PropTech startup QuintoAndar has just announced the closure of a huge $250m Series D round.

The company’s investment was led by SoftBank, the Japanese conglomerate that has previously invested in other unicorns like WeWork. SoftBank has also invested in companies Onfido and C2FO in the past.

Dragoneer Investment Group, the growth-oriented public and private investor, also participated in the round. The investor has previously invested in FinTech startup CRED and led the Swedish FinTech unicorn Klarna’s latest round.

Gabriel Braga, the CEO and co-founder of QuintoAndar, claims the investment has pushed the company’s valuation past the $1bn mark. The venture manages listings and digital contracts as well credit analysis solutions and transactions between renters and landlords.

Venture capital firm Kaszek Ventures and global growth equity firm General Atlantic also participated in QuintoAndar’s Series D funding round.

The QuintoAndar leadership has spotted a massive opportunity in Brazil where most people avoid buying properties and, instead, opt to rent, according to TechCrunch.

QuintoAndar aims to use the new money to attract more customers, recruit staff and build out broker partnerships.

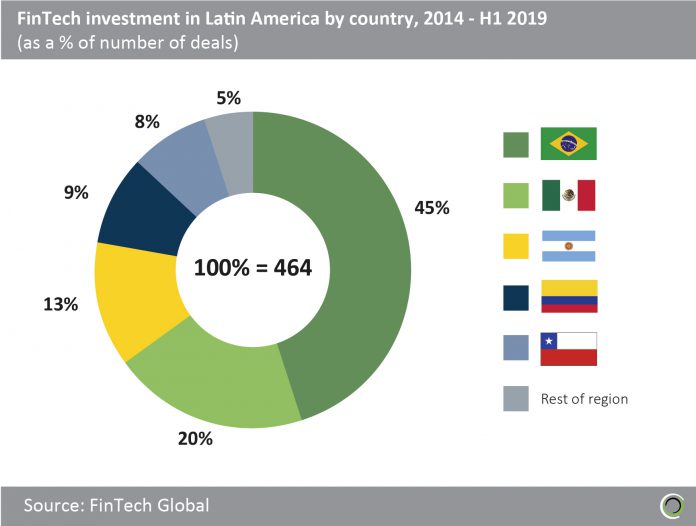

The unicorn is part of a thriving and emerging FinTech sector. According to FinTech Global’s research, Brazil is dominating the FinTech sector in Latin America. Between 2014 and the first half of 2019, the country received 45% of the industry’s investment in the region. Part of the reason the country is attracting so much money is because the nation has a huge unbanked population, meaning there is a lot of opportunities for savvy FinTech entrepreneurs.

Copyright © 2019 FinTech Global