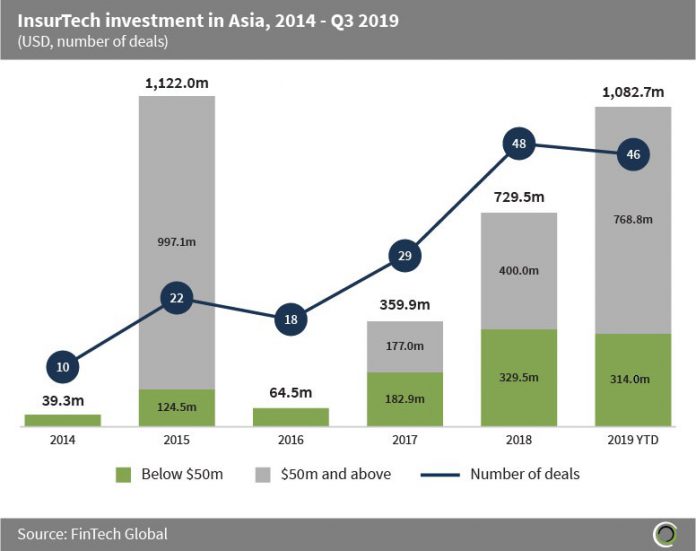

InsurTech companies in Asia have raised over $3.3bn between 2014 and Q3 2019, across 173 deals. Funding increased at a CAGR of 107.6% between 2014 and 2018, with deal activity increasing nearly five-fold during the period.

Investment so far in 2019 has hit over $1bn, equal to 31.9% of total capital raised by InsurTech companies in the region since 2014, setting strong expectations for the rest of the year. Further to this, deal activity is set to hit a record as well with 46 InsurTech transactions already completed so far in 2019, 95.8% of the previous record level of 48 deals set in 2018.

There was a significant increase in InsurTech investment in 2015 driven by ZhongAn’s $937.1m Series A round in Q2 2015. Upon exclusion of this deal, due to its considerably larger than historical size, investment reached $184.9m in 2015, matching the growth trend seen from 2014 to Q3 2019.

It is unsurprising that InsurTech is growing so rapidly in Asia as traditional insurance in the region tends to be biased towards high-net-worth individuals, due to agents being disproportionately driven by commission, hence leaving a mass market to be targeted by disruptive InsurTech companies. Coupled with the fact that according to Swiss Re, more than 90% of the Asian population do not own any form of insurance, investment in InsurTech in Asia is a very attractive opportunity for investors.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global