Riyad Bank has launched a new programme to establish strategic partnerships with entrepreneurs and technology companies in the finance sector.

The Saudi bank’s new programme was announced at the Future Investment Initiative event, revealing that the initiative would have $26.7m to play around with.

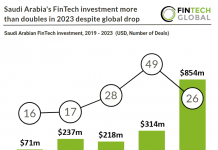

Tariq Al Sadhan stated that the launch of the programme comes as Saudi Arabia is experiencing an emergence of a new FinTech sector, powered by the proliferation of technology.

This is not the first sign that something is brewing the Middle Eastern and Africa FinTech space. A Bloomberg report from earlier this year estimated that the number of FinTech startups are about to double between 2020 and 2022. This includes a rise of Islamic FinTech, InsurTech, Regtech and blockchain-based startups.

In October, Dutch digital bank software provider Backbase opened a Dubai office to support the region’s banks in their ambitions to go digital.

Last year blockchain-based payments company Ripple formed an agreement with the Saudi Arabian Monetary Authority to support the use of xCurrent, Ripple’s enterprise software solution that enables banks to instantly settle cross-border payments with end-to-end tracking.

Yet, there are still challenges for the sector. The European Commission named 23 countries in February that had weak anti-money laundering and counter-terrorism funding processes. This blacklist included several nations in the Middle Eastern and African region.

The 23 jurisdictions were Afghanistan, American Samoa, The Bahamas, Botswana, Democratic People’s Republic of Korea, Ethiopia, Ghana, Guam, Iran, Iraq, Libya, Nigeria, Pakistan, Panama, Puerto Rico, Samoa, Saudi Arabia, Sri Lanka, Syria, Trinidad and Tobago, Tunisia, US Virgin Islands, and Yemen.

The EU’s member states rejected the list in March, stating that the European Commission had not been transparent about the drafting process. The list had also sparked an intense lobbying campaign form the affected territories.

A new list is reportedly in the works, sparked by money-laundering scandals in the EU. These scandals may also lead to the EU establishing a new anti-money laundering authority.

Elsewhere during the Future Investment Initiative event, Masayoshi Son, CEO of the huge tech investor SoftBank, apparently fell asleep during a panel. As one of his co-panellists spoke, the business leader seemed to be nodding off for about half-a minute, with his falling to his chest before Son snapped awake again.

Copyright © 2019 FinTech Global