Australian incumbents are under pressure from new FinTech startups. Now one of the leading bank executives has slammed new FinTech lenders’ interest rates.

Shayne Elliott, CEO at ANZ, was speaking at the Intersekt Fesstival in Melborune when he said that bank’s like his “would get caned” if they were behaving like some FinTech lenders.

He was talking about risk-based pricing for bank customers as a means of shoring up bank earnings when he started in on the short-term lending space, the Australian Financial Review reported.

“So we are starting to see a lot of growth in the payday lending space, which is high risk, I mean it meets a need but there are ethical questions about some of that,” Elliott said.

“There are businesses charging 35 and 40% interest and if we came out with a product like that we would get caned.”

While denying he was talking the buy-now-pay-later companies like Klarna, he stated his attack was targeting predatory lenders who charge individuals and businesses exorbitant amounts of interest for short term loans.

A similar discussion is happening in the US where regulators across the country has begun to investigate apps that allow people to tap into their salaries before their payday. Just like in Australia, there are concerns about these companies essentially being payday lenders acting like FinTech companies.

The ANZ boss’ attack comes as traditional banks Down Under are facing off with the rise of new FinTech startups and challenger banks that have begun to wash over the country.

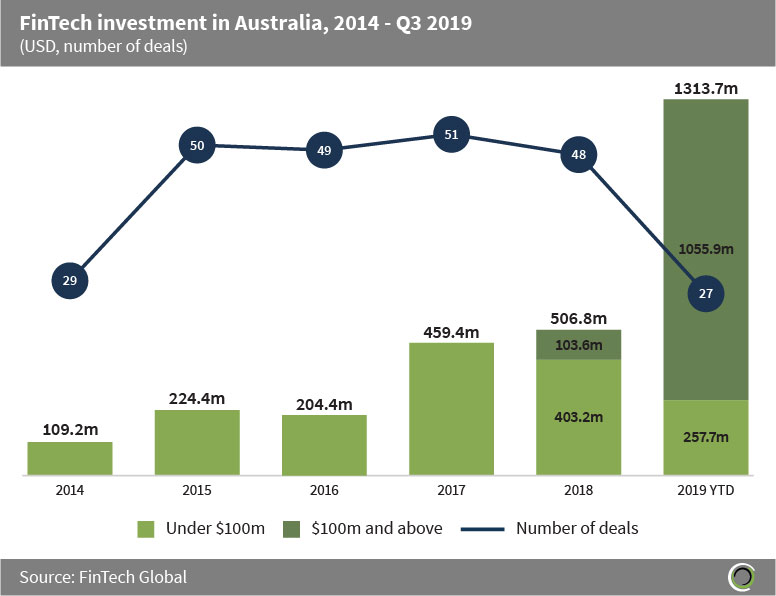

FinTech investment in Oz is on the rise. It has jumped from $109.2m in 2014 to $506.8m to suddenly skyrocket in 2019. In the year to date, the Australian FinTech industry has attracted $1.31bn, according to FinTech Global’s data.

Copyright © 2019 FinTech Global