deals in Canada raised nearly $1.2bn between 2014 and H1 2019. Companies headquartered in Toronto were responsible for half of the top 10 deals, with the investment value of the five deals accounting for just over 30% of the total capital raised by those deals.

- Control Mobile is a leader in payment analytics and alerts for SaaS, subscription and eCommerce businesses, delivering insights through its Android, iOS, and web-based products. Control raised $330.4m in a Series B venture round in Q4 of 2017, participated in by VISA, Industry Ventures and Carneros Bay Capital.

- All 10 deals occurred between 2017 and H1 2019. The increase in big ticket deals in the last three years raised the average investment size to $16.2m from $7m in 2014-2016. Capital allocation of the 10 transactions is widely distributed amongst subsectors, with Payments & Remittances companies accounting for three deals, Data & Analytics companies accounting for two, and RegTech, Blockchain, WealthTech, Real Estate, and Marketplace Lending companies accounting for one deal each.

- Lightspeed POS, a Payments & Remittances company offering POS software and omnichannel retail solutions for brick and mortar retail and hospitality businesses, raised $166m in a Series D late-stage venture round led by Caisse de Depot et Placement du Quebec in Q2 2017. Lightspeed issued an IPO on the TSX in March of 2019 at a share price of $16.00, raising $240m CAD in the primary market.