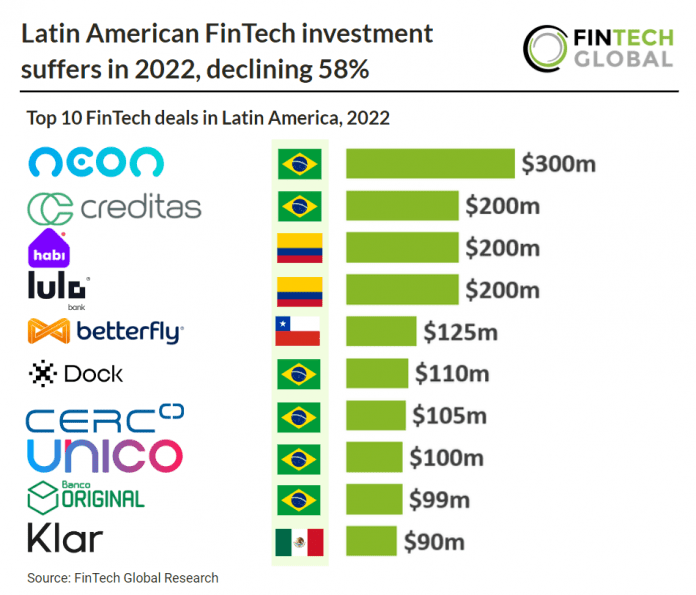

Key Latin American FinTech investment stats in 2022

• Latin American FinTech investment reaches $5.4bn in 2022, a 58% drop from 2021

• FinTech deal activity reaches 341 deals in 2022, a 15% reduction from 2021

• Brazil was the most active country in Latin America with 134 deals announced, a 39% share of total FinTech deals in the region

Latin America’s FinTech sector has seen a huge growth in investment over the last five years with a compound annual growth rate (CAGR) of 40%. This investment peaked in 2021 when the country saw $12.6bn raised by FinTech companies. Latin American FinTech investment in 2022 saw a sharp drop from 2021’s peak, reducing 58% although investment is still 80% higher than 2020 levels. FinTech deal activity also saw a 15% drop in 2022 but this is inline with global levels.

Neon, a digital bank offering credit cards and loans, was the largest FinTech deal during 2022 raising a considerable $300m in their latest Series D funding round led by BBVA. The company’s strategy is to launch new products based on its Democredit platform, offering proprietary intelligence for credit approval. Neon believes that this is a differential for the huge contingent of Brazilians who seek sustainable financing. BBVA’s investment and global expertise will allow Neon to offer loans in a more simple, sustainable and inclusive way. “We want to reach more Brazilians, contributing to reducing inequalities and making a difference in their lives”, Neon founder Pedro Conrade said.

FinTech is driving financial inclusion in Latin America. As a largely ignored region by traditional banks FinTech adoption continues to be a key player in Latin America’s FinTech growth and success, with more than 58% (388m) of people using FinTech services in Latin American and the Caribbean in 2021.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global