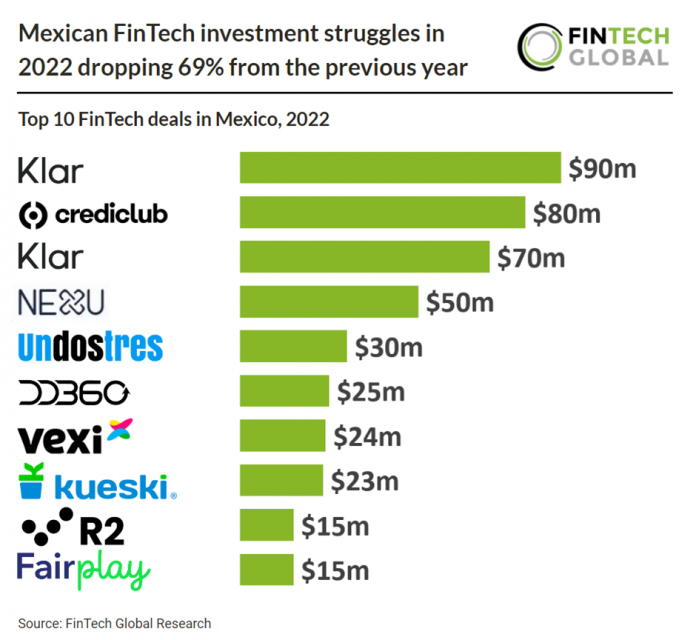

Mexican FinTech investment struggles in 2022 dropping 69% from the previous year

Key Mexican FinTech investment stats in 2022:

• Mexican FinTech funding reached $567m in 2022, a 69% drop from 2021 levels

• Mexican FinTech companies raised 89 deals in 2022, a 23% drop from the previous year

• PayTech was the most active FinTech subsector in 2022, with an 18% share of total FinTech deals.

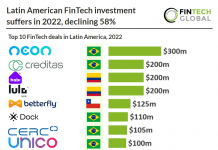

Mexican FinTech funding faltered in 2022 dropping 69% from their record-breaking year in 2021. FinTech deal activity saw a less dramatic decline, dropping 23% in 2022 which is better than other Latin American countries such as Brazil which saw a 45% drop over the same period. Mexico was the second most active FinTech country in Latin America during 2022, after Brazil, with a 21% share of total FinTech deals in the region.

Klar, a digital financial services platform, was the largest FinTech deal in Mexico during 2022 raising $90m in their latest Series C funding round, led by General Atlantic. Klar plans to leverage the funds to further enhance its platform with innovative solutions tailormade for the Mexican market, explore strategic acquisitions, deepen the Klar ecosystem by touching more customers via new distribution avenues, and invest in its team and talent. Klar has added 1.4m customers form June 2021 to June 2022, experiencing a 7x revenue increase and 4x transaction volume increase year-over-year. With this latest investment, the company has raised more than $150m in growth funding, the largest amount raised by any Mexican neobank to date.

PayTech was the most active FinTech subsector in Mexico during 2022 reaching 17 deals, an 19% share of total FinTech deals. Lending Technology was second with an 18% share and PropTech was third with a 17% share. Total transaction value in the digital payments sector is projected to reach $86bn in Mexico during 2023. Digital payments is expected to show an annual growth rate (CAGR 2023-2027) of 13.1% resulting in a projected total amount of $141bn by 2027. In 2021, more than a third (35%) of online purchases made in Mexico were paid for with credit or charge cards. E-wallets and debit cards followed, accounting for 27% and 19% of e-commerce payments.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global