Konfio is the name of the Mexican FinTech startup that just secured a credit facility of as much as $100m from Goldman Sachs.

The cash injection will be used to build up the company’s ability to provide unsecured working capital to SMEs. Konfio uses big data solutions to analyse credit behaviours and other pieces of information to make disbursements within a day.

It has the goal of lending roughly $250m in the next year, according to a report in Bloomberg. Most of Konfio’s latest loans are worth on average $20,000.

The deal came about after Konfio’s CEO David Arana apparently kept bumping in to representatives of Goldman Sach at different FinTech events.

This is not the first time Goldman Sachs has taken an interest in Latin American FinTech companies. The bank loaned Brazilian challenger bank Nubank about $49m in 2016. In July this year, FinTech Global reported that Nubank had raised a $400m Series F Round. This raise reportedly gave it a valuation worth over $10bn, turning it into a unicorn ten times over, a so-called decacorn.

Goldman Sachs has also provided SME lender Credijusto a $100m facility.

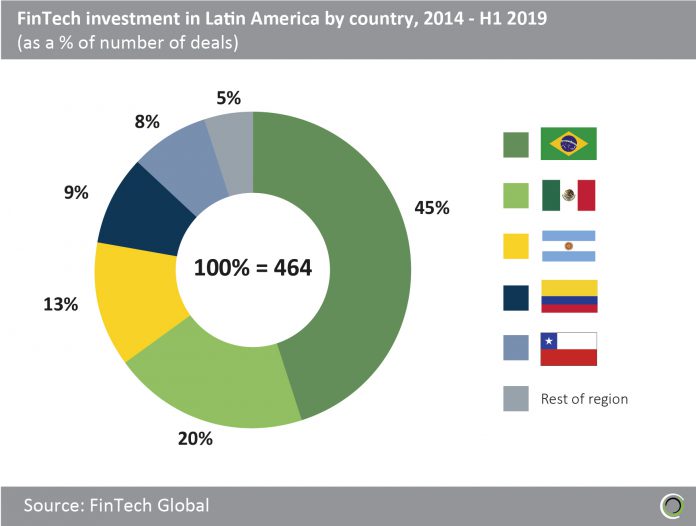

Brazil has dominated the investment in Latin America since 2014. Since then and up until the first half of 2019, Brazilian FinTech enterprises had received 45% of the investment into the continent, according to research from FinTech Global. Mexico’s FinTech companies received 20% of the investments during the same period.

Copyright © 2019 FinTech Global