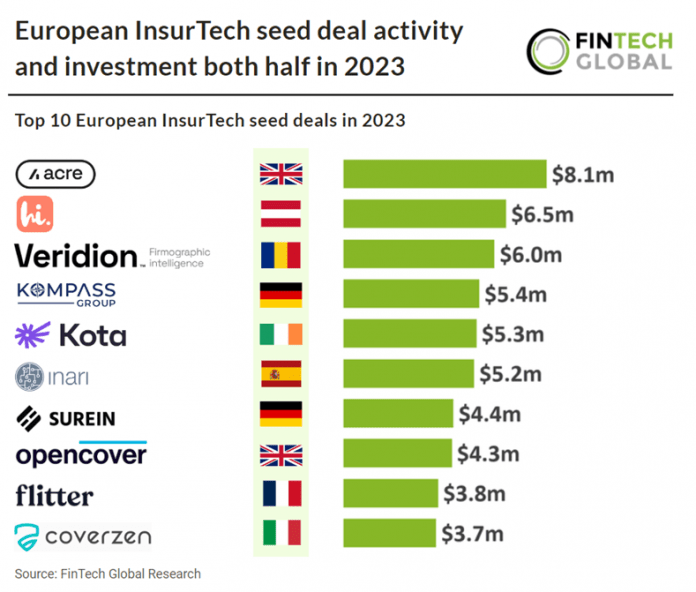

Key European InsurTech seed investment stats in 2023:

• European InsurTech seed companies raised a combined $87m in 2023, a 52% drop from 2022

• European InsurTech seed deal actviity totalled at 57 deals in 2023, a 51% reduction from the previous year

• The UK was the most active InsurTech country with a 35% share of deals in 2023

In 2023, European InsurTech seed companies experienced a significant decline in both funding and deal activity. They raised a total of $87m, reflecting a 52% drop compared to 2022. Similarly, the number of seed deals in the European InsurTech sector decreased by 51%, with only 57 deals recorded in 2023.

Acre, which are improving the insurance and mortgage application process for advisers, had the largest InsurTech seed deal in Europe during 2023 after raising $8.1 (£6.5m) in their seed round, led by Aviva Ventures and McPike Global Family Office. After securing this investment, Acre intends to sustain its current pace of customer expansion and work towards its goal of revolutionizing the home buying process. Acre is set to establish fresh collaborations with lenders and insurers to streamline its brokers’ ability to recommend and facilitate the acquisition of suitable financial products and services. A fundamental aspect of Acre’s vision involves a single entry and verification of client data and identity, to be seamlessly shared throughout the entire home buying journey. The firm’s ongoing evolution comes at a time when lending is increasingly complex due to the difficult economic climate, and brokers’ increased responsibility for outcomes for their customers. Acre CEO and founder Justus Brown said, “We pride ourselves on being at the forefront of innovation in financial advice, delivering a new, modern approach that simplifies the advice journey for brokers and delivers on the needs of clients. This latest fundraise demonstrates our strength and commitment to the market and supercharges our ambitions as the tech platform of choice for brokers.

The UK was the most active InsurTech seed deal country in Europe with 20 deals, a 35% share of total deals. Germany and France were the joint second most active InsurTech country with nine deals each, a 15% share of total deals.

The UK’s Financial Conduct Authority (FCA) has finalized regulations pertaining to insurance firms concerning the transfer and replacement of retained EU law provisions from the Insurance Distribution Directive (IDD). The FCA is in the process of substituting IDD delegated regulations with its own rules and guidance, ensuring a seamless regulatory framework for insurance-related activities. These changes will apply to all companies engaged in insurance activities and are scheduled to take effect on April 5, 2024. These actions by the FCA are a response to the UK’s departure from the EU and the necessity to revoke IDD delegated regulations while upholding essential requirements, following consultations outlined in CP23/19 to address the transitional period.