The vice-president of Ghana has announced an ambitious programme to digitalise the country’s economy.

Speaking at the Financial Times’ Africa Summit, Mahamudu Bawumia revealed that the government getting rid of physical money in a bid to fight corruption and unnecessary middlemen.

By establishing the country as digital economy, Ghana would improve transparency and accountability.

Some of the efforts – like electronically tagging every house in the country and to enable cashless payments for government services – are said to be introduced as early as 2020.

Bawumia also said that Ghana has already overtaken Kenya in terms of mobile payments, the Financial Times reports. The country had done this by enforcing full operability of mobile wallets across telecoms companies and banks.

Ghana is also digitalising its land registry using blockchain to reduce land disputes and was working on introducing national ID cards.

However, despite its efforts to bring about a truly cashless society, Ghana still has some ways to go before it can topple the big dogs of the market.

For instance, Kenya has long been a leader in FinTech technology adoption. The country is the home to M-Pesa, the mobile phone transfer system that many people state as the beginning of the rise of FinTech in Africa.

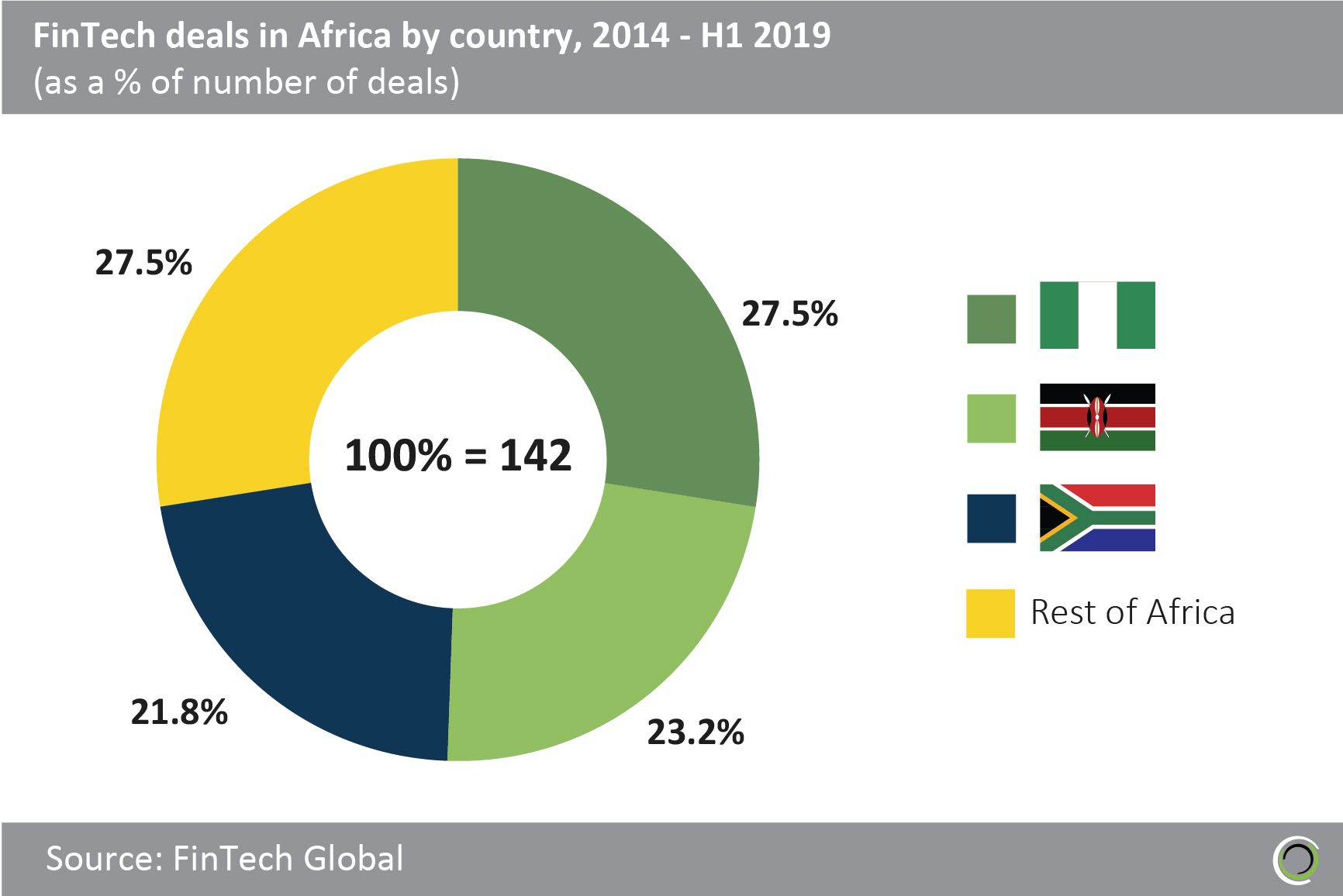

FinTech Global’s data shows that Kenya, Nigeria and South Africa received roughly three-quarters of all FinTech deal activities between 2014 and the first half of 2019.

Copyright © 2019 FinTech Global