The global challenger and neo bank market is set to grow at a compound annual growth rate of 40.4% in the next five years.

That is according to new research by ReportsnReports.com that estimates that the sector will increase its value from $280bn in 2019 to $301bn between 2019 and 2025.

The research notes that the digital banking solution providers are already thriving in Europe and that most of the predicted growth will happen in markets that are only now emerging. That includes the US, China, India and other Asian markets.

Case in point, Singapore is currently in the middle of a process that will see the state welcome five new digital banks to set up shop in the country. Companies looking to grab one of the five licenses on offer have until New Year’s Eve 2019 to make their case.

Similarly, HMBradly, Cogni and Chime are all digital banking providers that have set up shop stateside.

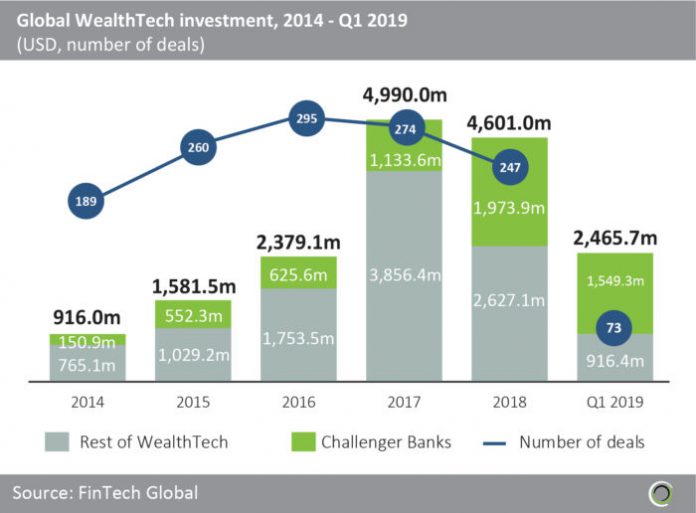

The challenger bank sector has gone from strength to strength in the past few years. This is exemplified in the fact that it has increasingly attracted bigger annual amounts of investment. According to FinTech Global’s data, the industry attracted $150.9m in 2014. That number had spiked to a massive $1.97bn in 2018.

Moreover, that record looks set to be broken in 2019, with the first quarter of the year seeing investments worth of $1.54bn getting injected into the industry.

Copyright © 2019 FinTech Global