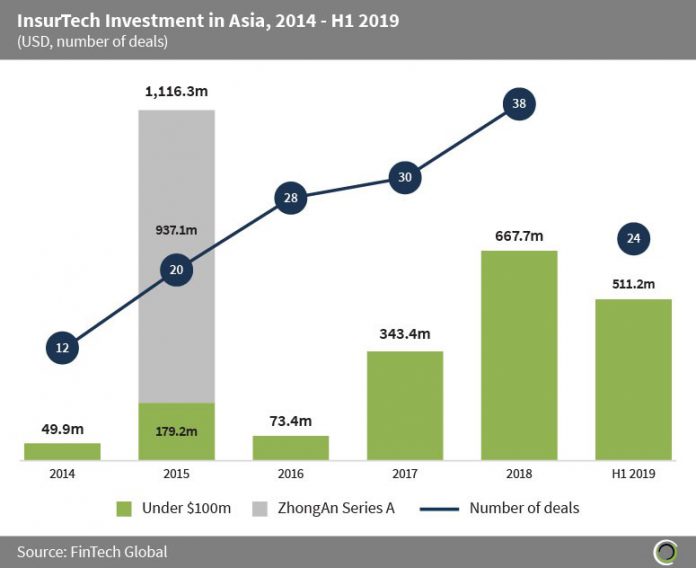

More than $2.7bn was invested in InsurTech companies in Asia between 2014 and H1 2019, across 152 transactions. As the sector has grown from relative obscurity, funding increased at a CAGR of 91.3% between 2014 and 2018, with deal activity more than trebling during the period.

Rising incomes and increasing awareness of insurance products have driven the growth of insurance markets in the region and the trend is expected to continue in the future, with insights from UBS tipping InsurTechs as a “saviour of the insurance industry” rather than a disruptor.

ZhongAn is China’s first online P&C insurance provider that boasts over 400 million customers and went public in Q3 2017. The company raised $937.1m from CDH Investments, CICC and Morgan Stanley in a Series A round in Q2 2015, and is purported to have sold in excess of 10 billion insurance policies. This deal is responsible for the increased amount of InsurTech investment in Asia in 2015 when total funding reach £1.1bn.

Investment in H1 2019 hit $511.2m, which is equal to 76.6% of the total capital raised in the sector in Asia last year, setting strong expectations for the rest of 2019.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global