Digital identity startup Jumio is to create a streamlined digital onboarding and eKYC process for non-bank remittance service provider I-Remit.

I-Remit empowers local Filipinos and those working internationally to easily send money in and out of the Philippines. According to the World Economic Forum, the country received the equivalent of around 10% of its GDP through remittances in 2018, due to nearly 10 million of Filipinos working abroad – the country’s total population is around 107 million.

The company recently released its online money transfer service IREMITX to enable individuals easily send and receive money. Money can be transferred across the Philippines and Canada, Singapore, Japan and UK.

By using Jumio, the company can compliantly and securely verify customers from over 200 countries and territories with 3,000 document types.

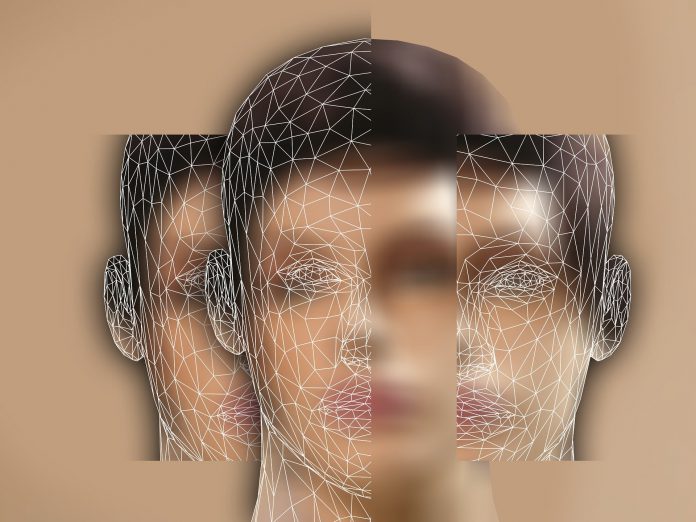

Jumio’s Identity verification services use machine learning, AI and face-based biometrics to ensure the person is who they claim to be. It matches a user’s live selfie with a photo of their government-issued ID.

This partnership continues Jumio’s expansion across Asia Pacific. Last year, the RegTech opened a sales office in Singapore to support the growth in the region.

I-Remit executive vice president of international treasury Ron Benito said, “Jumio’s technology solves two of our most pressing problems — onboarding scalability and customer experience.

“Jumio saves us money and time, provides eKYC speed and precision, and the customer onboarding experience is superior.”

Last month, Jumio released the latest version of identity verification tool. The new service leverages big datasets and AI to improve experiences.

Copyright © 2019 FinTech Global