Swedish digital-only bank P.F.C. (Personal Finance Co.) has picked Mambu’s SaaS banking engine to accelerate the deployment of its products.

The announcement comes after the bank, which launched ten months ago, has experienced a monthly growth of 35% on average.

“P.F.C. is exceptional in that we offer a highly personalised and transparent banking experience that’s simple to use,” said Eli Daniel Keren, founder and CEO of P.F.C.. “Our offering requires a highly flexible and scalable system, which is why we partnered up with Mambu. Mambu is a trusted and supportive partner. In just nine months, we were able to deploy a feature-rich mobile-first neobank, and can now focus on international expansion and innovations to enhance the customer experience, and deliver more value.”

P.F.C. will soon begin to deploy major additional features for personalized savings and credit products. Mambu’s rapid deployment capability supports the agility of P.F.C.’s product development and enables the mobile-first neobank to test and launch these new features much faster.

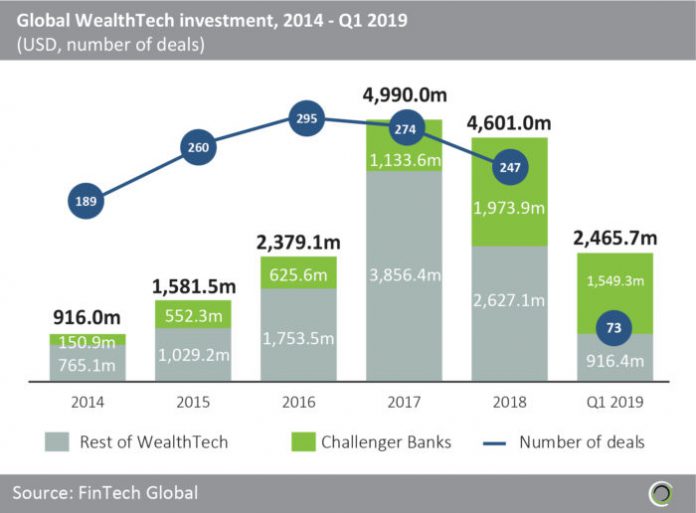

Challenger banks are attracting considerable investments around the world. FinTech Global’s data shows that investors have poured almost $6bn across 219 deals into the sector since 2014. Challenger bank investments have grown form $150.9m in 2014 to $1.97bn in 2018.

Looking at the Nordics in general, the region’s FinTech industry has over $2.1bn during that same period.